Building materials group CRH’s (GB:CRH) stock was a pandemic winner, but the stock has been trading down by 18% since the start of this year – could it be time to buy?

The company announced its interim results for 2022 last week and beat analysts’ expectations. The shares were among the top gainers on the FTSE 100 in the wake of the report.

About the company

Headquartered in Ireland, CRH is a manufacturer and supplier of materials for the construction industry. The company’s products are used in big infrastructure projects as well as residential and commercial buildings.

The company has operations in 29 countries and is a leading business house in North America and Europe.

Robust performance

CRH’s sales increased by 14% to $15 billion thanks mainly to product demand and increased prices. Due to its leading position in the industry, the company has been able to increase prices across all its products without hurting demand.

Along with top-line growth, the company has managed growth in its bottom line as well. The company posted a 29% increase in its profit after tax of $900 million. Its EBITDA margin increased by 90 bps to 14.7%, despite rising energy-related costs.

Half-year EBITDA was $2.2 billion, up by 21% from last year. The company expects its full-year number to be around $5.5 billion.

CRH’s dividends

CRH increased its dividend by 4% to 24 cents per share. The company has always done a fair job in terms of its capital allocation. It balances a win-win situation between its acquisitions and shareholder returns. In June 2022, the company announced that it would return $300 million to its shareholders in continuation of its ongoing buyback program.

CRH competitor and building product supplier Grafton Group (GB:GFTU) also reported its interim results on the same day and increased its dividend by 8.8% to 9.25p per share. It posted a jump of 12% in its revenue to £1.15 billion. Grafton’s shares are down by 41% YTD.

Are CRH shares a good buy?

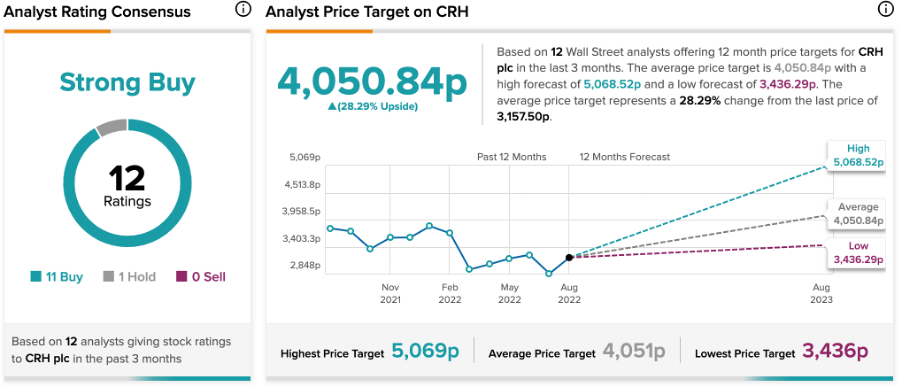

According to TipRanks’ analyst rating consensus, CRH stock has a Strong Buy rating. The company has a total of 12 ratings, including 11 Buy, and one Hold recommendations.

The CRH price target is 4,050.8p, with a high and a low forecast of 5,068.5p and 3,436.2p, respectively. The price target implies around 28.2% of upside potential.

Analysts forecast

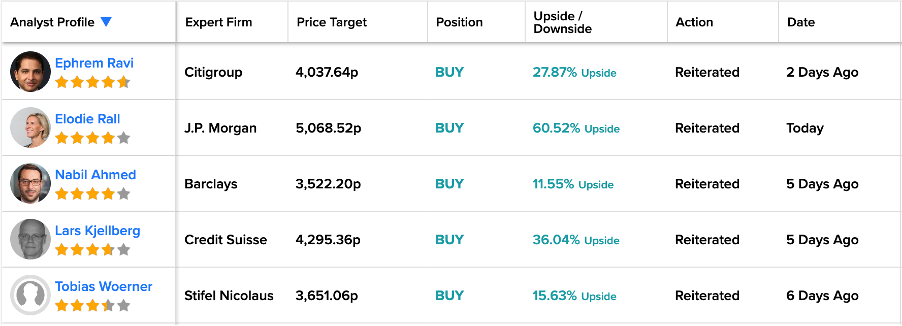

CRH stock enjoys wide coverage from analysts. Following the good performance in the results, a lot of analysts have reiterated their Buy ratings on the stock. Among them, Elodie Rall from J.P. Morgan has the highest target price of 5,068.5p with an upside potential of 60.5%

Rall has a success rate of 71% on CRH with an average return of 10.5% per rating.

Conclusion

Despite the challenging cost environment, the company not only managed a strong top-line but also transformed that momentum into good bottom-line growth.

The demand for its products remains strong, and the company is well-positioned to meet its full-year targets with the same enthusiasm. Overall, the stock story is bullish.