In a recent statement, the International Energy Agency claimed that “the world will almost exclusively rely on China for the supply of key building blocks for solar panel production through 2025.”

According to the IEA, China will likely manufacture more than 95% of the solar supply chain’s building blocks in the coming years. The agency added, “This concentration level in any global supply chain would represent a considerable vulnerability.”

China has absolute and relative advantages over developed nations when it comes to cost per unit produced, and on the other side of the spectrum, it has much more capital and labor than other developing nations, placing it in a prime position to dominate the solar manufacturing landscape.

In light of the IEA’s statement, I’ve identified three renewable energy stocks that could benefit from China’s solar expansion.

JinkoSolar (JKS)

JinkoSolar is a vertically integrated solar company that designs, manufactures, develops, and markets various solar components, including modules, wafers, cells, and ingots.

What stands out about Jinko is the firm’s China-centric manufacturing process, allowing it to benefit from systemic industry growth. Additionally, Jinko owns approximately 14% of the global solar module market, which is expected to grow at a CAGR (compound annual growth rate) of 7.4%, according to Allied Market Research, with a forecasted addressable potential of $260 billion.

Furthermore, Jinko is one of the heavy investors in the industry as its CapEx exceeds the industry median by 668%. Although the company’s aggressive reinvestment policy might erode the stock’s value in the short term, a gain in market position could benefit the firm’s investors in the long run.

Jinko stock is relatively undervalued, trading at a 56% discount to its five-year price-to-sales ratio. Moreover, its price-to-book value is trading at a 53% discount to its sector median. The stock’s undervalued status intertwined with its $200 million share repurchase program sets it up as a deep-value play.

Turning to Wall Street, JinkoSolar earns a Hold consensus rating based on two Holds assigned in the past three months. The average JKS stock price target of $55 implies 15.7% downside potential.

Canadian Solar (CSIQ)

Although Canadian Solar is a Canadian company, its CSI solar subsidiary is about to list as a publicly-traded stock in China due to its significant regional operational involvement. CSI’s sales grew 74% during the past year, conveying Canadian Solar’s potential as a major Chinese market participant.

Broadly, Canadian Solar is in growth mode, with its top-line surging at a three-year CAGR of 24.7%. Additionally, the firm has been adding intrinsic value to its business by the day, as its EBITDA has grown at a five-year CAGR of 30.3%.

Canadian Solar’s exponential growth is inextricably linked to its global market share for module shipments (roughly 7%), which is impressive considering the astronomical influx of market participants in the past decade.

Furthermore, relative valuation metrics imply that Canadian Solar stock is a gem, trading at a 88% discount to the sector average price-to-sales ratio and has a PEG ratio of 0.79x.

Turning to Wall Street, Canadian Solar earns a Hold consensus rating based on one Buy and three Holds assigned in the past three months. The average CSIQ stock price target of $40 implies 36% upside potential.

NIO (NIO)

NIO might not be directly involved in the solar supply chain, but it will surely be a systemic beneficiary of Chinese solar developments. China has opted to challenge the European and U.S. automotive industries by investing aggressively in electric vehicles, which could benefit companies such as NIO.

The company’s June deliveries jumped 60.3% year-over-year, bolstered by pandemic reopenings in China. During its second quarter, NIO’s deliveries grew by more than 14.4%, exceeding its total deliveries target.

Furthermore, NIO revealed its new ES7 last month (to be available for pre-order in August), a sleek five-seater SUV. There’s much optimism surrounding the model, meaning that NIO’s top-line sales could gather momentum into the back end of the year.

NIO stock’s more than 50% year-over-year slide has drawn it into undervalued territory. For instance, the stock’s price-to-sales ratio is 52% lower than its five-year average.

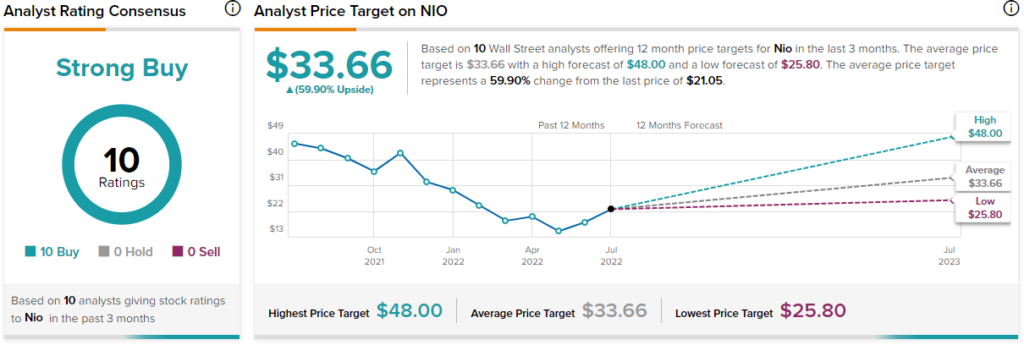

Turning to Wall Street, NIO earns a Strong Buy consensus rating based on 10 Buys ratings assigned in the past three months. The average NIO stock price target of $33.66 implies 59.9% upside potential.

Conclusion – Ample Upside Potential in Solar and Renewable Energy

China’s solar supply-chain dominance could benefit an array of renewable energy companies affiliated with the nation. The stocks mentioned in the article will likely be among the primary beneficiaries of China’s solar and renewable energy dominance.