Chewy stock (NYSE:CHWY) has formed a rather polarizing investment case. On the upside, this thriving online retailer of pet products and supplies boasts numerous appealing qualities, making it an enticing acquisition target. Conversely, Chewy’s investment appeal appears somewhat limited as an independent entity.

While the company delivers exceptional value to its customer base, the challenge lies in its lack of substantial profitability, posing significant obstacles to management’s capacity to create shareholder value. Accordingly, I am neutral on the stock.

Why Chewy Could Make for a Great Acquisition Target

In my view, Chewy presents a compelling acquisition target, particularly by prominent retail or e-commerce giants such as Amazon (NASDAQ:AMZN) or Walmart (NYSE:WMT). This stems from the fact that Chewy has managed to cultivate one of the most extensive and devoted customer bases within the pet industry.

The cutthroat nature of this sector demands effective management of customer acquisition costs, and Chewy has excelled in this area. Pet owners consistently invest in their beloved companions, generating high lifetime customer value. Consequently, companies operating in this domain are willing to make substantial upfront investments to acquire customers, and Chewy provides precisely that opportunity.

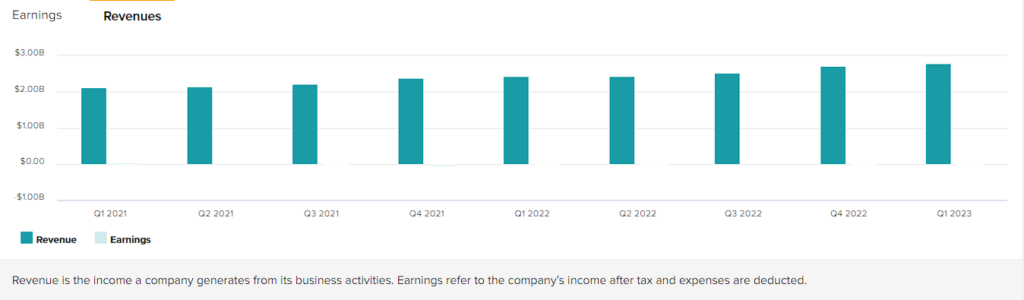

The growth trajectory of Chewy’s revenue further supports its appeal. Quarter after quarter, the company has demonstrated consistent revenue growth since 2018. Notably, Chewy’s revenue has surged from $763.5 million in Q1 2018 to an impressive $2.78 billion in Q1 2023, exhibiting growth across every quarter.

This success can be attributed to the recurring nature of pet supplies, ensuring predictable cash flow. In fact, Chewy’s most recent Q1 results indicate that $2.08 billion of its $2.78 billion in revenue came from Autoship Customer Sales, representing 74.7% of total sales, up from 72.2% last year. Autoship sales refer to the revenue derived from Chewy’s subscription service, which provides pet owners with convenient and customizable auto-reordering and deliveries.

This growing subscription model allows Chewy to enjoy reliable, high-quality cash flows while enhancing customer lifetime value. The value of trust that Chewy has built through this platform becomes an invaluable asset in an incredibly competitive industry, bolstering its customer retention strength.

To this point, Chewy’s ability to retain customers is a noteworthy advantage that sets the company apart in the pet business. Ending Q1 with 20.4 million customers speaks volumes in that regard. Moreover, net sales per active customer have experienced a 14.8% growth, amounting to $512 per quarter.

This growth trend in average revenue per user is expected to continue for years to come, driven by the increasing passion of pet “parents” to provide their furry companions with the best supplies available.

Overall, you can see why Chewy’s high percentage of recurring sales and wealth of data on each pet owner positions it as an attractive candidate for integration with a retail behemoth’s pet division. The combination of strong recurring revenue and valuable customer insights makes Chewy’s business an enticing proposition for potential acquirers in the industry.

Lack of Profits Prevents Shareholder Value Creation

Despite Chewy masterfully growing its customer base, percentage of recurring revenues, and overall business, its lack of meaningful profits prevents the creation of shareholder value. This is due to the company’s razor-thin margins, which can be attributed to several reasons. Some of them include:

- Intense Price Competition: The pet industry is highly competitive, with numerous players fighting for market share. This competition often leads to price battles, where companies strive to offer the lowest prices to attract customers. As a result, Chewy faces pressure to keep its prices competitive, which tends to squeeze profit margins.

- Customer Acquisition Costs: As I previously mentioned, CAC is the pet industry’s most critical metric, and Chewy invests heavily in maximizing all efficiencies around it. Acquiring new customers in a competitive market can be expensive, particularly through marketing campaigns, discounts, and promotions. These upfront costs can impact Chewy’s profitability, nonetheless.

- Free Shipping and Autoship Program: Another factor to consider is that Chewy offers free shipping on orders above a certain threshold and encourages customers to sign up for its Autoship program. While these initiatives enhance customer satisfaction and loyalty, as I previously praised, they can also put additional strain on the company’s margins. Shipping costs and discounts associated with these programs can eat into Chewy’s profitability.

Of course, as the company continues to experience growth in its customer base, it gains access to enhanced economies of scale, resulting in expanded profit margins over time. To provide some context, during fiscal 2016, the company recorded gross, operating, and net income margins of 16.6%, -11.9%, and -37.0%, respectively.

However, due to its strategic expansion efforts over the past seven years, these figures have significantly improved, reaching 28.7%, 0.6%, and 0.5% based on the most recent 12-month results.

Still, despite such a massive improvement, with Chewy’s costs now spread out to more than 20 million customers, the company can barely deliver a profit. Even if profit margins were to expand further, I believe they would hardly cross the low-single digits due to the very nature of the company’s business model.

Hence, while Chewy has built the perfect customer acquisition/retention ecosystem within the pet industry, it’s very hard for the company to grow shareholders’ wealth. However, a potential acquirer could embed this lovely ecosystem within their larger retail business model and unlock significant value!

Is CHWY Stock a Buy, According to Analysts?

Turning to Wall Street, Chewy has a Moderate Buy consensus rating based on 14 Buys, eight Holds, and one Sell assigned in the past three months. At $44.05, the average Chewy stock price target implies 14.9% upside potential.

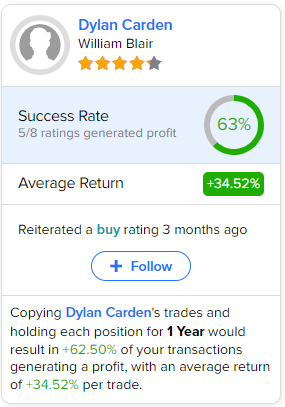

If you’re wondering which analyst you should follow if you want to buy and sell CHWY stock, the most accurate analyst covering the stock (on a one-year timeframe) is Dylan Carden from William Blair, with an average return of 34.52% per rating and a 63% success rate.

The Takeaway

Chewy has a hard time reaching meaningful margins that can produce substantial profits. From an earnings point of view, it seems almost impossible for investors to be sufficiently rewarded, even if the company scales further. However, it’s important to note that Chewy has developed what can be considered the most enticing marketplace for pet supplies available today.

Potential acquirers have the opportunity to capitalize on Chewy’s platform and unlock numerous operational efficiencies within their own retail ecosystems, potentially leading to notable improvements in Chewy’s margins. With shares of Chewy trading at just 1.5 times this year’s projected sales, this shouldn’t be a far-fetched scenario.