Look to the cloud, if you dare, for a potentially perfect wintertime investment. Snowflake (NYSE:SNOW) impressed Wall Street with expectation-beating profits and notable revenue growth. Hence, even if some analysts aren’t ultra-bullish about Snowflake now, I’m still bullish on SNOW stock for the winter and beyond.

Snowflake is based in Montana and provides cloud-computing software. SNOW stock hasn’t been a market darling like the “Magnificent Seven,” but it finished November on a strong note. Also, Snowflake has artificial intelligence (AI) connections, such as the company’s Cortex service. Specifically, Cortex allows its users to develop large language models (LLMs) for use in AI operations.

SNOW stock rallied today, and value investors might be reluctant to jump in the trade now. Yet, I believe there’s no reason to hesitate, as Snowflake’s results and forward guidance indicate strong demand for the company’s cloud-computing products/services.

Snowflake: Positive Data Makes the Case

Yesterday was a big day for Snowflake, as the company released its results for the third quarter of Fiscal Year 2024. This time, the skeptics and short sellers didn’t have a leg to stand on.

Here’s the rundown. First of all, Snowflake’s revenue increased by 32% year-over-year to $734.2 million — not too shabby, as this indicates demand for the company’s products. Plus, this result beat the consensus estimate by $21 million.

Furthermore, Snowflake Chairman and CEO Frank Slootman pointed out that Snowflake’s non-GAAP adjusted free cash flow totaled $111 million for the quarter, “representing 70% year-over-year growth.” Can you really blame Slootman for bragging about this?

Turning to the bottom-line results, Snowflake reported Q3-FY2024 earnings of $0.25 per share, coming in far above the year-earlier quarter’s $0.11 per share and easily surpassing the consensus estimate of $0.16 per share. Moreover, this result caps off a lengthy track record of quarterly EPS beats.

Slootman opined that these results “reflect strong execution in a broadly stabilizing macro environment,” so clearly, the CEO is confident about Snowflake’s future. Looking ahead, Snowflake’s management expects the company to generate FY2024 product revenue of $2.65 billion. This would represent an increase of 37% and is more optimistic than the company’s prior guidance of $2.6 billion.

Some Analysts are Cautious about SNOW, but Most are Bullish

As we’ll discuss in a moment, the majority of analysts on Wall Street are generally bullish about SNOW stock. However, there are a few doubters.

For instance, despite Snowflake’s excellent quarterly results, Guggenheim Securities analyst John DiFucci maintained a surprising Sell rating on Snowflake stock. DiFucci wrote, “It’s too early to call it a bottom for consumption trends, especially on the back of our fieldwork in talking with partners that suggest… conservative discretionary spending for at least the next few quarters.”

I’m not privy to Guggenheim’s “fieldwork,” so I can’t easily assess it. In any case, DiFucci still raised his price target on SNOW stock from $105 to $120.

Another cautious call came from Third Bridge analyst Jordan Berger. According to Berger, Snowflake “has a massive market opportunity in front of it.” However, “cloud cost cutting remains an important trend and Snowflake’s net revenue retention continues to decelerate.”

To me, it sounds like the skeptics are reaching for reasons to worry about Snowflake. If there truly is a “massive market opportunity” for cloud software businesses like Snowflake, then I expect the company to maintain its growth pace and deliver superior returns to the shareholders in the coming quarters.

Is Snowflake Stock a Buy, According to Analysts?

On TipRanks, SNOW comes in as a Strong Buy based on 25 Buys and five Hold ratings assigned by analysts in the past three months. The average Snowflake stock price target is $215.63, implying 14.9% upside potential.

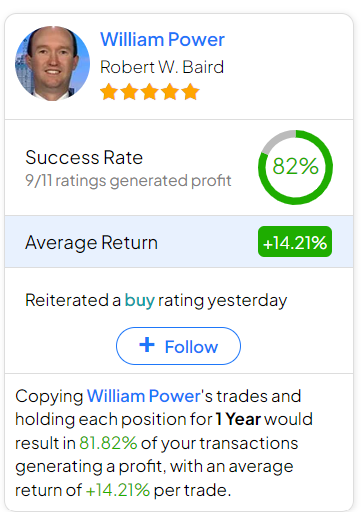

If you’re wondering which analyst you should follow if you want to buy and sell SNOW stock, the most profitable analyst covering the stock (on a one-year timeframe) is William Power of Robert W. Baird, with an average return of 14.21% per rating and an 82% success rate. Click on the image below to learn more.

Conclusion: Should You Consider Snowflake Stock?

Even when Wall Street is mostly bullish about a company, there will always be skeptics and worriers out there somewhere. I respect their opinions, but Snowflake’s results and guidance speak for themselves.

In other words, investors can weigh the cautious arguments but still make their own decisions about Snowflake. For the foreseeable future, I remain optimistic and feel that it’s a great time to consider a position in SNOW stock.