Investors soured on innovative tech in a big way last year. There’s no better way to gauge innovation stocks than with Cathie Wood‘s ARK Innovation Fund (ARKK), which crumbled by about 68% in 2022. With no Santa Claus rally to end the year, a number of disruptive innovation stocks found a way to sink lower in the final weeks of a disastrous year for growth investors. Though a comeback may be in the cards in 2023, it’s unclear when unprofitable innovators will finally hit rock bottom.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Down around 80% from its peak, ARKK is at a five-year low. As the Federal Reserve continues battling inflation with rate hikes, ARKK may still be a ways off from turning a corner. Undoubtedly, the fate of ARKK and other innovative tech stocks still seems largely tied to the actions of the Federal Reserve.

Unprofitable Disruptive Innovators are Oversold, but are They Undervalued?

Indeed, it’s hard to value stocks that don’t expect to become profitable anytime in the near future. Oversold stocks down by 80%-90% indicate oversold, not necessarily undervalued, conditions.

Capital has become harder to come by with every rate hike the Fed delivers. Moving forward, growth-focused investors will need to be more selective regarding names they’re looking to stash in their portfolios.

If an innovator needs to keep investing heavily in its future, it should keep growth going strong while making progress on narrowing losses to ease jittery investors.

Of late, growth numbers have been under pressure, thanks to headwinds that already have begun to work their way into financial results. The real question is how much of the fading growth is due to temporary recession-induced circumstances and how much is due to the corporate aging process.

Hyper-growth stocks tend to suffer steep drop-offs in growth rates as they mature. Rising competition and a lack of moat are primary drivers behind falling growth, which can result in downward valuation “resets.”

Undoubtedly, many holdings within the ARK ETFs may not be able to reaccelerate growth rates to 2021 levels after the recession has worked its course. Pandemic darlings like Zoom Video Communications (NASDAQ:ZM) have crashed by 88%. It’s unlikely to recover, given the economic reopening from COVID-19 and the rise of video-conferencing alternatives.

Despite the epic fall, ZM stock remains a top holding (at just shy of 10% of the flagship ARKK ETF) going into 2023. Clearly, Cathie Wood still believes in the firm. However, with so many rivals focused on capturing the work-from-home (WFH) trend, questions linger as to whether or not firms like Zoom can innovate their way back to growth. I, like so many other picky investors, remain skeptical.

Reasons for Optimism in 2023

With a pretty strong tech IPO slate in 2023, there’s hope that innovative tech can get some relief as new issues look to garner excitement over technological trends likely to change the world. Growth stocks can still score incredible returns for investors capable of picking long-term winners. With higher rates, though, come higher stakes.

Undoubtedly, 2022 was a year that saw tech investors throw in the towel. That said, there were notable technological advancements that continued to move forward.

Whether we’re talking about OpenAI and its game-changing Dall-E and ChatGPT projects or Meta Platforms’ (NASDAQ:META) continued investment in hardware and software powering the metaverse, it’s clear that innovation will continue to advance, even if the share prices of top tech firms don’t advance due to the decaying macro environment and tighter monetary policy.

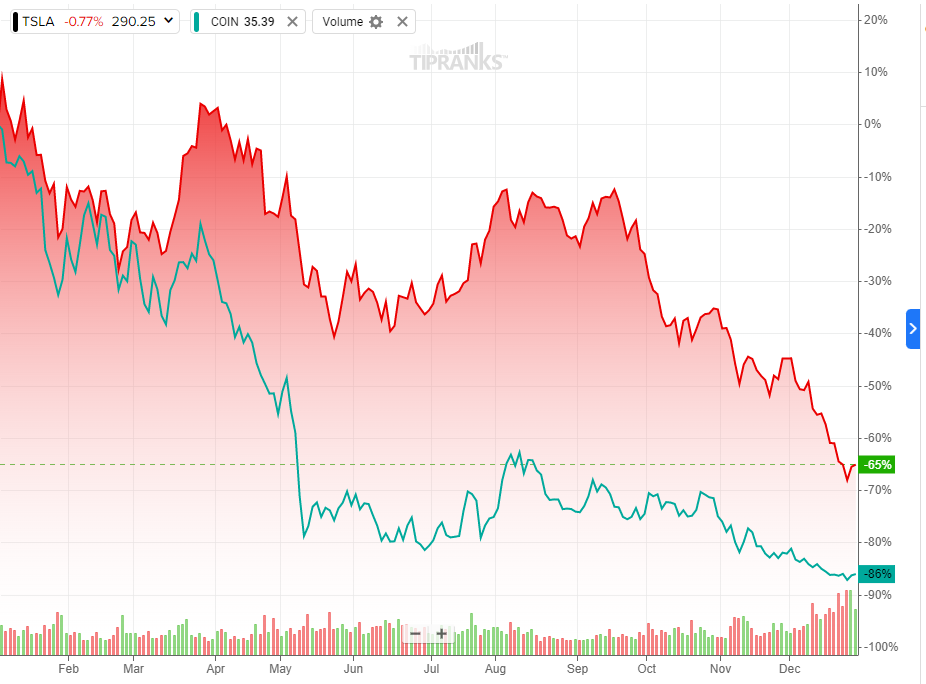

Despite the disastrous year for ARKK and the most innovative growth stocks, Wood’s popularity hasn’t taken as significant a hit as you’d expect. Wood isn’t ready to close up shop just yet. In fact, she’s been busy buying the dip in stocks like Tesla (NASDAQ:TSLA) and Coinbase (NASDAQ:COIN).

Wood’s brave bets amplify a tech turnaround if there’s one in store for 2023. That said, it could also exacerbate ARKK’s descent if it turns out the pain in innovation is not yet over. In any case, it’s hard to be an ARKK investor here as that sinking feeling carries into a new year.

Ultimately, Wood believes that “innovation stocks will eventually win.” While ARKK and innovation stocks will come back in due time, the main danger is if there’s another steep leg lower before the relief rally sets in.

As such, investors should carefully consider the downside risks when going against the grain. A dollar-cost averaging (DCA) approach, I believe, seems most prudent.