In the last year, Costco Wholesale (COST) has gained just 7.4%, underperforming the broader markets. But can this change in the coming quarters?

It seems likely, considering the company’s strong financial performance.

Additionally, a stimulus check of $1,400 is around the corner for many American households. This could trigger better-than-expected growth in consumption, which is good news for companies in the retail space.

Strong Growth And Cash Flow Visibility

Costco has delivered strong numbers for the second quarter of 2021. On a year-over-year basis, its net sales increased by 14.7% to $43.89 billion.

Most noteworthy was the company’s e-commerce sales. For Q2 2021, e-commerce sales growth came in at 74.8%. It should be noted that Costco grocery has already been offering same-day delivery for all fresh food products. In addition, two-day delivery is being offered for non-perishable food products and household supplies.

With data suggesting that online grocery sales will make up 21.5% of total U.S. grocery sales, Costco appears to be right on track. In the coming years, companies that provide robust omni-channel sales are likely to survive and grow, and given the e-commerce investments and focus in the recent past, Costco is well positioned in the space.

Another point of strength for Costco is cash flows. The company’s operating cash flow has increased from $5.8 billion in FY2018 to $8.9 billion in FY2020. So, why will cash flows continue to increase?

Growth in paid members is a key reason. In FY2018, the company had 51.6 million paid members and this increased to 58.1 million by FY2020. Furthermore, in 2021, the company’s paid membership base has already increased to 59.7 million households, which generates $3.7 billion in cash fees. With a 91% renewal rate in the U.S. and Canada, it seems likely that its membership base will continue to swell.

A big trigger for membership growth is the company’s potential growth in China. Currently, Costco has only one warehouse in China. However, Costco is in the process of opening new stores. It’s also worth noting that China is home to 1.3 billion people. So, if growth gains traction, membership should surge in the coming years.

On top of this, in the last three years, comparable sales growth has averaged approximately 8%. The growth in e-commerce has also boosted comparable sales. This is likely to translate to higher warehouse level operating margin. To put things into perspective, average sales per warehouse was $176 million in FY2018, rising to $192 million in FY2020.

Considering these key factors, operating and free cash flows are likely to increase. This in turn could lead to further dividend growth and potential deleveraging. That said, debt is not a concern, with the company boasting a negative net-debt position as of Q2 2021.

Analysts Weigh In

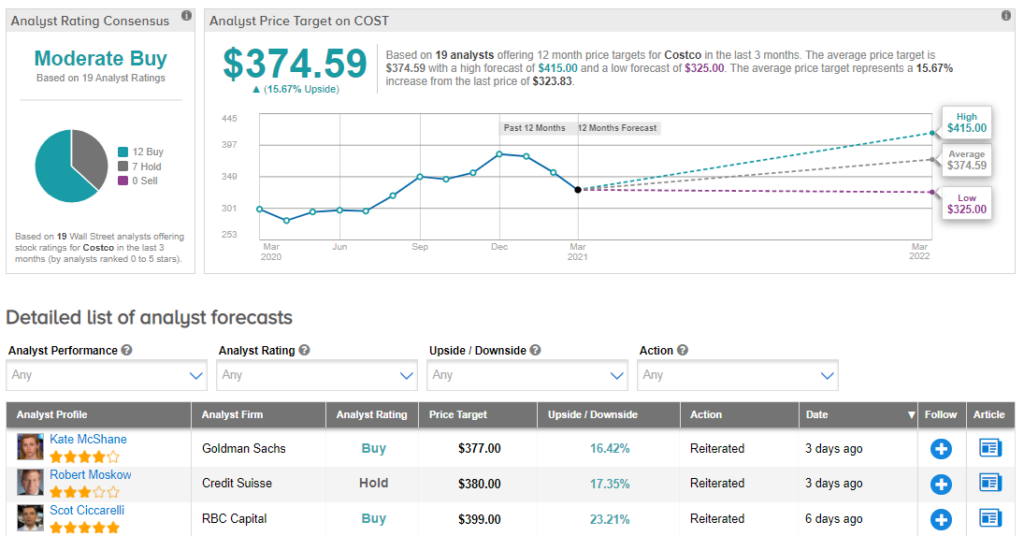

Turning to the analyst community, Costco has received 12 Buys and 7 Holds in the last three months. So, it gets a Moderate Buy consensus rating. Based on the $374.59 average analyst price target, shares could surge 16% in the year ahead. (See Costco stock analysis on TipRanks)

Concluding Views

It’s worth noting that COST stock was among the most resilient names during the coronavirus-triggered market meltdown in March 2020 due to its strong fundamentals and business model that is relatively immune to economic shocks.

With the U.S. economy driven by consumption, Costco is likely to continue reporting strong numbers. The National Retail Federation estimates that retail sales for FY2021 will increase by between 6.5% and 8.2%. At the same time, international expansion will likely trigger membership revenue growth.

Disclosure: On the date of publication, Faisal Humayun did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.