The logic is that the more people that are on Ozempic (and similar weight-loss drugs), the less demand there will be for food, especially unhealthy junk food rich in empty calories. Though Ozempic fears hitting the broader basket of food stocks may seem warranted, given the potential negative impact on sales, I’d argue concerns are now overdone, especially when it comes to food stocks (such as CELH, MNST, BRBR) that are more or less Ozempic-proof — or at least less vulnerable to a sales blow from weight-loss drugs.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

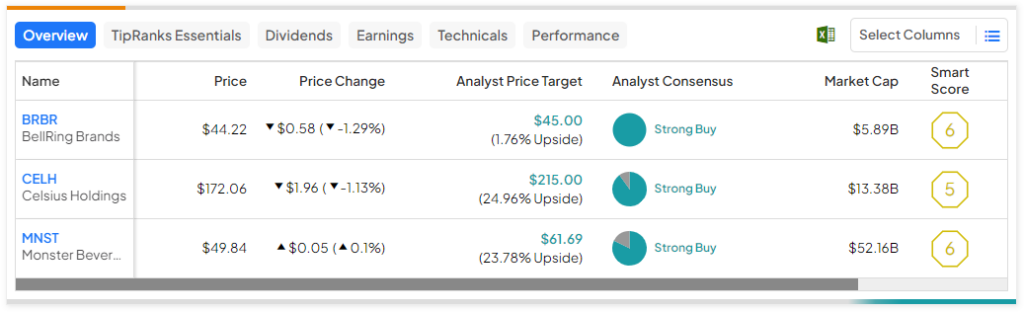

Therefore, in this piece, we’ll use TipRanks’ Comparison Tool to check out three Strong-Buy-rated food and beverage plays that can still thrive in a world where more consumers are on Ozempic.

Celsius Holdings (NASDAQ:CELH)

Celsius Holdings is one of the market’s hottest growth stocks outside of the tech scene. The company behind health-conscious energy drinks is a hit with young consumers, like millennials, and stands out as one of the most disruptive forces to hit the beverage scene in quite a while.

As the economy tests a potential recession, Celsius’ line of “fitness drinks” could continue to experience robust growth as the firm continues to go after a sizeable non-alcoholic beverage market as a relative lightweight with a mere $13.4 billion market cap. For now, I’m siding with the many analysts who are incredibly bullish on the firm.

The second quarter, which saw sales soar 112% year-over-year, helped give CELH stock a big jolt, with shares surging over 20% on the news. More recently, shares have fallen about 15% from their recent high on the back of a bearish call and broader weakness in the food and beverage space (thanks, Ozempic).

Still, the company doesn’t just have a hot brand (built on the back of partnerships with major retailers) and a great product, but it’s been making good use of Pepsi’s (NASDAQ:PEP) distribution capabilities. Looking ahead, Celsius CEO John Fieldly expects his firm to “further leverage PepsiCo’s best-in-class distribution system.”

It’s one thing to have a hot new product, but it’s another to have the ability to strike deals with retailers and beverage behemoths to help it take growth into overdrive. Looking ahead, I don’t think there’s stopping the growth freight train that is Celsius. Not even Ozempic seems to have what it takes to spark a significant growth slowdown.

Personally, I view weight-loss drugs as a potential tailwind. Weight-loss drugs combined with a healthy diet and fitness (both areas where Celsius excels) are a perfect combo for melting off the fat.

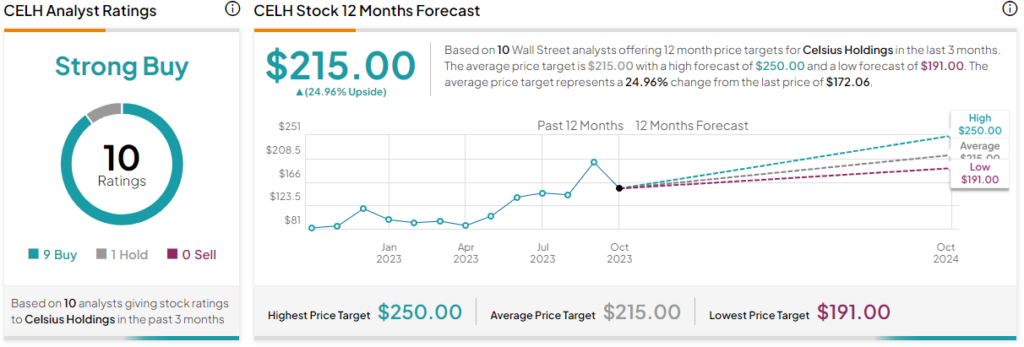

What is the Price Target for CELH Stock?

Celsius is a Strong Buy on TipRanks, with nine Buys and one Hold rating assigned in the past three months. The average CELH stock price target of $215.00 entails 25% upside potential.

Monster Beverage (NASDAQ:MNST)

Monster Beverage is another energy drink company that’s witnessed explosive growth, with over 417% in gains enjoyed over the past 10 years. Over the past 25 years, the stock has been the market’s number-one performer. While I have no idea if Celsius is the next Monster, I believe Monster has an extensive moat and a game plan to keep growth going strong.

