Cathie Wood’s investing philosophy is based on unwavering conviction in a portfolio heavily favoring high-growth names with disruptive qualities. But against an economic backdrop of soaring inflation and high interest rates, that strategy wilted during 2021 and 2022.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

However, Wood’s Ark Invest’s flagship ARKK fund appears to have got its mojo back this year, and looking ahead to the post-high rate landscape, that is something Wood expects will continue.

“The fear of rising interest rates hurt our strategy, and then the actuality or the reality of rising rates last year really hurt our strategy,” Wood recently said. “This year, we’ve started outperforming, and I think it is because investors are looking over the top of these interest rate increases, anticipating their end, and ultimately, their decline.

“If we’re right,” she goes on to add, “disruptive innovation is going to cause a lot of deflation. And that’s a good thing. Deflation caused by disruptive innovation will cause an explosion in the growth rates of units in the disruptive innovation space. So we think we’ve been through the worst of it.”

If Wood is correct here, then ‘disruptive innovation’ might be the way forward. With that in mind, we decided to check out a couple of those type of names Wood has been busy loading up on recently.

In fact, Wood is not alone in thinking these are worthwhile additions to a portfolio. According to the TipRanks database, certain Street analysts see big gains ahead for the pair. Let’s see why investors should pay attention here.

Archer Aviation (ACHR)

Speaking of disruptive innovation, let’s delve into the realm of urban air mobility. Archer Aviation is an innovative electric vertical takeoff and landing (eVTOL) aircraft manufacturer and technology company. Archer is a key player in the emerging urban air mobility (UAM) industry, with a mission to revolutionize urban transportation by developing sustainable and efficient electric aircraft designed for short-distance, urban air travel.

It’s still early days for this pre-revenue firm, but Archer has some big backers behind it and recently obtained a $215 million investment from a consortium that featured Stellantis, Boeing, and United Airlines.

The backlog for its eVTOL vehicle, Midnight, includes U.S. airlines United and Mesa, both of which are considered strategic partners, and so is Stellantis, the auto giant responsible for being the exclusive contract manufacturer for the mass production of Midnight. Archer has set its sights on achieving certification in 2024 and launching commercial operations the following year.

More in the here and now, earlier this month, the company announced that the U.S. Air Force had delivered the company’s initial payment, totaling nearly $1 million for a mobile flight simulator. It amounts to the first payment of the recently disclosed contracts that have a value of up to $142 million.

The stock has been one of the year’s biggest success stories, even after a recent pullback, delivering year-to-date gains of 180%. Meanwhile, Wood has been loading up. She bought 6,005,798 shares over the past 2 months via her ARKK, ARKQ, and ARKX ETFs. These ETFs now hold 15,798,848 shares combined, which currently command a market value of more than $82 million.

While there are plenty of unknowns ahead for this disruptor, Raymond James analyst Savanthi Syth thinks the company offers a unique value proposition.

“Archer continue[s] to lead on certification among companies under coverage, albeit FAA timelines are far from certain, and the industry continues to move forward with certification-conforming aircraft coming in 2024 (with pilot-on-board flights likely at Archer and Joby in 1H24), which we believe should build momentum in sentiment among investors and the public,” Syth explained. “While we are generally constructive on the prospects and opportunity for the group, ACHR stands out as particularly compelling at current valuation combined with the progress to date and a balanced approach to commercialization.”

