Citigroup (NYSE:C) recently reported its Q4-2023 earnings results, which I’ll discuss in detail. In a nutshell, the bank’s Q4 results were impacted by $4.7 billion in regulatory, restructuring, and business loss charges, pushing Citigroup to a quarterly loss. Underlying business momentum, even excluding these charges, was very weak, reinforcing the need to restructure some of the bank’s operations.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Still, I am bullish on the stock, as Citigroup is set to benefit from these restructuring efforts, with business momentum expected to pick up as well. My bull case rests on an attractive tangible book discount (tangible book value of $86.19 compared to a $52.02 share price), which provides a sizable margin of safety should its operating momentum remain subdued despite optimistic expectations from management.

Citigroup’s Operational Overview

Citigroup reports results in six main operating segments: U.S. Personal Banking at 28.3% of Q4-2023 revenues, Services at 25.8% of revenues, Markets at 19.6%, Wealth at 9.6%, Banking at 5.4%, and All Other – managed basis (includes former Legacy Franchises, global staff functions, corporate treasury, etc.) at 11.7% of revenues. Let’s analyze how these major segments performed.

U.S. Personal Banking revenues were up 12% year-over-year in Q4 2023, much better than the 1% decrease in expenses. However, net credit losses were significantly higher, up 88% from the prior year period. As a result, the return on tangible common equity (RoTCE) was merely 3.6% in Q4 (full year 2023: 8.3%).

Services revenue increased by 6% compared to Q4 2022, below the 9% increase in expenses. These developments, coupled with higher credit losses, brought net income 42% lower year-over-year. Nevertheless, RoTCE in the traditionally strong segment came in at 13.4% in Q4 (full year 2023: 20%).

Markets was the weakest segment in the quarter, with revenue plunging 19% year-over-year. The weak performance was exacerbated by an 8% increase in expenses. The main culprit behind the lackluster performance was losses on Argentina’s currency devaluation. All in all, RoTCE in this segment was -1% in Q4 (full year 2023: 7.4%).

Wealth revenues declined by 3% despite a 4% increase in expenses. RoTCE was 0.1% in the quarter (2023: 2.6%). The persistent weak performance makes the segment a key point of attention for management, with an outside manager, Andy Sieg, selected to revitalize the business.

Banking was the best-performing segment in terms of revenue in Q4, growing 22% year-over-year on the back of a pick-up in investment banking. Expenses grew 37% from the prior-year quarter (which had benefited from provision releases), resulting in a negative RoTCE of 6% in Q4 (2023: negative 0.2%).

All other (managed basis) saw revenues decline 17% in Q4, impacted by business disposals. Expenses shot up 92% on the back of a $1.7 billion FDIC special assessment charge impacting all U.S. banks in the quarter. This resulted in a $2.3 billion loss for the segment in Q4.

For the bank as a whole, Q4 revenue declined 3% year-over-year (2023 overall saw 4% growth), while expenses were up 23% relative to Q4 2022. This is largely due to the bank taking $4.7 billion in specific charges during the quarter, including restructuring.

While I would not say that all charges incurred in Q4 were extraordinary (banking is inherently a risky business, layered with regulatory charges and ever-changing business dynamics), the magnitude of the provisions overwhelmed the underlying profit generation of the bank.

RoTCE came in at -5.1% in Q4 (4.9% in 2023). Furthermore, tangible book value was down 0.8% quarter-over-quarter to $86.19/share, and earnings per share (EPS) were -$1.16/share in Q4. The $4.7 billion in charges had a $2.00 negative impact on EPS, while the RoTCE headwind was 9.2%. Even without the extraordinarily large charges, RoTCE would have been 4.1% in the quarter, a lackluster result, strengthening the case for business restructuring.

Citigroup’s Capital Position and Shareholder Returns

Citigroup’s CET1 ratio (which looks at a bank’s capital relative to assets) finished the year at 13.3%, down 0.3% quarter-over-quarter, with gains in the available-for-sale portfolio on the back of lower interest rates (+0.13%) partially offsetting losses incurred during the quarter and capital distribution (Citigroup kept its dividend, which yields 4%, at $0.53/share per quarter and bought back shares in Q4). As explained on the conference call, the bank expects to do a modest level of buybacks in Q1 2024 as well.

