If ARK Invest CEO Cathie Wood bought or sold a stock, it’s reasonable to assume that she had a good reason for doing this. I’m not saying that anyone should blindly follow Wood’s trades, but perhaps we can get a sense of why Wood’s ARK Innovation ETF (NYSEARCA:ARKK) would sell Coinbase Global (NASDAQ:COIN) stock. Personally, I’m neutral on COIN stock, as I like Bitcoin (BTC-USD), but I’m concerned about Coinbase’s current valuation.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Coinbase Global is possibly the most famous U.S.-based cryptocurrency trading platform (Binance might also claim that title). Consequently, Coinbase stock has a tendency to follow the price of Bitcoin, though it’s not a one-to-one correlation.

In other words, if you’re going to invest in COIN stock, you’ll want to keep tabs of what’s going on in the world of cryptocurrency and the blockchain, as well as events pertaining to Coinbase in particular. Two such events, as we’re about to touch upon, involve important people reducing their share positions in Coinbase, and you should wonder why this is happening if you’re a cautious trader.

An Insider and a Well-Known Investor Sell Coinbase Stock

When corporate insiders buy or sell shares of their company’s stock, it’s worth paying attention to, and I use TipRanks’ Insider Trading Activity tracker to stay on top of this. After all, it’s probably a good sign when a company’s executive parks his or her own money in that company’s stock. On the other hand, when they’re selling their own company’s stock, I wonder if they see problems that the public doesn’t see.

In this instance, Coinbase Global Chairman of the Board Brian Armstrong sold 74,325 COIN stock shares between July 3 and July 5 at an average price of $78.44 per share. That’s a sizable divestment, as the total sale(s) amounted to $5,829,845.

Armstrong’s timing wasn’t perfect, as COIN stock is higher than $78.44 now. Still, it’s possible that he sold the shares to take profits. Perhaps Armstrong bought at a much lower price and was satisfied with his returns. So, I won’t read too much into his transactions right now (though I might revisit this topic of Armstrong continues to sell Coinbase shares).

Meanwhile, Wood’s ARK Innovation ETF reportedly sold a whopping 132,152 COIN shares at a closing price of $89.15 per share on July 11. We’re talking about a $11.8 million share sale, which is nothing to sneeze at.

Why Would Wood Sell Coinbase Stock?

It was only a few months ago that I reported on Wood’s fund buying COIN stock. What would prompt her to sell now? Could it be valuation concerns?

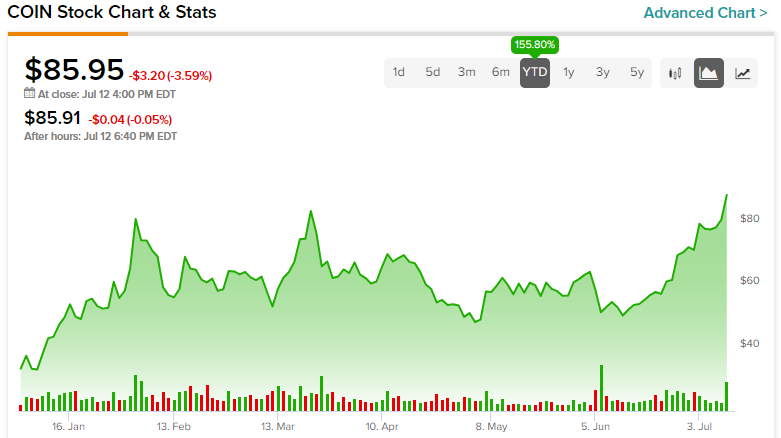

That’s what I’m worried about more than anything else when it comes to Coinbase. Bitcoin is nowhere near its prior peak of around $69,000, but Coinbase stock has been displaying plenty of strength. If COIN stock is often correlated to Bitcoin, then it appears to have gotten ahead of itself.

Furthermore, value-focused investors might be wary of Coinbase because the company has been unprofitable since Q1 of 2022. Therefore, with no earnings, it’s difficult to assess the value of Coinbase, as it doesn’t have a P/E ratio.

I’m not sure if Wood is greatly concerned about Coinbase’s valuation (she seems more like a momentum/growth investor), but there’s another issue to consider. Specifically, the U.S. Securities and Exchange Commission’s (SEC) is bringing legal action against Coinbase. This problem is top-of-mind among analysts who have recently expressed concerns about Coinbase’s future prospects, including Piper Sandler’s Patrick Moley.

Indeed, Piper Sandler analysts cited Coinbase’s valuation and the case brought forth by the SEC when the firm downgraded COIN stock from Overweight to Neutral and lowered its price target on the shares from $65 to $60.

Is COIN Stock a Buy, According to Analysts?

Turning to Wall Street, COIN is a Hold based on five Buys, eight Holds, and six Sell ratings. The average Coinbase stock price target is $58, implying 32.5% downside potential.

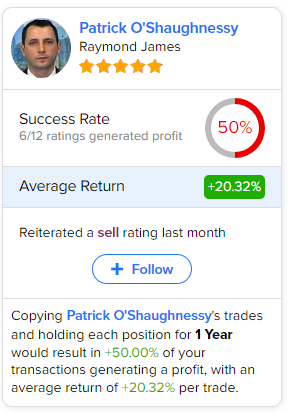

If you’re wondering which analyst you should follow if you want to buy and sell COIN stock, the most profitable analyst covering the stock (on a one-year timeframe) is Patrick O’Shaughnessy of Raymond James, with an average return of 20.32% per rating. Click on the image below to learn more.

Conclusion: Should You Consider COIN Stock?

As you can see, analysts aren’t super enthusiastic about Coinbase in 2023, and a corporate insider sold a large number of shares. On top of all that, Wood’s fund divested a huge chunk of Coinbase stock — though I’ll admit, that might have been an instance of Wood taking profits after a substantial share-price rally.

Still, I can’t just ignore the valuation concerns and the SEC’s legal action against Coinbase. In the final analysis, I like cryptocurrency generally and Bitcoin in particular, but I wouldn’t consider COIN stock right now.