The COVID-19 pandemic adversely affected companies across different industries, especially retail. Though many retailers sold their products through their e-commerce channels, the closure of stores due to the pandemic restrictions had an impact on sales.

Even retailers that were deemed an essential business, and whose stores were allowed to remain open, suffered supply constraints due to the pandemic.

Let’s compare two retailers, Costco Wholesale Corp. (COST) and Walmart (WMT), using the TipRanks Stock Comparison tool, and see how Wall Street analysts feel about these stocks.

I am neutral about both stocks.

Costco Wholesale Corp.

Costco is a wholesaler that operates membership warehouses and e-commerce websites, and offers its members low prices on a selection of branded and private-label products across different categories.

Last week, the company announced net sales for the month of August of $15.75 billion, up 16.2% year-over-year. In the fourth-quarter, ending on August 29, COST posted net sales of $61.4 billion, a jump of 17.4% year-over-year.

In addition, the company reported comparable sales of 14.2% for the month of August. Adjusting for the impact of changes in gasoline prices and currency exchange fluctuations, total comparable sales were 9.1%.

According to Wells Fargo analyst Edward Kelly, the adjusted comparable store sales figure for COST tracked above consensus estimates of 7%. The analyst added that trends “remained about steady sequentially compared to the July period on a two and three-year stacked geometric basis.”

In fiscal Q3, the company posted net sales of $44.4 billion, up 21.7% year-over-year. Earnings for the quarter stood at $2.75 per share, an increase of 45.5% year-over-year. (See Costco stock charts on TipRanks)

Looking at COST’s Q3 results and its August sales figures, analyst Kelly is of the opinion that the “stock’s return to pre-pandemic levels seems to imply that COST keeps none of the upside, which seems wrong to us. At least some of its share gains should be sticky given member growth, while emerging trends (working from home and de-urbanization) represent other incremental positives.”

Typically, Costco increases its membership fees every five years and Kelly expects these fees to increase over the next 18 months, which could be a “potential catalyst for sales and earnings.”

Kelly also pointed out that the “company’s fundamental outlook overall remains bright, especially with the digital narrative improving.”

Indeed, in fiscal Q3, Costco’s e-commerce sales through its websites, excluding foreign exchange fluctuations, rose 38.2% year-over-year.

Turning to the rest of the Street, analysts are bullish about Costco, with a consensus of Strong Buy rating, based on 13 Buys and four Holds.

The average Costco price target of $461.71 implies 0.5% upside.

Walmart

Walmart is an omnichannel retailer that sells its products through both brick-and-mortar stores, and its e-commerce websites. The company operates through three business segments including Walmart U.S., Walmart International, and Sam’s Club.

Sam’s Club is a membership-only warehouse club that also operates the website, samsclub.com. It primarily competes with Costco. Walmart offers Sam’s Club membership through two options: Plus membership is priced at an annual fee of $100, while Club membership is priced annually at $45.

In Q2, the company’s adjusted earnings came in at $1.78 per share, up 14% year-over-year. Additionally, total revenue climbed 2.4%, to $141.05 billion.

WMT’s performance in Q2 was driven by a strong performance of Sam’s Club, as comparable-store sales rose 7.7%, while e-commerce sales increased 27%. Sam’s Club membership income growth rose 12.2% in Q2, registering double-digit growth for the fourth consecutive quarter.

The company’s management stated on its Q2 earnings call that following the stellar Q2 results it was raising its guidance. For FY22, it now expects its net sales to grow in the range of 6% to 7% year-over-year. WMT anticipates adjusted EPS to come in between $6.20 to $6.35 per share. (See Walmart stock charts on TipRanks)

When it comes to Sam’s Club, for FY22, Walmart’s management stated, “We anticipate Sam’s Club comps to increase 7.5% to 8.5% excluding fuel and tobacco…”

Late last month, Tigress Financial analyst Ivan Feinseth reiterated a Hold rating, with a price target of $170 (15.2% upside) on the stock. While the analyst was optimistic about the company’s “strong business performance,” Feinseth believes that the stock is currently at a “premium valuation [that] leaves little opportunity for significant share price outperformance.”

The analyst added, “Even as WMT continues to expand its e-commerce and omnichannel shopping and fulfillment capabilities, it continues to face increasing competition and innovation from a broad spectrum of competitors, including dominant online retailer Amazon along with other retailers of all types and sizes that continue to expand their e-commerce and brick-and-mortar presence and omnichannel fulfillment capabilities.”

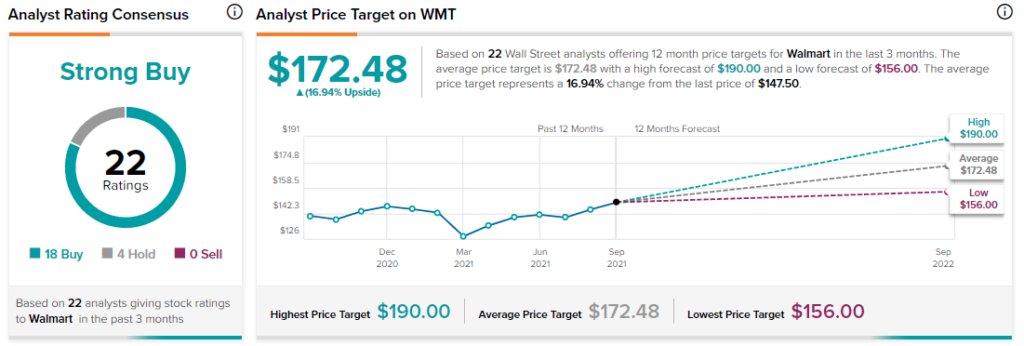

Turning to the rest of the Street, analysts are bullish about Walmart, with a Strong Buy consensus rating, based on 18 Buys and four Holds.

The average Walmart price target of $172.48 implies 16.9% upside potential from current levels.

Bottom Line

While analysts are bullish about both Walmart and Costco, based on the upside potential over the next 12 months, Walmart seems to be a better Buy.

Disclosure: At the time of publication, Shrilekha Pethe did not have a position in any of the securities mentioned in this article.

Disclaimer: The information contained in this article represents the views and opinion of the writer only, and not the views or opinion of Tipranks or its affiliates, and should be considered for informational purposes only. Tipranks makes no warranties about the completeness, accuracy or reliability of such information. Nothing in this article should be taken as a recommendation or solicitation to purchase or sell securities. Nothing in the article constitutes legal, professional, investment and/or financial advice and/or takes into account the specific needs and/or requirements of an individual, nor does any information in the article constitute a comprehensive or complete statement of the matters or subject discussed therein. Tipranks and its affiliates disclaim all liability or responsibility with respect to the content of the article, and any action taken upon the information in the article is at your own and sole risk. The link to this article does not constitute an endorsement or recommendation by Tipranks or its affiliates. Past performance is not indicative of future results, prices or performance.