The 13.3% CET1 level represents a 1% buffer relative to the 12.3% Q4 regulatory requirement.

Optimistic 2024 Outlook

With Q4 2023 arguably a very weak quarter, the bank was nevertheless optimistic about its prospects in the new year. Here is the outlook:

Revenues of $80 billion-$81 billion, or growth of 2.5% over 2023.

Expenses of $53.5 billion-$53.8 billion, or a drop of 4.9% relative to 2023.

The higher revenue will come from a broad rebound in businesses (Treasury and Trade Solutions, Services, Investment Banking, Wealth, and Retail Services), offsetting a marginal reduction in net interest income.

The expense reductions are driven by a $0.7 billion-$1 billion incremental severance and cost-cutting charge to be incurred in 2024, ultimately resulting in a net headcount reduction of 20,000 people.

Citigroup expects capital benefits from its business exits and operational simplification over time, with the bank reconfirming its 11-12% RoTCE medium-term target.

Plenty of Upside Potential if Targets are Met

One way to estimate the fair value of Citigroup is to compare it with peers such as JPMorgan Chase (NYSE:JPM). JPMorgan has consistently delivered high profitability, making it a benchmark in the U.S. banking industry. Over 2023 and 2022, JPMorgan delivered RoTCE figures of 19% and 18%, respectively. The stock currently trades at a heavy premium to tangible book, about 1.96 to be precise.

Taking the midpoint of Citigroup’s 11-12% RoTCE target, the fair value tangible book multiple for Citigroup we can imply from JPMorgan’s valuation is 1.2 times. This is roughly double the current 0.6 multiple. Why is there such as big gap?

Firstly, Citigroup has not yet reached its profitability target and is unlikely to do so in 2024, given the ongoing restructuring efforts. Furthermore, JPMorgan has delivered strong profitability year after year, earning investors’ confidence. As a result, I reckon Citigroup will trade at a discount to JPMorgan even after it reaches its profitability target. But should it deliver 11-12% RoTCE in several consecutive years, earning a 1.2 times tangible book valuation in the market is certainly attainable.

To sum up, progress on the bank’s RoTCE target is vital for the re-rating of the stock, with the first step being a high single-digit RoTCE in 2024.

Is Citigroup Stock a Buy, According to Analysts?

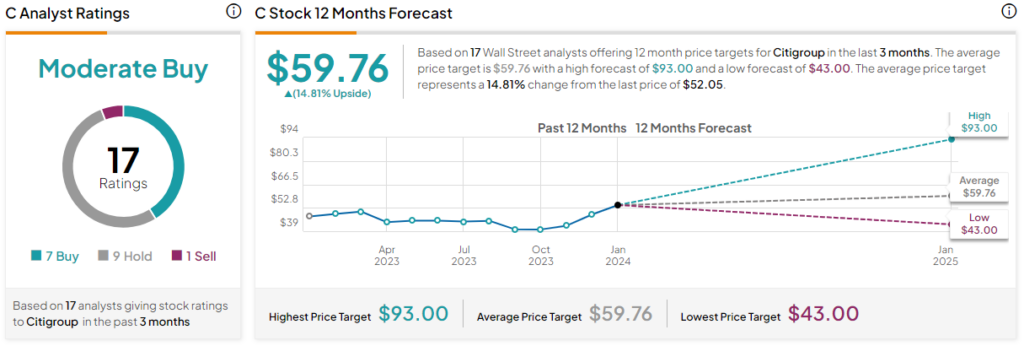

Turning to Wall Street, Citigroup earns a Moderate Buy consensus rating based on seven Buys, nine Holds, and one Sell rating assigned in the past three months. Additionally, Citigroup stock’s average price target is $59.76, implying 14.8% upside potential.

The Takeaway

Citigroup had a weak end of the year but is set to benefit from its restructuring efforts and underlying business improvement in 2024, forecasting increasing revenues and lower costs. As a result, I remain bullish on the stock. Despite recent months’ gains, which call for a more gradual upward trend from here, the company’s business momentum and results should sustain growth.