When investors seek stability and regular income from their investments, dividend-paying stocks often come to mind. The Coca-Cola Co. (NYSE:KO), a carbonated soft drink manufacturing giant, is one such company that can satisfy investors’ thirst through dividends.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company has raised its dividends for 61 consecutive years, which helped it earn a spot among the esteemed Dividend Aristocrats (stocks that have raised their dividends for at least 25 consecutive years). Furthermore, KO offers a dividend yield of 3.21%, surpassing the sector average of 2.13%. Also, Wall Street analysts anticipate the stock’s price to increase by over 12% in the next 12 months.

Here’s What Makes KO Stock Worth Considering

Coca-Cola’s impressive dividend policy points to its commitment to shareholders. The company annually reviews its dividend payout, taking into account factors such as financial performance, cash flow, and growth prospects. This approach ensures that dividends remain sustainable and aligned with the company’s overall financial health.

Last month, the company reported a strong third-quarter earnings report. Both earnings and revenue surpassed the analysts’ expectations and increased from the year-ago quarter. Coca-Cola’s sound performance suggests that consumers are willing to buy its products despite higher prices and concerns about the impact of weight-loss drugs on the beverage demand.

Importantly, the company remains confident about its performance, as it raised guidance for the second consecutive quarter. For Fiscal 2023, the company anticipates organic revenue growth between 10% and 11%, up from its prior outlook of 8% to 9%. Moreover, it guided for a 7% and 8% per share rise in comparable earnings, up from its prior range of 5% to 6%.

It is worth highlighting that the Q3 results were perceived positively by analysts, with ten of them reaffirming a Buy rating on KO stock. At the same time, four analysts rated the stock a Hold.

Among the bullish analysts, Christopher Carey from Wells Fargo is optimistic about the company’s ability to grow earnings in 2024 based on the stability of Coca-Cola’s sales volume.

Likewise, Carey believes Coca-Cola’s profit margins will rise in the near future. He expects strong sales and divestitures to offset negative effects from foreign exchange, inflation, or product mix.

What is the Price Target for KO?

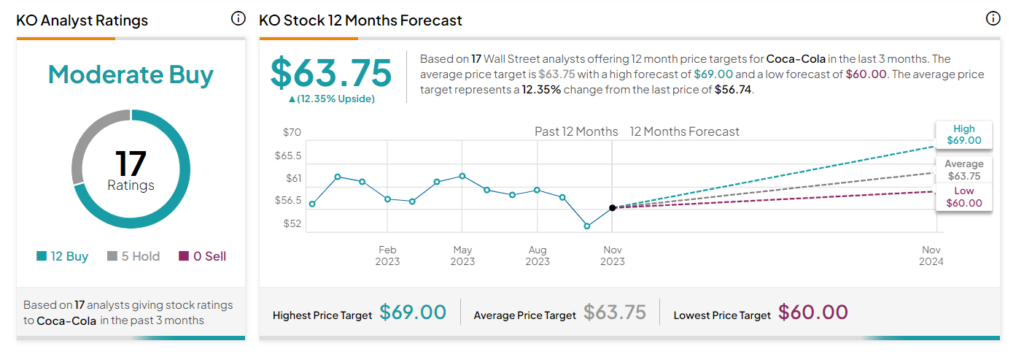

Overall, Wall Street analysts are cautiously optimistic about KO stock. It has received 12 Buy and five Hold recommendations for a Moderate Buy consensus rating. Meanwhile, the average Coca-Cola stock price target of $63.75 implies 12.4% upside potential from current levels.

Ending Thoughts

Dividends are a key part of a stock’s total return. They offer investors not only a source of steady income but also the potential for long-term capital appreciation. Coca-Cola’s dividends seem to be appealing in uncertain market conditions as the company continues to grow dividend payments.