Chegg (CHGG) is a company that’s out to make education a simpler prospect. It offers both textbook rentals and purchases and also boasts online tutoring, among other services for students. Such a firm might have a solid claim on its market, especially in a time when schools can basically close down at any time due to COVID-19.

However, KeyBanc isn’t so optimistic about Chegg’s chances going forward. The company took a is currently down over 7%. I, however, remain cautiously bullish on Chegg, thanks to its versatility in the field.

Chegg’s year so far is down significantly. Last April, it was challenging the $100 per share mark. Currently, it’s down about two-thirds of that after a slump running from April to October and a disastrous post-Halloween drop.

The latest news will likely do little to inspire investors. KeyBanc Capital downgraded the company from “overweight” to “sector weight.”

The biggest reason is a likely decline in growth trends in the United States. Educational products and services, in general, are set to hit a downtrend, KeyBanc noted, which will leave Chegg on a bad footing.

Wall Street’s Take

Turning to Wall Street, Chegg has a Moderate Buy consensus rating. That’s based on five Buys and six Holds assigned in the past three months. The average Chegg price target of $41.78 implies 28.3% upside potential.

Analyst price targets range from a low of $35 per share to a high of $55 per share.

Hedge Fund Confidence Soars Despite Lack of Dividend

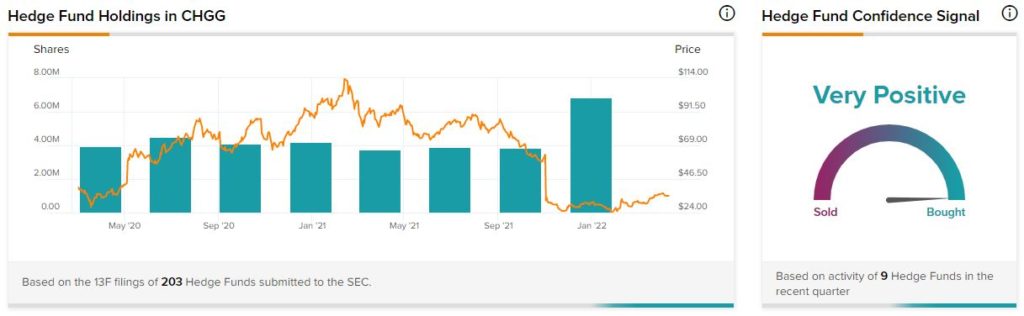

If the hedge funds are any indication, based on the TipRanks 13-F Tracker, there’s plenty of reason to get behind Chegg. Most of 2021 featured comparatively steady hedge fund involvement with Chegg.

However, between September and December, something substantial happened that sent hedge funds scrambling to buy Chegg. Hedge funds nearly doubled their stake in Chegg, going from around 3.874 million shares to 6.842 million shares.

Hedge funds were assuredly not lured by Chegg’s rich dividend. Chegg’s dividend history is flat-out nonexistent. Chegg has yet to issue a dividend and has no plans to do so any time soon.

An Investment in Education

It’s easy enough to see KeyBanc’s point here. Yes, it’s a safe bet that U.S sales of remote learning tools are likely to drop. Schools have been opening up, and most of them are back in play on at least some level or another.

With schools getting back to a semblance of normal, that means the demand for Chegg’s services is likely to decline in turn. It’s not completely vanished, of course.

Some parents already learned that homeschooling wasn’t nearly as difficult as they imagined and decided to continue accordingly. Additionally, Chegg has a brisk business overseas, and localization is likely to continue to add to Chegg’s coffers.

However, like a lot of other pandemic winners, losing the pandemic will cost Chegg a certain amount of business. Publicly-available alternatives are coming back into play, and that will hurt accordingly. Perhaps not as much as KeyBanc posits, but certainly to some degree.

Others question KeyBanc’s assessment here as well. One valuation suggests that Chegg is actually worth about $50.07 per share. With Chegg currently trading well below that, and also below its lowest price targets, that makes Chegg a comparative bargain, at least for now. There’s also a good slug of upside potential for investors here.

The only real outstanding question to ask is if Chegg can make up the losses from its pandemic-induced trade. Usually, people consider education a good investment. That makes them more likely to pay for it, and that should insulate Chegg from recession-related damage.

Granted, potential customers are likely to have less disposable income going forward, but education often survives these downturns. Whether customers are trying to improve their employment chances or give their children a leg up, education plays its role here. Customers are willing to make sacrifices elsewhere as needed.

That will give Chegg and those like it some extra insulation. Throw in Chegg’s geographical appeal, taking on markets globally, and that only improves the picture.

Concluding Views

Chegg is operating in a very recession-resistant field. With a recession likely to happen before too much longer, that will be valuable for Chegg investors. Throw in the comparatively low price tag right now to own a share, and Chegg makes a very good case for further ownership.

Sure, it’s going to take its lumps going forward, as every other company will. However, it’s also taking those lumps now, before the worst of a recessionary environment fires up. It can make adjustments now to fend off the worst, and the worst is likely yet to come.

That’s enough to make me at least moderately bullish. Chegg sees the writing on the wall and is getting ready accordingly. It’s hard to fault a company as ready to prepare for the worst as it is the best.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure