Electric truck startup. Short seller accusations. A SEC probe. Sounds familiar? No, we’re not talking about Nikola, but the latest controversial EV maker: Lordstown Motors (RIDE).

CEO Steve Burns said on Thursday it is cooperating with the SEC after the company was accused last week by short seller Hindenburg Research of duping investors. However, the CEO failed to appease a jittery Wall Street, and shares further retreated in the trading session, bringing the year-to-date losses to 33%.

While BTIG analyst Gregory Lewis notes the SEC investigation has the ability to impact the stock’s performance, the analyst believes the company’s fate will be decided by the strength of its yet to be released product.

“Management’s ability to execute in terms of getting the Endurance through Beta testing and into production and winning vehicle orders will be the biggest driver of the stock over the next year,” Lewis said.

Over the next few weeks, the company will begin sending out the initial batch of 57 Beta vehicles, with pre-production slated to kick off in late July ahead of final production, which is expected to start in late September.

The Beta will be sent to a mix of regulators and customers, although Lewis thinks that the run out at the San Felipe 250 in Baja California in a month’s time, will be the first major public test for the hub-motor skateboard (not a true Beta).

“One of the biggest pushbacks on the Endurance pickup is its hub-motor technology, a strong showing in Baja should alleviate some of those concerns,” the analyst noted.

On the customer demand front, the company has signed a vehicle procurement agreement with Holman Enterprises, a fleet manager with approximately 2 million vehicles. Lewis says the agreement amounts to an “evolution of a pre-order, but still without a deposit.” The analyst estimates the agreement is for roughly 12,000 vehicles, which brings Lordstown’s total vehicle procurement agreements to the 20,000 region.

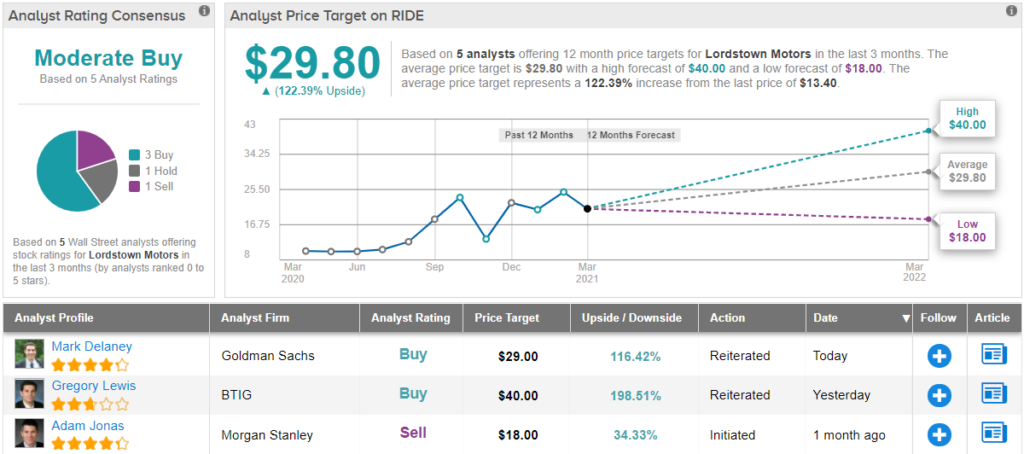

Overall, Lewis sticks to a Buy rating on RIDE shares although the price target is reduced from $50 to $40. That said, the new figure still suggests massive upside of 198% in the coming year. (To watch Lewis’ track record, click here)

Looking at the consensus breakdown, analysts are split when considering Lordstown’s prospects; with an additional 1 Buy, Hold and Sell, each, the stock has a Moderate Buy consensus rating. However, the projection is for plenty of 12-month gains; going by the $29.80 average price target, shares are expected to surge by 122%. (See RIDE stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.