Compass Minerals International (CMP) shares have lost more than half of their value over the past year. Despite the steep decline, the stock could have further downside ahead. This is due to the valuation remaining rich based on Compass’ future earnings projections and the poor condition of its balance sheet, which prevents the development of shareholder value creation. Accordingly, I am neutral on the stock.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

What Makes Compass Minerals an Interesting Business?

Compass Minerals is one of the most prominent providers of critical minerals utilized to solve nature’s challenges for its customers and communities. More specifically, the company’s salt products help maintain safe roadways during winter weather but are also used in several other consumer-related, industrial, and agricultural applications.

Further, the company’s plant nutrition business develops an innovative and diverse portfolio of products that enhance the quality and yield of crops while aiding sustainable agriculture. Finally, the company’s specialty chemical business serves the water treatment industry and other industrial processes.

Compass’ most attractive characteristic is its competitive advantage in the industry. It operates the largest rock salt mine in the world, which is located in Goderich, Ontario, Canada, along with the largest dedicated rock salt mine in the U.K., located in Winsford, Cheshire.

As a result, the company is the dominant player in an oligopoly along with Cargill and K&S. Further, with the company’s clients primarily comprising governmental entities, Compass faces little to no counterparty risk and enjoys more or less predictable cash flows.

Compass Minerals’ Financial Position Has been Deteriorating

On the one hand, Compass Minerals has been generating relatively robust revenues over the years, as its basic materials are critical for the purposes we mentioned. On the other hand, there is little to no growth to be captured in the space. CMP generated $1.12 billion in sales last year, which is relatively the same level of sales they reported a decade ago.

In the meantime, however, its costs have been growing, especially lately, due to surging inflation. For context, the company’s EBITDA margin used to hover between 20% and 30%. The metric now stands at 14.6% as of its last 12 months’ results.

In the meantime, the company remains heavily indebted, with net debt of $877.3 million despite its recent deleveraging developments. It may not sound like a huge amount, but it is for the size of Compass Minerals. To illustrate how burdened the company is by its debt liabilities, its total debt-to-equity ratio has gradually expanded from around 100% five years ago to roughly 322% as of its latest report.

The combination of declining EBITDA margins and heavy indebtedness has resulted in the company being barely able to generate any net income. The company’s net income margins from fiscal 2017 to fiscal 2020, for instance, (excluding last year’s net income because it was affected by one-off events), have hovered between 3.13% and 6.28%.

The Valuation Remains Rich Despite the Recent Correction

Compass Minerals’ stock price had remained relatively stable between 2010, and 2020, despite its compressing net margins. This is likely due to CMP paying a rather hefty dividend during this period. Specifically, the dividend used to grow annually from 2014 to 2017, reaching a plateau of $0.72 per quarter that lasted until September of 2021.

Around that time, the stock would yield between 4.5% and 8%, thus sustaining the stock price. Obviously, growing dividends against declining earnings led to increased indebtedness and destruction of its book value. The company was forced to finally cut the dividend last year to a quarterly rate of $0.15, which eventually led to the much-needed stock price decline.

Nevertheless, I find the stock remains rather overvalued. Consensus EPS estimates point toward $0.22 for this fiscal year and $1.78 for Fiscal Year 2023. Therefore, the company will hardly be profitable this year. In addition, if the company delivers on analysts’ 2023 estimates, the stock is still trading at 19.4 times forward P/E.

Even if the company were highly profitable, it would likely take years to reduce the debt on its balance sheet to reasonable levels. However, I believe the stock would need to be in the mid to high single digits to be reasonably valued based on its margins and (lack of) growth prospects. The risks are simply too high to justify the current multiple, despite Compass’ competitive advantages.

Wall Street’s Take on CMP Stock

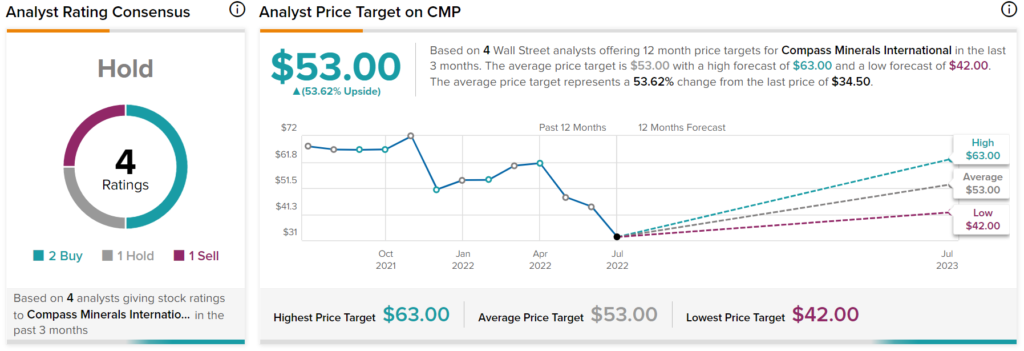

Turning to Wall Street, Compass Minerals International has a Hold consensus rating based on two Buys, one Hold, and one Sell assigned in the past three months. At $53.00, the average CMP stock forecast implies 53.6% upside potential.

Takeaway – Avoid The Stock

In my view, Compass Minerals’ investment case screams that the stock is to be avoided. The company’s margins are already razor-thin, and with inflation soaring, it’s likely that the bottom line will face further pressure moving forward.

The balance sheet is also in very poor condition, questing the company’s prospects even if its profitability were to meaningfully improve. These factors, combined with a rich valuation against an already risky investment case, suggest there could be further downside for the stock.