Beverage giant The Coca-Cola Co. (NYSE: KO) reported adjusted comparable earnings for the third quarter of Fiscal Year 2023 of $0.74 per share, up by 7% year-over-year. This was above analysts’ consensus estimate of $0.69 per share.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company’s net revenues increased by 8% year-over-year to $12 billion while organic revenues went up by 11% year-over-year. This beat analysts’ expectations of $11.4 billion.

For FY23, Coke now expects its organic revenues to grow in the range of 10% to 11%, up from its prior outlook between 8% and 9%. The company anticipates comparable earnings to rise between 7% and 8% per share, up from its prior range of 5% to 6%.

Looking ahead to 2024, the company expects its comparable net revenues to be affected by currency headwind in the mid single-digits.

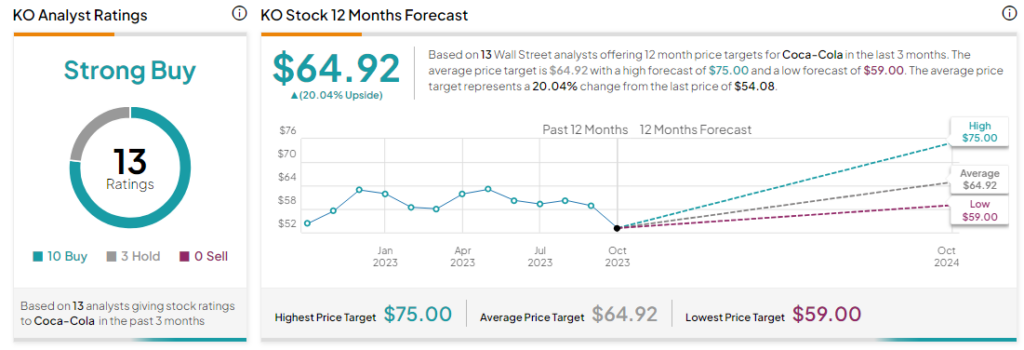

What is the Future Forecast for KO Stock?

Analysts are bullish about KO stock with a Strong Buy consensus rating based on 10 Buys and three Holds. The average KO price target of $64.92 implies an upside potential of 20% at current levels.