After a rough couple of years, China’s tech sector is surging in 2023. Using ETFs is a great way for U.S. investors (and non-mainland China investors in general) to gain exposure to this rebound. Here’s why Chinese tech stocks suffered in 2021 and 2022, why they’re bouncing back, and three ETFs that investors can buy to tap into the continued growth of China’s tech stocks.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Why Did Chinese Tech Stocks Fall in 2021 and 2022?

The Chinese market, in general, had a difficult go of things in 2021 and 2022. For example, if we use the iShares MSCI China ETF (NASDAQ:MCHI) as a proxy for China — the ETF lost 21.7% in 2021 and another 22.7% in 2022. This was mainly a result of the COVID-19 pandemic and China’s “zero tolerance” response to it, which saw the government lock down large parts of the country for prolonged periods of time.

This was a frequent topic of concern on the earnings calls of U.S. companies last year, ranging from Starbucks (NASDAQ:SBUX) talking about locations closing for undetermined periods of time or a multitude of luxury goods retailers discussing falling demand due to the lockdowns.

Chinese tech stocks fell even harder than the broader market. In addition to the aforementioned challenges, they faced a regulatory crackdown in which the government took a heavy-handed approach toward their affairs. There are many examples, but most famously, the government nixed Alibaba’s (NYSE:BABA) plans for an IPO of Ant Financial at the last minute, reportedly because then-CEO Jack Ma had criticized China’s financial system.

The government also cracked down on businesses such as gaming and online education, erasing a significant amount of market value in the process. Chinese authorities even forced ride-hailing company Didi Global (OTC:DIDIY) to delist from the NYSE following its massive $68 billion IPO. Fears that shares of even some of China’s biggest tech stocks could be forced to delist from U.S. exchanges didn’t help matters.

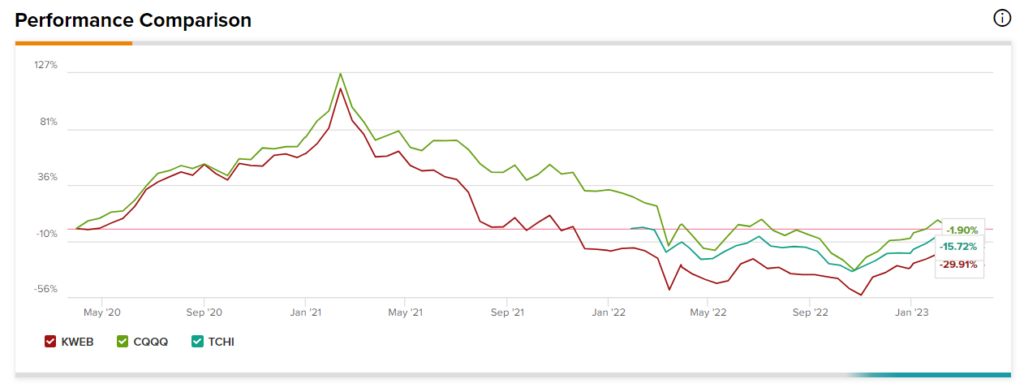

Based on these headwinds, top China tech ETFs endured heavy losses in 2021 and 2022. The KraneShares CSI China Internet ETF (NYSEARCA:KWEB) lost 48.9% and 17.2% in 2021 and 2022, respectively. Meanwhile, the Invesco China Technology ETF (NYSEARCA:CQQQ) lost 24.5% and 30.1% over the same time frame. Lastly, the newer iShares MSCI China Multisector Tech ETF (NASDAQ:TCHI) only debuted in 2022, but it has lost 24% since its inception.

Things are Looking Up

However, things are starting to look up, and Chinese tech stocks are responding. Over the past six months, KWEB and CQQQ are up nearly 30%, while TCHI is up almost 20%. China is easing its COVID restrictions, and the economy is opening back up. Meanwhile, the government also seems to be relaxing its approach towards China’s tech giants, at least for the time being, as it recognizes that they need the help of these tech powerhouses to help kickstart China’s economy again.

News that Alibaba is exploring the idea of splitting into six different companies is also bringing renewed excitement to the sector. While this can be seen as the government prying into Alibaba’s affairs, many shareholders and analysts are excited about the move, which they believe can unlock value and give investors plenty of options.

It could also derisk the likelihood of governmental interference in the future, as six smaller companies, each focused on a specific area, would be less powerful and thus less likely to draw the ire of regulators.

Lastly, China is also one of the few major economies in the world that is easing monetary conditions and adding liquidity to its economy at a time when other countries like the United States are raising interest rates and tightening. It all adds up to a better outlook for China and its tech sector, and these three ETFs all offer a way to gain exposure to this powerful theme.

1. KraneShares CSI China Internet ETF (KWEB)

With $5.8 billion in assets under management, the KraneShares CSI China Internet ETF is the most prominent of the China tech ETFs. KWEB fell further than CQQQ and TCHI over the past two years because it places a more specific emphasis on internet and e-commerce stocks (as opposed to the broader tech sector), and these were the companies that were in the government’s crosshairs. The chart below, created using TipRanks’ ETF Comparison tool, illustrates the disparity between KWEB and the other two ETFs.

However, KWEB is starting to pick up some momentum, quietly racing to a 26.4% gain over the past six months.

As you might expect, thanks to KWEB’s investment focus on Chinese internet stocks, China’s internet giants like Alibaba and Tencent (OTC:TCEHY) combine to make up about 20% of the fund. KWEB holds 33 positions, and its top 10 holdings account for just under 60% of the fund, so it’s somewhat top-heavy.

Many of the other top holdings are the locally-listed shares of some of China’s other consumer-facing internet names that many non-China investors are likely familiar with, such as Baidu (NASDAQ:BIDU), Pinduoduo (NASDAQ:PDD), NetEase (NASDAQ:NTES), and JD.com (NASDAQ:JD).

One downside to note is that KWEB has a somewhat high expense ratio of 0.69%. It also does not pay a dividend, although this is not the fund’s focus, as it’s targeted at growth investors.

2. Invesco China Technology ETF (CQQQ)

As you might be able to guess from the ticker symbol, the Invesco China Technology ETF is the Chinese counterpart to Invesco’s popular Invesco QQQ ETF (NASDAQ:QQQ), which focuses on the Nasdaq (NDX) and has grown into one of the largest ETFs in the world over the years. CQQQ is smaller than the QQQ product, with $957.9 million in assets under management.

CQQQ is similar to KWEB in that its top 10 holdings make up over 50% of the fund, but it has a much wider breadth and depth of holdings with 132 positions.

Like KWEB, Tencent is the top position here (accounting for nearly 11% of the fund), but a key difference is that Alibaba is absent from this ETF. Other top holdings that the two similarly-focused ETFs have in common include Pinduoduo, Baidu, and Tencent Music (NYSE:TME).

Entertainment platform Bilibili (NASDAQ:BILI) is another top holding that non-China investors may be familiar with. Additionally, you’ll find companies like Sunny Optical Technology (OTC:SNPTF) which focuses on developing optical products, giving this ETF a bit of a different flavor than KWEB.

Like KWEB, CQQQ has a fairly high expense ratio of 0.7%. It pays a dividend that yields a minuscule 0.07%, but this isn’t really going to move the needle with investors.

3. iShares MSCI China Multisector Tech ETF (TCHI)

One additional way to play a bounce back in Chinese tech stocks is with the iShares MSCI China Multisector Tech ETF.

This is a much more diversified ETF than KWEB or CQQQ, with 182 holdings. Furthermore, TCHI’s top 10 holdings make up just 37% of assets. There’s plenty of common ground between the top holdings of TCHI and the two ETFs above, including Netease and Baidu. Tencent and Alibaba are present here as well, but they make up for a much smaller 3.9% and 3.4% of this ETF’s holdings, respectively. Sunny Optical Technologies and Bilibili are key holdings here as well.

Further down on the list, there are consumer goods tech stocks like Lenovo Group (OTC:LNVGY), making TCHI a bit different from the other two ETFs. Additionally, TCHI has a slightly lower expense ratio than KWEB and CQQQ at 0.59%.

One thing to be aware of about TCHI is that it’s a relative minnow in the world of ETFs, and with just $7.7 million in assets under management, it could be subject to greater volatility than the much larger KWEB and CQQQ.

Closing Thoughts

All three of these ETFs offer investors smart and slightly different ways to gain exposure to the ongoing resurgence in China’s tech sector. I like KWEB the best because of its exposure to Alibaba, which seems likely to have a lot of catalysts in the near future, but all three look promising. I also like KWEB because it declined the most, which could give it the most torque as a bull market in Chinese tech gains momentum.

Investors can use TipRanks’ ETF Comparison Tool to quickly compare three (or more) ETFs like this and evaluate key criteria like expense ratios, technicals, and performance.

While these ETFs have recovered from their lows over the last few months, they still have a long way to go to get back to where they were, indicating that there could be more upside ahead.

Here’s another reason I think ETFs are a good way to invest in China. Right now, the government is warming up to the tech sector, but there’s always the potential for things to change, so I like the idea of owning a diversified basket of Chinese tech names just in case the government does decide to clamp down on an individual company. If this happens, owning one of these ETFs mitigates this risk because you own an array of other stocks as well.