Although Wall Street has turned its back on some of the most disruptive tech stocks, it’s hard to ignore the hype surrounding some of the latest AI innovations. OpenAI, a firm that Elon Musk helped back, has been making quite a splash of late with creative products whose disruptive potential cannot go ignored. In this piece, I’ll compare two mature AI plays — Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG) and Apple (NASDAQ:AAPL) that appear like the most intriguing high-upside candidates for 2023.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

DALL·E and OpenGPT Chat are two of the most intriguing AI-powered innovations to come out of the OpenAI pipeline. DALL·E can create fascinating works of art based on input text, while OpenGPT is a “groundbreaking” conversational chatbot that can answer questions and even write essays. Though there are limitations (data accuracy is a concern), one can’t help but be intrigued when giving such early-stage OpenAI products a demo run.

Alphabet (GOOGL)

OpenAI’s conversational AI could signal where smart home assistants are headed next. Google Assistant, Siri, and Alexa haven’t really gotten more intelligent in recent years. This could change as OpenAI looks to emerge as a worthy challenger.

Indeed, Alphabet is one of the best public companies to play the next step of AI. With a wealth of data from billions of users around the world, Alphabet arguably has the tools to produce the most advanced AI.

Of course, Alphabet may already have an OpenGPT-like conversational offering behind closed doors. It’s just not ready to be unleashed to the world. Given OpenGPT’s limitations, lack of sourcing, and potential for misuse, a next-generational chatbot may not be ready for the masses quite yet.

Indeed, safety measures and regulatory guidelines may be needed for the Google Assistant to get that next big update we’re all hoping for. In any case, I view Google as a leader in the AI space. Ultimately, I think it’ll be Alphabet, not OpenAI, that will cannibalize its search engine over time.

After a turbulent year for tech, GOOGL stock is absurdly cheap at 18.4 times trailing earnings. We may have little visibility into the AI projects Alphabet’s working on, but it remains one of the disruptors likely to hold its throne at the top of the tech world.

What is the Price Target for GOOGL Stock?

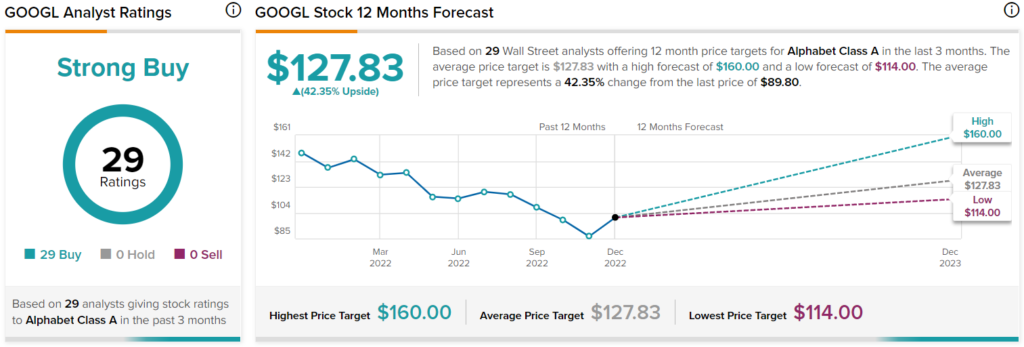

Wall Street still likes Alphabet stock, even as the bear claws at the share price. The average GOOGL stock price target of $127.83 implies 42.35% gains from here.

Apple (AAPL)

Apple’s Siri has come a long way since its early days. Still, there’s a lot of room for improvement if the AI assistant is to impress and delight as OpenAI’s offerings have. Like Google, I view Apple as having the data resources to make next-generation AI possible.

Indeed, Apple is far from an AI pure-play. Hardware continues to contribute an overwhelming chunk of the revenue pie – though services have grown by leaps and bounds over the years.

Like Google, Apple likely already has a more advanced assistant that’s not quite ready for prime time. Apple’s not a market first-mover. It’s more than willing to wait for its peers to test the waters and stomach the risks and repercussions. Once the time is right, Apple swoops in to “one up” its rivals, as it has done so many times.

Apple didn’t invent the smartphone; it made it better. As its focus shifts to next-generation products (think smartwatches and headsets), look for Siri to play a more significant role in our daily lives. Apple’s relentless focus on protecting user privacy has made it one of the more trusted companies in big tech. This solid reputation will help the firm as federal regulators look to put forth measures to ensure that next-generation AIs are safe.

Indeed, many things can go wrong when unleashing a profoundly game-changing technology to the world. Apple is one of the firms that will design with good intentions in mind from the get-go. In that regard, Apple may have a nice edge in the AI wars.

What is the Price Target for AAPL Stock?

Apple stock has taken a beating of late. Analysts stand by the name, with the average AAPL stock price target of $179.71. That’s a 33.5% gain from current levels.

Conclusion

OpenAI’s latest offerings may not be able to give human creatives a run for their money yet. However, it’s tough to tell how far-reaching the disruptive AI technology will be in 10 years from now. OpenGPT, in particular, looks like it could be a successor of Google’s search engine. Indeed, it’ll take many more improvements before an OpenAI product can take share away from the dominant search giant.

AI continues to advance, even as the hype (and investment dollars) continue to be drained from the tech sector. At this juncture, investors can’t place bets on OpenAI. However, Alphabet and Apple can launch comparable (and likely superior) AI-powered disruptive products over the next decade.