McDonald’s (NYSE:MCD) has created massive wealth for shareholders over time. Shares of the quick service restaurant giant have returned 276% in the last 10 years and a whopping 1,770% since November 2003, after adjusting for dividends. Valued at $207 billion, MCD stock trades just 5% below its all-time high and offers a dividend yield of 2.3%. I remain bullish on McDonald’s stock due to its strong brand presence, diversified revenue streams (which continue to diversify further), and reasonable valuation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

An Overview of McDonald’s Business Model

Among the most recognizable brands in the world, McDonald’s began as a small drive-in restaurant in California and has grown into an American heavyweight that serves 63 million customers every single day. It owns and operates restaurants and franchises in the U.S. and several international markets. The company ended Q3 with 41,198 locations in more than 100 countries, but it owns and operates around 5% of these restaurants, while 95% are operated by franchises.

However, investors should understand that McDonald’s owns a majority of its locations, which are leased out to franchisors. In fact, its property value on the balance sheet is over $42 billion, and the company earned $7.3 billion in rental revenue in the first nine months of 2023. This suggests that more than 60% of franchise-based sales are derived from rental income, which is quite exceptional. The rest is generated via annual franchise fees.

Additionally, rental sales account for close to 40% of McDonald’s revenue, providing it with a steady stream of cash flows across business cycles.

McDonald’s predictable cash flows allow it to pay shareholders an annualized dividend of $6.68 per share. Moreover, as its rental income has increased over the years, its dividend payouts have risen by 14.8% annually since 1994, showcasing the resiliency of this business model.

With a payout ratio of 52.5%, McDonald’s has enough flexibility to raise dividends, deleverage its balance sheet, and invest in growth projects that will drive future cash flows higher.

How Has McDonald’s Performed in 2023?

Despite a sluggish macro environment, McDonald’s increased sales by 11% year-over-year to $19.1 billion in the last three quarters. Its top-line growth, coupled with a lower cost base, has allowed it to increase its net income by a stellar 50% year-over-year in the first nine months of 2023.

McDonald’s is fairly recession-resistant and might actually thrive during periods of sluggish consumer spending. Typically, consumers trade down from full-service dining and casual dining during recessions in the hunt for cheaper meal options, acting as a tailwind for McDonald’s and other quick-service restaurants.

A weak economy favors McDonald’s and its peers, as witnessed by an 8.1% increase in same-store sales in the U.S. in Q3 2023.

Unlike several other restaurant companies, McDonald’s unique business model allows it to benefit from sky-high profit margins. For instance, its operating margins surged to 46% in Q3 compared to a margin of 16.4% reported by Chipotle Mexican Grill (NYSE:CMG).

McDonald’s Acquires Carlyle’s Stake in China

Carlyle Group (NASDAQ:CG) and CITIC, two investment firms, have a strategic partnership with McDonald’s that operates and manages the latter’s business in mainland China, Macau, and Hong Kong. Last month, McDonald’s agreed to acquire Carlyle’s minority stake in this partnership.

The CITIC Consortium will maintain its controlling stake in this venture, which stands at 52%. Further, McDonald’s will remain a minority partner but will increase its stake to 48% from 20%.

McDonald’s partnership with CITIC and Carlyle has been quite fruitful in growing the company’s brand in China, which is also its second-largest market. Since 2017, McDonald’s has doubled its restaurant count in this region to over 5,500.

McDonald’s President and CEO Chris Kempczinski stated, “We believe there is no better time to simplify our structure, given the tremendous opportunity to capture increased demand and further benefit from our fastest growing market’s long-term potential.”

The business has generated systemwide sales growth of over 30% in China since September 2019. CITIC remains optimistic about growing the McDonald’s brand organically in China and expects to end 2028 with more than 10,000 restaurants.

Is MCD Stock a Buy, According to Analysts?

McDonald’s is forecast to increase sales by 0.4% year-over-year to $23.3 billion, while adjusted earnings are expected to grow by 16.9% to $11.81 per share for 2023. So, MCD stock is priced at 8.9x forward sales and 24.2x forward earnings, which is not too expensive, given its high-quality business.

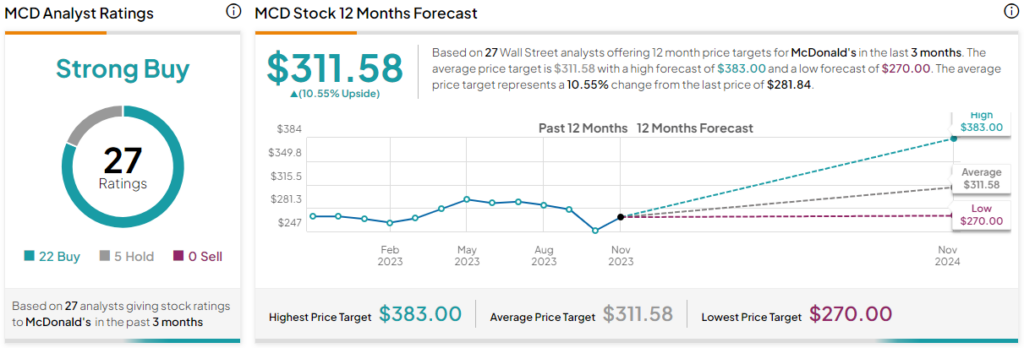

Out of the 27 analysts covering McDonald’s stock, 22 recommend a Buy, five recommend a Hold, and none recommend a Sell. The average MCD stock price target is $311.58, which is 10.6% above the current trading price.

The Takeaway

McDonald’s has survived multiple economic downturns over several decades and is likely to emerge unscathed from the ongoing macro uncertainty. I believe that its high profit margins, stable earnings, pricing power, and widening base of franchise fees make it a top investment choice today.