In a prior piece, I briefly remarked on the firm’s growth catalysts, noting that the growth multiple (41.3 times trailing price-to-earnings at the time) was warranted. Shares have since contracted, and little has changed about the growth story. As such, I’m even more bullish as the valuation comes down further on the back of industry-wide weakness (yes, Ozempic is a likely factor behind the decline).

At writing, MNST stock goes for 36.8 times trailing price-to-earnings, well below where it traded (over 40 times) at around its nearly-$60 per-share peak. The dip seems buyable, even with the growing concerns over Ozempic’s impact on food and beverage firms.

Fortunately, Monster has been gravitating toward healthier, sugar-free options loaded with vitamins — a move that could help it adapt as weight-loss trends progress. Also, let’s not discount the company’s brand, which is synonymous with energy drinks at this point.

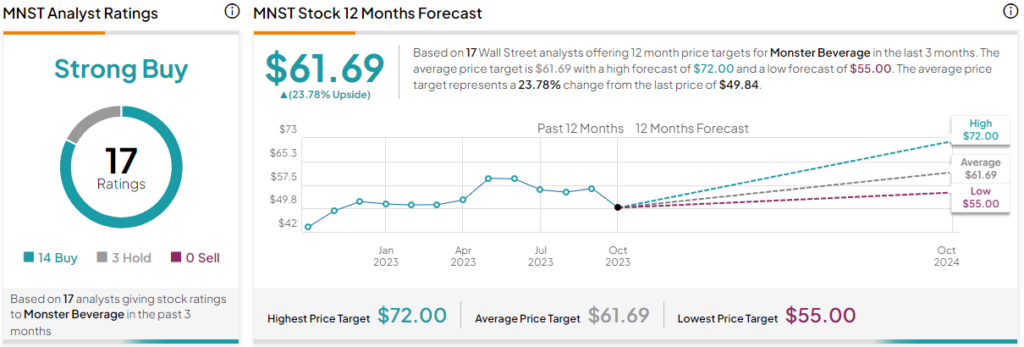

What is the Price Target for MNST Stock?

Monster is a Strong Buy, according to analysts, with 14 Buys and three Holds assigned in the past three months. The average MNST stock price target of $61.69 entails 23.8% upside potential from here.

BellRing Brands (NYSE:BRBR)

BellRing Brands is a lesser-known food stock behind such brands as Premier Protein, PowerBar, and JointJuice. Although you’ve probably never heard of the company, odds are you’ve heard of the brands, especially if you’re big into fitness.

The stock is sitting near a fresh all-time high, just shy of $45 per share. Clearly, the Ozempic woes haven’t rung BellRing Brands (forgive the pun!). Though shares are pricier than the peer group at 38.6 times trailing price-to-earnings versus the 17.6 times packaged foods industry average, I find it hard to be anything but bullish.

Needham analyst Matt McGinley is a huge bull on BellRing Brands, noting that the firm’s investments in promos and marketing will set the stage for “strong volume growth next year.” Despite the Buy rating and optimism heading into 2024, Bank of America (NYSE:BAC), which reiterated its own Buy rating and a $50.00 price target this week, holds the Street-high price target.

As for obesity drugs, BellRing Brands seems to have virtually no exposure to that headwind, given that protein products and PowerBars tend to be taken by consumers who don’t need to be on weight-loss drugs. For such a crowd, a rigorous exercise routine and PowerBars are their version of Ozempic.

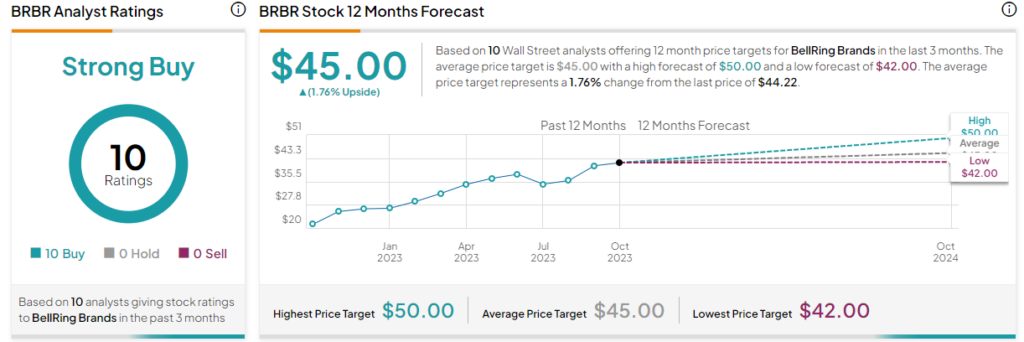

What is the Price Target for BRBR Stock?

BellRing is a Strong Buy, according to analysts, with 10 unanimous Buy ratings assigned in the past three months. Nonetheless, the average BRBR stock price target of $45.00 entails just 1.8% upside potential. Indeed, BRBR stock has had a run, but two notable Buy reiterations have flowed in over the past week.

The Takeaway

There’s a lot of hype regarding the hot new weight-loss drug trend. Ozempic and other weight-loss drugs have been a significant pressure point for the broader basket of food stocks. Though such drugs have introduced a haze of uncertainty surrounding various food firms, it’s becoming hard to pass up on the valuations of certain food plays, including the ones that may actually benefit as consumers double down on their weight-shedding goals either while on or off weight-loss drugs.

Of the trio presented in this piece, analysts expect the most upside potential (25%) from Celsius Holdings.