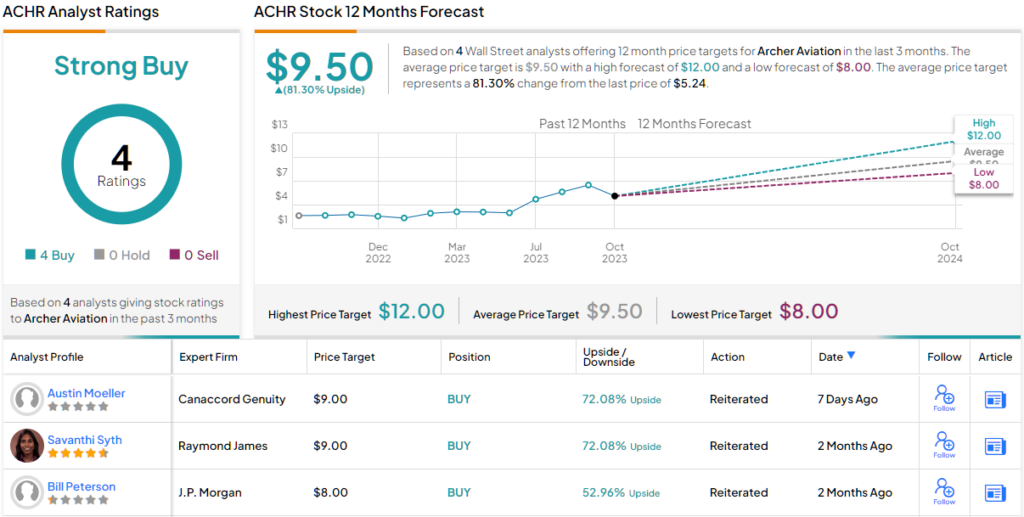

These comments underpin Syth’s Outperform (i.e., Buy) rating while her $9 price target implies shares will gain 71% over the coming year. (To watch Syth’s track record, click here)

Overall, the bulls are definitely running for ACHR, as the stock’s Strong Buy consensus rating shows – it is backed up by 4 unanimously positive analyst reviews. The shares are trading for $5.21 and the $9.5 average price target suggests a one-year upside potential of ~81%. (See ACHR stock forecast)

Crispr Therapeutics (CRSP)

We’ll continue down the innovation-focused path with Crispr Therapeutics, a leading gene editing firm targeting the development of transformative gene-based therapies for serious diseases. This it does via the use of its proprietary CRISPR/Cas9 platform, a revolutionary genome-editing tool that allows for precise and targeted modification of genes.

The company has a diversified portfolio of therapeutic programs across a spectrum of medical conditions, including hemoglobinopathies, oncology, regenerative medicine, and rare diseases.

But with biotechs, it’s all about catalysts, and Crispr has a big one coming up.

In partnership with Vertex Pharmaceuticals, CRISPR has been developing exa-cel (exagamglogene autotemcel), a potential medication for sickle cell disease (SCD) and transfusion-dependent beta thalassemia (TDT).

The FDA granted Priority Review for the SCD indication and has assigned a PDUFA date for December 8 (for TDT there’s a March 30, 2024, date set). Beforehand, on October 31, an Advisory Committee will hold a meeting to discuss and offer its recommendations on the biologics license application (BLA). Exa-cel could therefore become the first CRISPR gene-editing therapy to gain FDA approval.

This kind of name and the potential for game-changing solutions is right up Wood’s alley. The past 2 months have seen her loading up on 194,324 shares via the ARKK & ARKG ETFs. These ETFs now hold 6,529,322 shares combined, at the current share price, worth ~$277.5 million.

Truist analyst Joon Lee is in no doubt as to the impact approval could have, while other expected developments are set to add further sheen.

“It’s not lost on us that exa-cel PDUFA for SCD is on Dec 8th, a day before the start of ASH 2023, which could be an inflection point for CRSP,” he writes. “EU/UK regulatory process is also progressing and could lead to approval(s) near-term based on EMA/MHRA submissions in Dec 22. IO, regenmed and in vivo programs are also advancing with possible updates by YE23, likely also at ASH.”

“Net-net,” Lee sums up, “CRSP is at the cusp of delivering a historic first ever CRISPR-Cas editing therapeutic drug product, which we think could be a $2.5BN peak U.S. sales opportunity by 2030. CRSP is one of our 5 favorite stocks for 2023.”

It’s no surprise to learn that Lee has a Buy rating on CRSP shares while his Street-high $220 price target suggests shares have huge 417% growth potential for the next 12 months. (To watch Lee’s track record, click here)

So, that’s Truist’s view, let’s turn our attention now to rest of the Street: CRSP’s 10 Buys, 5 Holds and 1 Sell coalesce into a Moderate Buy rating. There’s plenty of upside – 94.51% to be exact – should the $83.33 average price target be met over the next months. (See CRSP stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.