The stellar bull run in Nvidia (NASDAQ:NVDA) stock continues with its Q1 earnings and upbeat guidance, providing additional fuel for growth. NVDA stock has gained nearly 160% year-to-date and commands a market cap of about $939 billion. Meanwhile, the robust AI (Artificial Intelligence) demand and NVDA’s dominant positioning in the AI space indicate that the uptrend in NVDA stock could sustain, implying that it could become the first chip company to attain $1 trillion in market cap.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Coming out of the Q1 earnings call, Susquehanna analyst Christopher Rolland increased his price target to $450 from $350, implying about 18.5% upside from the current price levels. Based on Rolland’s price target, NVDA could easily surpass $1 trillion in market cap over the next 12 months.

Rolland expects NVDA’s end markets to grow rapidly. Autonomous driving and high-end infotainment will support auto market demand. Meanwhile, large cloud deployments for AI and machine learning will drive strong demand for its GPUs in the Datacenter segment.

Thanks to the recent run in NVDA stock, its valuation looks expensive. However, Rolland believes that NVDA’s premium valuation over its peers is warranted as it is well-positioned to capitalize on the growing end markets.

Echoing similar sentiments, Goldman Sachs analyst Toshiya Hari believes that the momentum in NVDA’s Datacenter segment will likely sustain in the coming quarters. Hari said that the “proliferation of Generative AI across various verticals” will drive sequential growth in the coming quarters.

While the analyst sees competition rising, he expects Nvidia to maintain its leadership in the industry, at least in the near term, due to the deployment of complex AI models. Hari raised his price target on NVDA stock to $440 from $275 and reiterated a Buy recommendation.

Given the expectations of sustainable demand amid AI buzz, several analysts increased their price targets on NVDA stock following Q1 earnings.

One of them is Craig-Hallum analyst Richard Shannon, who upgraded NVDA stock to Buy from Hold. He raised the price target to $500 from $190. Also, Morgan Stanley analyst Joseph Moore raised NVDA stock’s price target to $450 from $304.

What’s the Prediction for NVDA Stock?

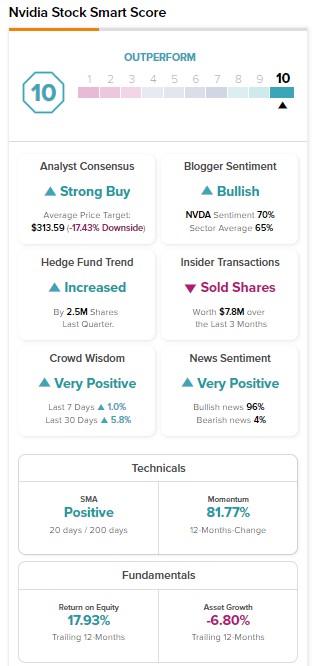

The company’s solid financial performance and AI demand keep analysts upbeat on NVDA stock. It has 26 Buy and seven Hold recommendations, translating into a Strong Buy consensus rating. Further, the stock carries a “Perfect 10” Smart Score on TipRanks.

Bottom Line

Solid AI demand, flourishing end markets, analysts’ Strong Buy consensus rating, and upward revisions in price targets following Q1 earnings suggest that the momentum in NVDA stock could sustain and drive its market cap higher.