Manufacturing and providing services for non-lethal projectile systems and body cameras, Axon Enterprise (AXON) is inherently controversial because its core products have been at the forefront of high-profile law enforcement cases. Nevertheless, the company’s ability to foster accountability may be the only practical way forward for normalizing the relationship between society and the police. I am bullish on AXON stock.

While 2020 will forever be scourged with the memory of COVID-19, the global health crisis brought to light another pandemic: the brewing inequities between Americans of privileged socioeconomic backgrounds and historically marginalized communities. During the late spring and summer seasons of that fateful year leading up to the historic presidential election, the issue of police brutality generated headlines.

One of the companies that happened to be in the crossfire was Axon Enterprise. Perhaps best known for its Taser “energy weapon,” Axon has been instrumental in providing law enforcement officers with a non-lethal tool to rapidly de-escalate dangerous circumstances before serious injury or death occurs.

Firing two small darts that can reach a distance of approximately 35 feet (11 meters), a Taser disrupts a person’s nervous system, leaving them temporarily disabled.

Additionally, Axon develops various camera systems that integrate into police officers’ uniforms and patrol vehicles. Recording both audio and video footage, Axon cameras provide real-time evidence of police encounters with suspects, theoretically enabling the justice system to prosecute such matters accurately and appropriately.

Though debates about net effectiveness abound, the financial evidence indicates growing support among security agencies for Axon products, thus boosting AXON stock.

Axon Enterprise’s Smart Score Rating

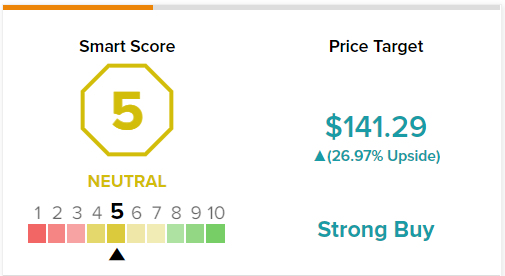

Interestingly, on TipRanks, AXON has a 5 out of 10 Smart Score rating. This metric indicates that the stock is likely to perform in line with the broader market.

Revenue by Segment Augurs Well for AXON Stock

One of the key factors for assessing the viability of AXON stock is, of course, its growth potential. In the first quarter of 2022, the company posted revenue of $256.4 million, up over 31% from the year-ago level.

Additionally, in Fiscal Year 2021, AXON rang up record sales of $863.4 million, gaining almost 27% from the prior year’s remarkable tally. However, it’s the segment breakdown of sales that arguably provides the most encouragement.

In Q1 2019 – one year prior to the COVID-19 catastrophe – Axon generated total net sales of $115.8 million. Against this tally, the Services segment represented 23.9% of revenue. Fast forward to Q1 2020, and this allocation to Services increased to 27%. Keep in mind that this quarter covered the initial onset of the pandemic.

By Q1 2021, Services contributed nearly 28% of total sales for the quarter. In the most recent Q1 report, the Services tally increased to over 31%, suggesting that not only are law enforcement agencies buying Axon products, but they’re also using them extensively. Irrespective of the social controversies that always run parallel with police methodologies, this holistic integration is a net positive for AXON stock.

The Efficacy Debate Rages On

Despite the seemingly intuitive benefit that police body cameras and non-lethal weapons provide – in short, accountability in police interactions with the underlying community and life-saving alternatives for dangerous situations – investors should note that AXON stock is inherently a controversial investment.

Primarily, the National Institute of Justice states that some “studies suggest that body-worn cameras may offer benefits while others show either no impact or possible negative effects. The mixed results of these studies strongly imply that additional research is needed.”

An example of mixed effectiveness comes from a Birmingham, U.K. study, which found that “deploying body-worn cameras resulted in a statistically significant reduction in citizen injury, but no statistically significant reduction in officer use of force or injury.”

Other critics, such as the ACLU of Washington, warned in part that “a long history of surveillance establishes a close connection between increasing surveillance infrastructure and exacerbating racial bias in policing.”

Finally, some law enforcement agencies lag well behind others in delivering body cameras to their officers. Presumably, the economic pressures of the moment may hinder such deliveries and integration, rendering moot Axon’s supposed benefits to officers and the communities they serve.

Wall Street’s Take on AXON Stock

Turning to Wall Street, AXON stock has a Strong Buy consensus rating based on six Buys, one Hold, and no Sell ratings. The average Axon Enterprise price target is $141.29, implying 27% upside potential.

Conclusion: Perfect is the Enemy of the Good

Understandably, the complex social issues between the privileged class in the U.S. and historically marginalized communities cannot be readily resolved with an easy-to-pull lever. Certainly, anything involving shifts in police protocols or training is sure to rouse controversy. At the same time, it’s important not to let perfect be the enemy of the good.

Perhaps the confusion about AXON stock is the assumption that the underlying company will cure various social and historical ills. It cannot. Instead, its main purpose is to provide tools for the protection of both officers and their communities.

In that sense, Axon isn’t a perfect solution, but it’s arguably the best society has right now.