On the surface, hydrocarbon energy giant ConocoPhillips (NYSE:COP) appears irrelevant. With political and ideological forces pushing for clean and sustainable solutions, fossil fuels just don’t cut it anymore. However, Russia’s military belligerence in Ukraine has no end in sight. As a result, simple math suggests that crude oil prices will move higher, which will benefit upstream specialists like ConocoPhillips. Subsequently, I have little choice but to be bullish on COP stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Math Points to a Northbound Direction for COP Stock

Let’s just start with the meat of the argument. Only Russian President Vladimir Putin knows when the war in Ukraine will end. Because he has provided practically zero signs that he is interested in a legitimate peace agreement, the conflict will continue. Almost certainly, this terrible dynamic translates to artificially reduced crude oil supplies, which will probably boost COP stock.

As geopolitical analysts have stated, a sense of normalcy will materialize in Eastern Europe only when Putin is defeated. Because he’s a strongarm leader, Putin can’t just walk away from Ukraine, not when he has escalated matters to the gravest threat possible: the use of nuclear weapons. Sure, it may be posturing, but no rational head of state would dare use such language flippantly.

Since a retreat is simply not in the Russian government’s playbook, the military conflict will tragically continue until Russia can no longer fire any shots. Considering its vast supply of weapons, that’s going to take a long time.

As for the economic impact, the math couldn’t be clearer. According to the International Energy Agency, “Russia is the world’s largest exporter of oil to global markets and the second largest crude oil exporter behind Saudi Arabia.” With Russia seemingly committed to a deadly game of the sunk-cost fallacy, the Western world – which generally supports Ukraine – will likely see reduced oil imports.

If so, classic supply-demand dynamics dictate that crude oil prices will rise. Because ConocoPhillips specializes in the exploration and production segment of the hydrocarbon value chain, COP stock could see a rise in its share price.

Indeed, the bullishness has already begun. Over the trailing three months, COP stock has gained over 20%. Since the beginning of the year, it’s up almost 16% after incurring an inauspicious start to 2024, as you can see below.

Domestic Politics and Economic Matters May Help ConocoPhillips

If Russian military belligerence were the only factor, COP stock would still be an intriguing bullish opportunity. However, ConocoPhillips has other tailwinds, including favorable domestic politics and a positive economic trend.

First, while there has been a broader push to integrate green energy solutions, the fossil fuel industry remains supremely relevant. For decades, American society has built its infrastructure around hydrocarbons. Granted, there are efforts to incorporate renewable solutions like wind and solar. Nevertheless, the world still runs on oil.

And that brings up a significant but sometimes overlooked political relationship. Especially in a critical election cycle, neither the Biden administration nor the Democrats at large can afford to adopt a draconian stance against fossil fuels. After all, oil workers vote – and their votes count just as much as anyone else’s vote.

Moreover, as a Bloomberg report pointed out in the runup to the 2020 election, many households that depend on hydrocarbons for their livelihood live in swing states like Ohio. Stated differently, the Democrats – if they have any chance of winning – cannot afford to alienate a key voting bloc. So, COP stock may actually be able to walk ground that’s smoother than advertised.

Second, on the economic front, another strong jobs report in March translates to a practically unavoidable equation: more money is chasing after fewer goods. That’s inflationary, which has historically helped critical resource sectors like crude oil.

The reason is fairly straightforward. Because most Americans still drive combustion-powered vehicles, when oil prices rise, people in this country have little choice but to open their wallets. Oil, along with other key resources like food and water, is simply a non-negotiable item. People must pay or face severe consequences.

As a result, COP stock should be able to weather numerous economic storms, making it attractive.

It’s Time to Revisit COP’s Fiscal 2024 Forecast

With the positive fundamentals in mind, it’s time to revisit analysts’ expectations for ConocoPhillips in Fiscal 2024. They’re looking at earnings per share of $8.71 on revenue of $58.63 billion. These stats are disappointing relative to last year’s print (EPS of $8.77 on revenue of $58.57 billion).

However, the high-side estimates call for EPS of $12.98 on sales of $70.31 billion. Looking at the greater context, it’s likely that ConocoPhillips will end up toward the upper end of fiscal projections. Again, reduced supply and heightened demand should augur well for COP stock.

Is ConocoPhillips Stock a Buy, According to Analysts?

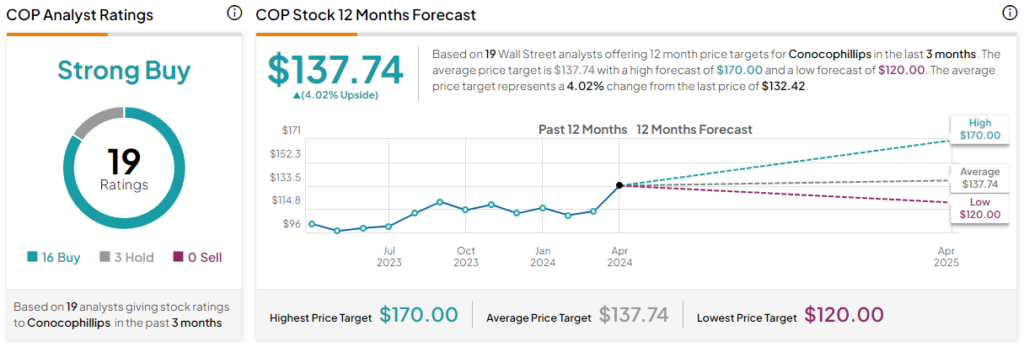

Turning to Wall Street, COP stock has a Strong Buy consensus rating based on 16 Buys, three Holds, and zero Sell ratings. The average COP stock price target is $137.74, implying 4% upside potential.

The Takeaway

While the surface-level view of ConocoPhillips is that of a hydrocarbon enterprise that may be fading from relevance, reality tells a different story. With domestic politics, international flashpoints, and economic dynamics presenting an upward catalyst for COP stock in the form of reduced supply and rising demand, the upstream specialist deserves a reassessment of its forward projections.