After some of its Big Tech brethren threw down the gauntlet with blowout earnings last week, Twitter (TWTR) stepped up to the plate. While the microblogging platform’s quarterly statement was by no means a disaster, the Street was not pleased with the display. The shares took a heavy beating in the subsequent session – sinking by 15%.

Although Wells Fargo’s Brian Fitzgerald says Twitter’s Q1 results were “relatively solid,” he sees several reasons for the market’s harsh reaction. The 5-star analyst puts the selloff down to a combination of “comparatively muted upside compared to big 1Q beats by GOOGL and FB, a slight mDAU miss in the quarter, and 2Q revenue guide midpt slightly below the Street and Op Income guide well below on ramping investments.”

What’s more, after the company recently said it aims to double revenue by 2023, Fitzgerald thinks investors were likely “looking for 1Q to more forcefully assert TWTR’s momentum toward achieving LT (long term) targets.”

Let’s look at the quarter’s numbers, then.

Revenue increased year-over-year by 28.8% to $1.04 billion, in the process beating Wall Street’s forecast by $10 million. At $0.16, Non-GAAP EPS beat the consensus estimate by $0.02. While these figures were good, compared to Facebook’s exceptional results, the numbers were relatively tame.

And as far as monetizable daily active users (mDAU) are concerned – an essential metric to gauge user engagement – Twitter disappointed; at 199 million, the figure came in just below the consensus estimate of 200 million.

The forecast for mDAUs is a worry, too. It seems it will be hard to match Covid-19 era growth levels, and for the remainder of 2021, management anticipates mDAU growth to slow to LDD (low double digits), with 2Q acting as the “low point.”

The Street was also letdown by the revenue projection for 2Q21, which is now anticipated to be in the $980 million to $1.08 billion range. Consensus had $1.05 billion.

So, while Fitzgerald notes the stock’s pullback “arguably presents an opportunity,” the analyst counts “indications of steadier brand advertising performance and evidence that TWTR can reaccelerate mDAU growth vs. the LDD trough anticipated by the company in 2Q” among the reasons why he stays on the sidelines for now with a Neutral (i.e., Hold) rating. Fitzgerald also lowered the price target from $80 to $65. That said, following the drop, there’s potential upside of 18% from current levels. (To watch Fitzgerald’s track record, click here)

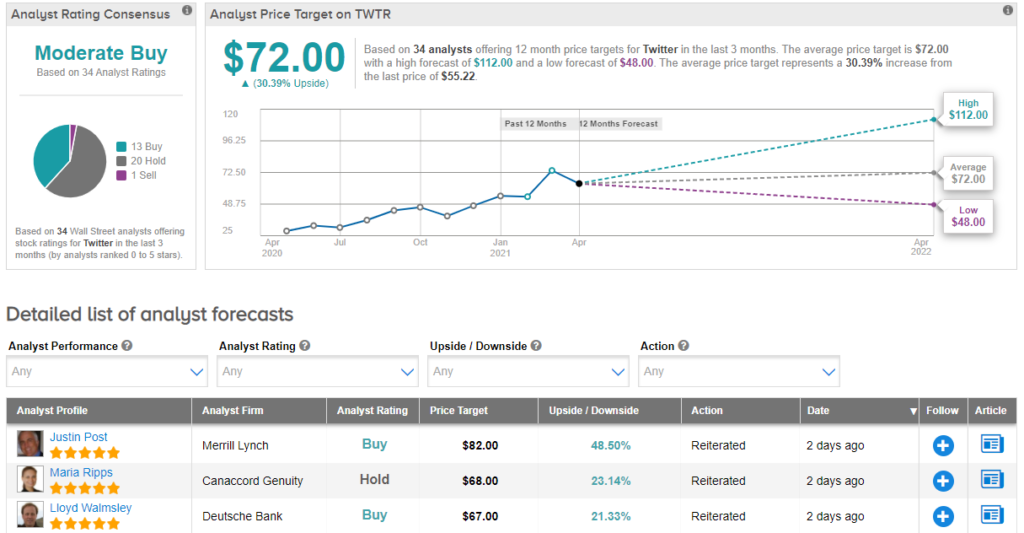

According to the rest of the Street, the projection is for more upside. The average price target stands at $73.03, suggesting gains of 32% in the year ahead. Overall, the stock has a Moderate Buy consensus rating based on 14 Buys, 19 Holds and 1 Sell. (See Twitter stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.