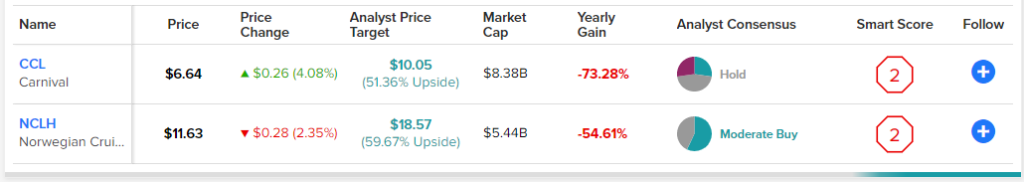

Cruise lines have been an uncomfortably choppy ride over the past year. Therefore, in this piece, we used TipRanks’ Comparison Tool to see where Wall Street stands on two major cruise line operators — CCL and NCLH — that (forgive the pun) seem to be treading water going into the fourth quarter of 2022. Based on upside potential alone, NCLH seems like the better stock, but let’s dive deeper.

Undoubtedly, many investors who bought these two stocks during the 2020 dip expecting a swift recovery are feeling discouraged. Carnival (NYSE:CCL) and Norwegian Cruise Lines (NYSE:NCLH) are back to 2020 levels, with the former name now even lower than its 2020 depths.

Though the coronavirus pandemic may be winding down, macro headwinds and a recession could sink the cruise line trade further into the depths. Indeed, it’s tough to be a cruise line operator these days, with such elevated operating costs and enhanced sensitivity to the state of the consumer.

While the coming recession may be shorter-lived, it’s still difficult to gauge how rough the waters will be for the cruise line companies heading into 2023. They got knocked down by the global pandemic, and an ensuing recession just seems like more salt rubbed in their wounds.

Though they face the same industry and macro headwinds, certain cruise line firms may be better poised to sink than swim. Indeed, debt levels are the weight that sinks companies when interest rates rise. Now, without further ado, let’s take a look at CCL and NCLH.

Carnival Corporation (CCL)

It’s been an excruciating year for Carnival, which is down 67% year-to-date and about 90% off its all-time highs. The fallen travel and leisure firm may seem like a value-rich rebound play, but the balance sheet isn’t in an ideal spot right now, with a potential recession-driven demand slowdown in the cards.

The company has roughly $28.2 billion in net debt as of the August 2022 quarter, up more than 12% year-over-year. That’s a lot of debt for a company with a mere $8.6 billion market cap! At this juncture, it seems like the market expects debt to sink shares as the macro outlook weakens further.

Despite the frail balance sheet that seems to be getting worse with time, there is hope for the firm as it looks to manage through yet another dire year. Carnival CEO Josh Weinstein has a challenging task on his hands. However, he did note that the relaxation of protocols has caused “a meaningful improvement in booking volumes.”

Undoubtedly, bookings have come such a long way since the COVID-19 lockdown days. As the pandemic goes endemic, Carnival may finally get some relief it so needs as it looks to chip away at its mountain of debt.

Thus far, Carnival has failed to convince investors, with a third-quarter number that fell short of estimates. For Q3, per-share losses came in at a wider-than-expected $0.58, much worse than the $0.06 per-share loss estimate. The $4.3 billion in revenue also wasn’t anything to write home about.

The one thing that could turn the tide for Carnival is the pent-up demand for experiences such as cruising. A recession will hurt consumers’ wallets, but many people have been saving up for cruises for years during lockdowns. As Carnival sets sails, there’s a good possibility that bookings could continue to rise while fuel costs sink further.

The worst may be in the rearview for Carnival, but don’t expect smooth sailing into 2023.

What is the Price Target for CCL Stock?

Analysts are taking on a wait-and-see stance with Carnival, with a “Hold” consensus rating based on three Buys, five Holds, and three Sells assigned in the past three months. The average CCL stock price target of $10.05 implies a generous 51.4% in upside potential, however. The debt is a major concern, but if things go right, Carnival is a name with bounce-back potential.

Norwegian Cruise Lines Holdings (NCLH)

Norwegian Cruise Lines stock is off around 80% from its all-time high, just north of $60 per share. At under $12, NCLH stock is still a few bucks above its 2020 lows. Undoubtedly, Norwegian seems to be a less at-risk play than its peer Carnival. Just because its 2023 prospects are brighter, though, does not mean Norwegian is out of the woods.

Like Carnival, Norwegian has clocked in larger-than-expected losses in recent quarters. Looking ahead, management expects a “gradual” move to pre-COVID-19 margins. Despite upbeat expectations, the company is committing to maintaining a comfortable liquidity position. That’s only prudent in the face of profound uncertainty.

The $10.5 billion in net debt on the balance sheet may not be pretty, but it seems more than manageable. The firm boasts $1.8 billion in cash and one of the most impressive fleets in the industry.

Further, CEO Frank Del Rio is a very capable leader. At 2.4x sales and 6.2x book value, NCLH seems like an intriguing recovery play over the next five years. Undoubtedly, the firm’s recovery trajectory could prove very gradual, but it seems destined to survive another hurricane in the form of a global recession.

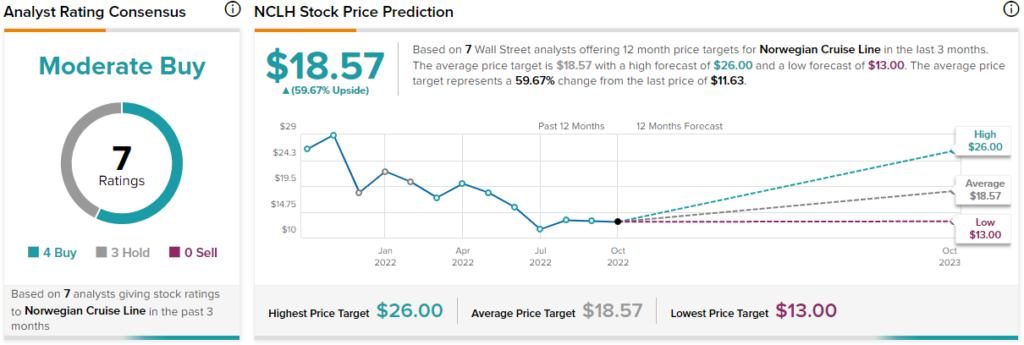

What is the Price Target for NCLH Stock?

Wall Street is more upbeat on Norwegian Cruise Lines, with a “Moderate Buy” rating based on four Buys and three Hold ratings assigned over the past three months. The average NCLH stock price target of $18.57 implies 59.7% in gains over the year ahead.

Conclusion: Cruise Line Stocks May Not be That Bad Now

Cruise line stocks have left investors bruised. With low expectations and potential pent-up demand catalysts, they may not be in nearly as much trouble as investors think going into 2023.