The deceleration in active accounts and revenue growth rate, uncertainty related to the pandemic, and macro and geopolitical headwinds impacting ad spending took a toll on Roku’s (NASDAQ:ROKU) financial and operating performance.

Due to these challenges, Roku stock has declined by 55% this year. Further, it has fallen about 70% over the past year.

Now What?

Despite the challenges, Roku delivered better-than-expected Q1 sales. Moreover, it managed to grow its active accounts by 1.1 million. Roku expects inflationary pressure, geopolitical conflict, and supply-chain headwinds to hurt TV unit sales and gross player margins and delay ad spending in some of the verticals in the near term. However, it expects to achieve 35% year-over-year revenue growth in FY22.

Pivotal Research analyst Jeffrey Wlodarczak sees this 35% revenue growth guidance as “aggressive” owing to the challenging operating environment.

Wlodarczak has a Sell recommendation on Roku stock and reduced his FY22 net new active account expectations to 6.2M from 9M as he views the U.S. streaming market as fully penetrated while the TV market is still weak.

Furthermore, he lowered his FY22 revenue growth forecast to 30% from 33%, citing a weakening ad environment. Wlodarczak cut Roku’s price target to $80 from $95 amid rising interest rates (a higher interest rate environment led to an increase in the discount rate in the analysts’ DCF model).

Along with Wlodarczak, Benjamin Swinburne of Morgan Stanley also maintained a Sell recommendation on ROKU shares and reduced the price target to $105 from $115. Swinburne listed the U.S. active account base, competition, and growth headwinds for his bearish stance.

While Wlodarczak and Swinburne are bearish, most analysts providing recommendations on ROKU stock maintain a bullish view given its market-leading platform and the secular shift toward TV streaming.

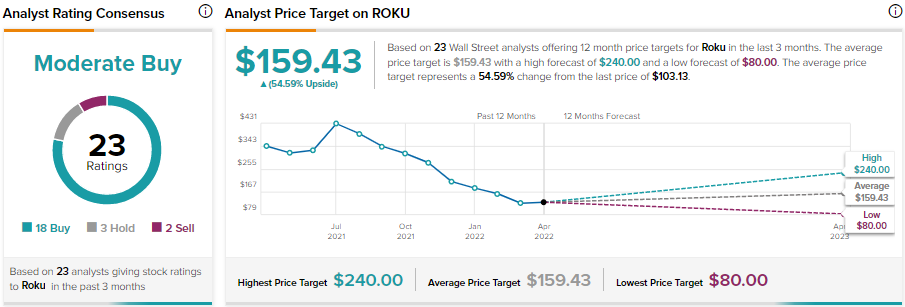

Of the 23 analysts providing recommendations on ROKU stock, 18 recommended a Buy, three had a Hold, and two suggested a Sell.

Bottom Line

Roku’s strong competitive positioning and ongoing shift of audiences, content, and advertisers towards connected TV provide a solid long-term growth platform for Roku. However, macro and geopolitical headwinds could continue to play spoilsport in the short term.

Due to the significant correction in ROKU shares, the price target of $159.43 implies 54.6% upside potential to current levels.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure