Once today’s trading comes to an end, Snowflake (SNOW) will take its turn to deliver its latest quarterly statement.

Much has changed since the data warehousing leader’s splashy market entry back in September 2020. That might be less than 2 years ago but represents a completely different age. One when companies with extremely hot valuations were par for the course. That is not the case anymore, as valuations – of growth stocks in particular – have contracted across the board. While previously there was much talk around Snowflake’s lofty valuation, the shares now sit 47% below the price they began trading at.

As such, Rosenblatt’s Blair Abernethy thinks it’s time to reevaluate.

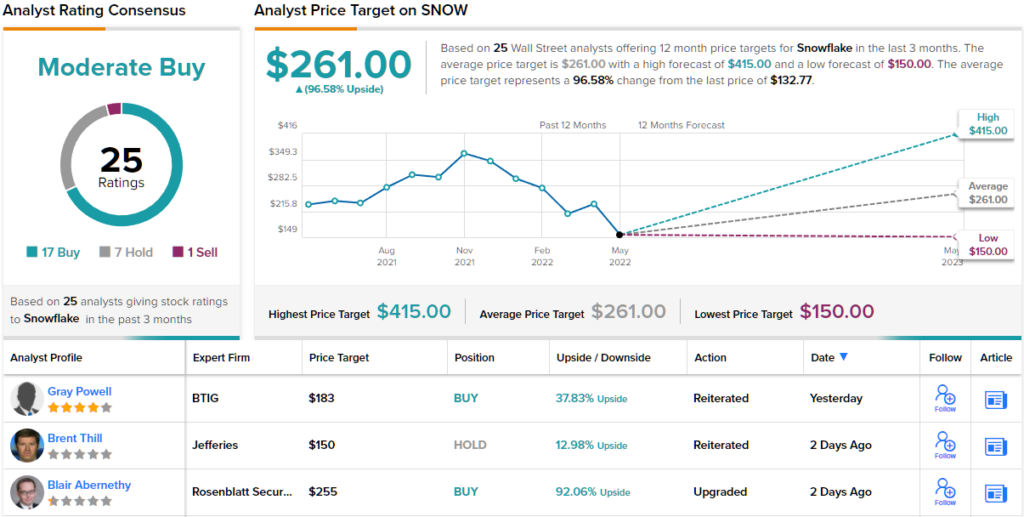

Due to a “significant decline” in the share price, Abernethy has upgraded his rating from Neutral (i.e., Hold) to Buy. That said, at the same time, given recent rising interest rates, the multiple compressions of similar stocks, and growing concerns around the potential for “broader economic impacts of the war in Ukraine,” there’s a reduction to the price target. The figure drops from $325 to $255. Nevertheless, there’s upside of 92% from current levels. (To watch Abernethy’s track record, click here)

As for the Q1/FY23 results (April quarter), Abernethy is anticipating “solid growth.”

Based on continued enterprise digital transformation “momentum,” and Snowflake’s “healthy” +160% Net Revenue Retention (NRR) rate, Abernethy is expecting Product Revenue growth of 81% which will see the figure land at $387 million. This is above the guided range of $383-$388 million although a drop from the 102% growth rate delivered in Q4.

The figure is also based on the robust Q1 growth delivered by the leading Cloud Service Providers (CSP’s). Alll three major platforms saw YoY growth of around 40%-50%, which Abernethy believes “demonstrates aggressive growth within the base market for Snowflake.” On the bottom-line, the analyst is expecting EPS of $0.04, which is above the Street’s $0.00 estimate.

However, the Street’s price target remains above Abernethy’s revised objective; at $261, the figure suggests investors will be sitting on returns of ~97% a year from now. Most analysts remain in Snowflake’s corner, but not all are convinced; the stock’s Moderate Buy consensus rating is based on 17 Buys, 7 Holds and 1 Sell. (See Snowflake stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.