Used car retailer CarMax (NYSE:KMX) is scheduled to announce its fiscal third-quarter results on December 22. The company’s Q2 FY23 (ended August 31, 2022) performance reflected that the market for used car vehicles has become weak as high inflation and soaring interest rates have impacted vehicle affordability. Moreover, consumer sentiment is low due to growing fears of an impending recession.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Wall Street’s Estimates for Q3 Results

CarMax’s revenue grew 2% to $8.1 billion in the fiscal second quarter. The company’s earnings per share (EPS) declined 54% year-over-year to $0.79, significantly lagging analysts’ consensus estimate of $1.39. Costs in the quarter increased at a higher pace than sales and dragged down the gross margin to 9.05% from 10.2% in the prior-year quarter.

CarMax is focused on driving further operational efficiencies as it continues to navigate adverse business conditions. It is taking various measures, including staff reduction, to align its expenses to the sales levels.

Analysts expect CarMax’s Q3 EPS to fall 60% to $0.65, reflecting continued margin pressure and lower sales. Wall Street expects Q3 revenue to decline about 16% to $7.2 billion.

Is CarMax a Good Stock to Buy?

Wedbush analyst Seth Basham sees more downside than upside risk for CarMax stock heading into the third quarter results. Despite low expectations, Basham expects the company to deliver disappointing Q3 numbers as the rate of sales decline rivals the Great Recession. In line with his investment thesis, Basham lowered his price target for CarMax stock to $55 from $67 and reiterated a Hold rating.

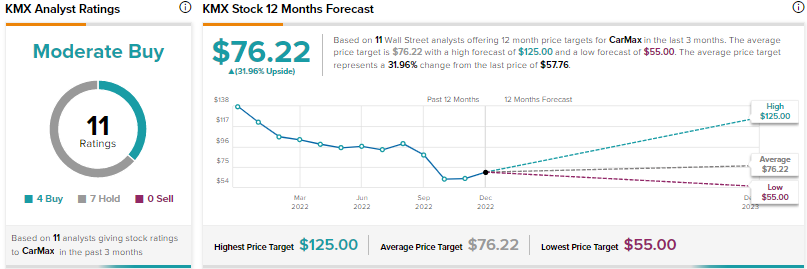

Overall, Wall Street is cautiously optimistic about CarMax stock, with a Moderate Buy consensus rating based on four Buys and seven Holds. The average KMX stock price target of $76.22 implies 32% upside potential. Shares have collapsed nearly 56% year-to-date.

Conclusion

CarMax’s profitability and sales are expected to continue to be under pressure amid tough business conditions and a decline in consumer spending on big-ticket items like cars. Management’s commentary will shed more light on the extent of weakness expected in the upcoming quarters.