McDonald’s (NYSE:MCD) dividend growth has recently accelerated – a theme that I believe is here to stay. The iconic fast-food restaurant franchisor recently hiked its dividend by roughly 10%, a lofty rate versus the previous years. Simultaneously, the company’s Q3 results once again showcased McDonald’s ability to keep growing its top and bottom lines at attractive rates despite its very mature operations. Thus, I believe management will strive to sustain above-average hikes, moving forward. I am bullish on the stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Examining McDonald’s Dividend Growth Potential

McDonald’s has a pretty impressive track record when it comes to dividends. The company has been serving up not just burgers and fries but also consistent dividend growth for quite a while. Specifically, the company has raised its quarterly dividend every year since 1976, now boasting 49 years of consecutive annual dividend hikes. What’s quite interesting is that despite McDonald’s featuring such an extended and ripe dividend growth track record, the pace of dividend increases has accelerated recently.

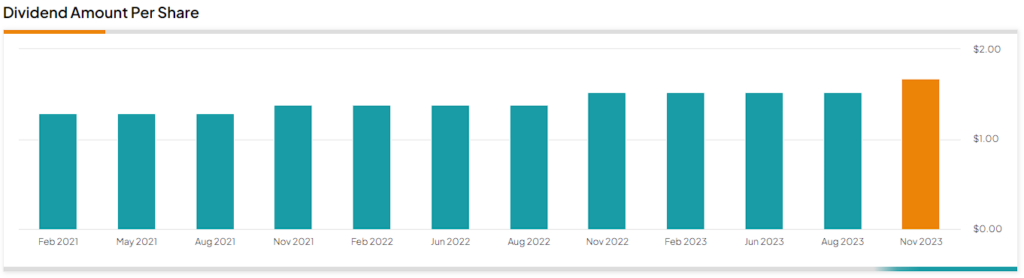

Here are the company’s most recent dividend increases:

- 2023 Dividend Hike: 9.9%

- 2022 Dividend Hike: 10.1%

- 2021 Dividend Hike: 7.0%

- 2020 Dividend Hike: 3.0%

Undoubtedly, McDonald’s has experienced a remarkable surge in dividend growth over the last few years compared to its rates in 2020-21. The driving force behind this upswing lies in the company’s excellent performance in recent quarters, marked by a noteworthy acceleration in net income growth.

Adding to this success story is the positive impact of inflation on McDonald’s menu prices. Concurrently, the company’s royalty-oriented business model, characterized by its capital-light nature, has played a pivotal role in maintaining low costs. The harmonious combination of escalating revenues and controlled costs has not only propelled the company’s profits but has also paved the way for robust increases in dividends. Let’s take a deeper look.

Strong Results Signal Strong Dividend Growth Potential

As I mentioned, McDonald’s above-average dividend hikes lately have been supported by solid results. In fact, the company’s Q3 report showcased another exciting trading period, with sales growing by 14.0% to $6.69 billion. Speaking of reaccelerating figures, this quarter’s top-line growth was higher than the previous quarter’s 13.6% and notably higher than the previous year’s decline of 5.3%. Adjusted EPS growth also surged to an impressive 19% to $3.19 — a new all-time high figure for the company.

Revenue Growth: Strong Momentum

The company’s strong momentum from Q2 was carried over in Q3, spurred by an expansion in its restaurant network and notable same-store sales figures. At the end of the quarter, the company’s restaurant count stood at 41,198 restaurants, up 3% compared to last year’s 39,980.

Meanwhile, existing stores reported a remarkable 8.8% rise in sales. The combination of higher same-store sales and a larger count of stores led to the 14% rise in revenues mentioned earlier. It’s worth highlighting that same-store sales growth surpassed the inflation rate, underscoring resilient and steadfast consumer loyalty.

I think it boils down to McDonald’s menu maintaining its attractive pricing compared to the rising costs at your average restaurant these days. While many other eateries have significantly increased their prices over the past year, McDonald’s has somehow managed to stay budget-friendly, even with a few steep price hikes in the mix.

Profitability Surges, Encourages Strong Dividend Hikes

McDonald’s profitability surged in Q3, as strong revenue and superb cost control powered by the company’s business model led to a significant increase in its bottom line. This success paved the way for a noteworthy dividend hike, exemplified by the impressive 9.9% increase announced alongside the quarterly earnings report.

In the third quarter, McDonald’s operating margin soared to an impressive 47.6%, marking a notable expansion from 47.2% in the preceding quarter and 47.3% the previous year. To truly grasp the significance of this achievement, let’s cast a quick glance at the recent performance of some heavyweights in the quick-service restaurant realm, which include companies like Yum! Brands (NYSE:YUM), Restaurant Brands International (NYSE:QSR), Wingstop (NASDAQ:WING), and Chipotle Mexican Grill (NYSE:CMG).

Their operating profit margins? 34.9%, 32.7%, 26.2%, and 16.7%, respectively. These are formidable contenders in the industry, yet none come close to matching the level McDonald’s consistently attains. The credit for this distinction largely goes to McDonald’s highly-efficient and scalable business model, boasting a whopping 95% of its restaurants operating as franchises. It’s the very source of the superb cost control at McDonald’s that I mentioned earlier.

The powerful synergy of McDonald’s escalating revenue and widening profit margins orchestrated a remarkable upswing in its EPS. To be precise, its adjusted EPS experienced a strong 19% surge, rising to a record $3.19. Notably, strategic share repurchases totaling approximately $2.69 billion over the past four quarters also played a role in bolstering this metric.

Recording such substantial increases in EPS, you can see why management felt confident enough to follow with double-digit dividend hikes. I believe this trend is set to continue, as McDonald’s seems to have plenty of room for above-average dividend increases. Specifically, based on the company’s results and ongoing momentum, Wall Street expects the company to achieve EPS of $11.79 this year. Even following this year’s double-digit dividend increase, this implies a comfortable forward payout ratio of 57%.

Is MCD Stock a Buy, According to Analysts?

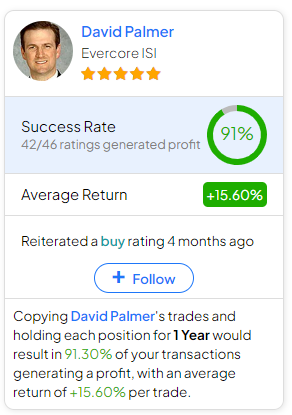

Regarding Wall Street’s view on the stock, McDonald’s continues to showcase a Strong Buy consensus rating. This is based on 22 Buy and five Hold ratings assigned in the past three months. At $310.42, the average MCD stock forecast suggests a 15.9% upside potential.

If you’re wondering which analyst you should follow if you want to buy and sell MCD stock, the most accurate analyst covering the stock (on a one-year timeframe) is David Palmer from Evercore ISI, with an average return of 15.6% per rating and a 91% success rate. Click on the image below to learn more.

Conclusion

In conclusion, McDonald’s impressive dividend growth trend reflects not just a history of consistency but a recent acceleration backed by robust financial performance. The company’s ability to sustain strong revenue growth, control costs effectively, and maintain an impressive profit margin sets it apart in the quick-service restaurant industry.

With a tremendous track record of 49 years of consecutive annual dividend hikes and a forward payout ratio of 57%, McDonald’s appears poised to continue its above-average dividend increases. I believe this makes the stock an appealing choice for investors bullish on stable income and long-term growth. Still, I would urge investors to remain mindful of McDonald’s valuation, which often hovers at premium levels, given the company’s qualities.