COVID-19 has put several little-known pharma companies on the map. Going hand in hand with these nano-caps’ pursuit of coronavirus solutions, hopeful investors have sent the small players’ shares to previously unimaginable heights.

Vaxart (VXRT) might be the purest example of this phenomenon. At the start of the year, the vaccine specialist’s market cap stood at $17.39 million, with each share going for $0.34. Fast forward to July 29, and the biotech is valued at $1.2 billion, with shares changing hands for $11 apiece, an increase of an amazing 3,135%.

Vaxart is not an outlier, as several other names have also recorded incredible gains, but its rise is even more remarkable considering the biotech’s oral COVID-19 vaccine candidate hasn’t even entered Phase 1 of the clinical trial process.

Now, this Cinderella story might be acquiring a darker hue. A recent article in the New York Times alleges that all might not be well in the biotech sector, and that Vaxart – among other companies such as Moderna and Regeneron – are profiteering off investors’ and the public’s hope for a vaccine/therapy.

Specifically, in Vaxart’s case, the allegation revolves around the biotech’s misleading announcement that it was selected for inclusion in the government’s Operation Warp Speed program (Vaxart’s candidate was included in a separate trial arranged by a federal agency). Following the announcement, shares soared and a hedge fund with a large stake in Vaxart sold off stock to the tune of $200 million.

As to be expected, following the article’s publication, a sell-off ensued. Now, Vaxart faces the possibility of an investigation into any wrongdoings and the prospect of investors taking legal action.

However, B.Riley FBR analyst Mayank Mamtani rejects the article’s allegations and suggests “investors take advantage of the sell off.”

The 5-star analyst commented, “We believe VXRT’s weakness was particularly disproportionate relating to allegation of company deploying associations with U.S. government’s Operation Warp Speed program as ‘marketing ploy’ which in turn translates to well-timed stock transactions to ‘generate big profits.’ We disagree with that premise and highlight VXRT’s management, including the newly appointed CEO, Andrei Floroiu, have not sold any shares recently. Since appointment on 6/15, new CEO was granted 1.75 million stock options, with only half vested to date and not exercised despite the potential to realize $6 million-plus in potential gains. In comparison, we note gains from company executives of REGN and MRNA to be much more significant, including scheduled and unscheduled share disposal.”

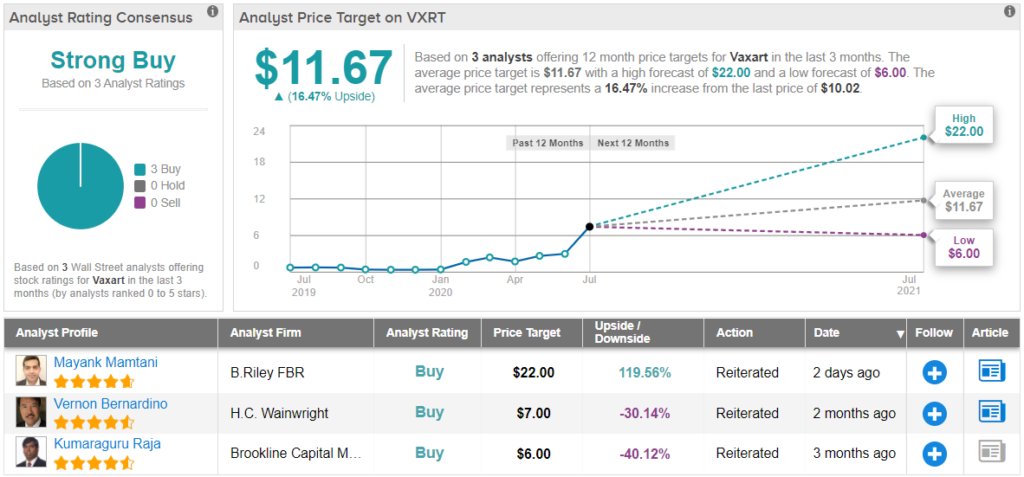

Therefore, Mamtani’s confidence in Vaxart remains intact. The analyst’s Buy rating stays as is, as well as the $22 price target, implying upside potential of a strong 120%. (To watch Mamtani’s track record, click here)

2 additional Buy ratings from the analyst community provide Vaxart with a Strong Buy consensus rating. According to the analysts, shares could rise by 16.5% over the coming months, as indicated by the $11.67 average price target. (See Vaxart stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.