Shares of popular crypto exchange platform Coinbase (COIN) were dealt a massive one-two hit to the chin on Tuesday. The stock fell nearly 13% during the session, surrendering an additional 16% in the after-hours following the release of a weak quarter that saw revenues nosedive 27%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The results were brutal, and it now seems clear that Jim Chanos — a short-seller who slammed Coinbase for having over-earned last year — was right on the money.

Although Coinbase stock seems like a cheap stock that keeps getting cheaper, the magnitude of the top-line miss may be enough reason to take a raincheck on the name. Undoubtedly, the appetite for speculation has fallen like a rock. It’s not just crypto that’s fallen out of favor; growth stocks, and even certain classes of value stocks, have been treading water of late.

In prior pieces, I warned that the possibility of a cyclical downturn in the crypto markets would apply negative pressure on COIN stock, regardless of how low its price-to-earnings multiple got.

Though some Wall Street analysts still see value in the name, I remain bearish.

Coinbase Clocks in Q1 Loss

Coinbase may have raised the bar a bit too high going into the quarter. The company clocked in $1.17 billion in quarterly net revenue, and a per-share loss of $1.98. The sharp decline can be blamed on the dissipation of retail trader interest.

The real question is whether the quarterly flop was an outlier or the start of a trend that could confirm Chanos’ views that COIN stock was a value trap. Although it’s hard to tell what the crypto market’s next move will be, I’d argue that the path of least resistance is lower.

The stock and bond market plunge has been brutal thus far. Bitcoin (BTC) has essentially traded as a tech stock so far, and it will probably continue to do so.

Though retail interest in crypto could bounce back unexpectedly, I’d argue that Bitcoin and the like do not seem like they’ll hold their own as stocks roll over.

Coinbase’s Other Intriguing Offerings

Coinbase is still innovating.

Even as markets sink further into correction, management will continue to invest in expanding its offerings. Most notably, Coinbase NFT could propel abstract digital goods to the mainstream. With an extensive network of users and deep pockets to put into marketing, Coinbase may, one day, have the best NFT exchange of them all.

Coinbase NFT went live last week with 0% fees in what appears to be a limited-time offer. Though the marketplace is intriguing, I’m not so sure the current lineup of NFTs is enough to propel COIN stock out of its funk. Further, interest in crypto is tied to interest in NFTs.

The NFT marketplace may also become crowded, with Mark Zuckerberg also expressing interest in getting into the NFT space with Instagram. Given Zuckerberg sees his firm as a metaverse company, it’s hard to argue that he’s not already looking to make a huge splash in the NFT space.

In any case, I don’t see Coinbase NFT as exciting with such a loss of crypto interest. NFTs and crypto are pretty much tied at the hip.

COIN Stock: Still Not Cheap Enough

At writing, Coinbase stock trades at around 2.6 times sales. That’s cheap, but the multiple is bound to expand if retail trading volumes don’t recover. Retail trading volume nosedived 38% of the first quarter, and the scary thing is, that could be just the start.

Though Coinbase stock will eventually hit bottom, it probably won’t do so without a turnaround in Bitcoin.

Wall Street’s Take

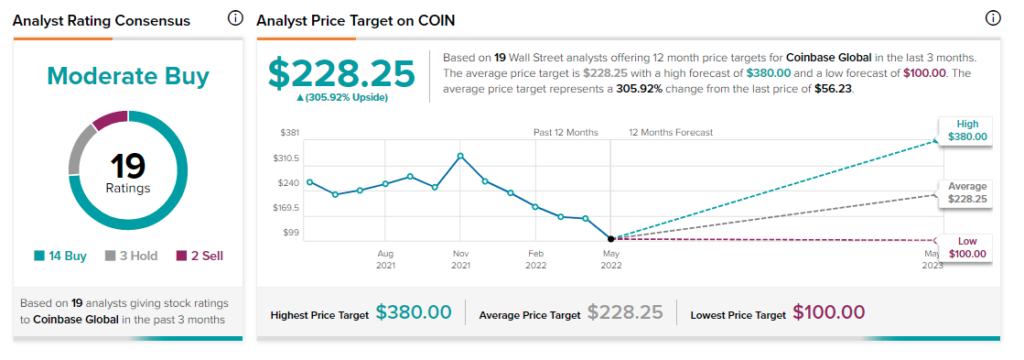

According to TipRanks, COIN stock comes in as a Moderate Buy. Out of 18 analyst ratings, there are 14 Buy recommendations, two Hold recommendations, and two Sell recommendations.

The average Coinbase price target is $268.12, implying 305.9% upside potential. Analyst price targets range from a low of $135 per share to a high of $500 per share.

Bottom Line on Coinbase Stock

There was no sugarcoating Coinbase’s quarter. Chanos looks like a genius for having talked about his COIN stock short position a while back.

In due time, crypto will heat up again, and Coinbase will be ready to over-earn again, with its NFT marketplace, among other innovations. Until then, I’d treat Coinbase as a cyclical stock whose low multiple does not tell the full story.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure