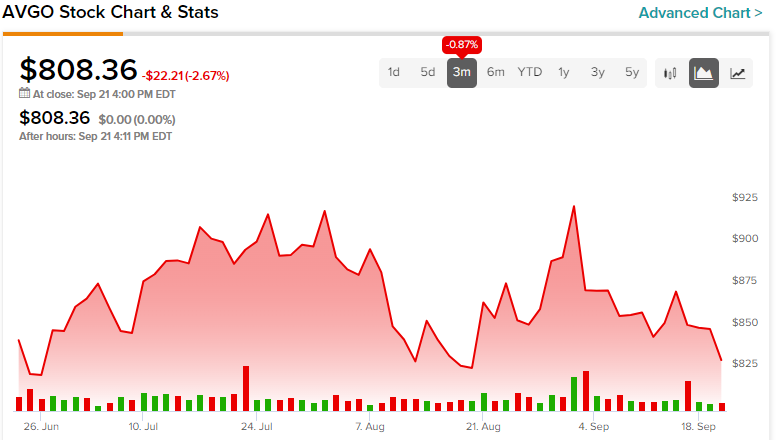

Shares of semiconductor firm Broadcom (NASDAQ:AVGO) are finally coming down after the stock’s impressive rise in the past year. Though AVGO is pricier now than when it started the year, with a much smaller dividend yield, AVGO stock is still a Strong Buy right now, according to the analyst community.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Of course, Broadcom is no Nvidia (NASDAQ:NVDA), and it probably never will be one. However, it still has a fantastic, growing software business, a stake in the artificial intelligence (AI) game, and the means to continue impressing investors in future quarters. After the stock’s latest slip, I remain upbeat and bullish, like most analysts covering the firm. Undoubtedly, Broadcom’s hot run now lies in the rearview, but there’s probably still plenty of value (and upside) to be had as the firm continues firing on all cylinders.

Add recent insider buying activity into the equation (a director reportedly loaded up on weakness), and it’s difficult to throw in the towel on Broadcom stock after its recent September swoon. I view the latest correction in shares as mostly tied to macro factors, rate fears, and the latest round of Fed chatter rather than it being due to something AVGO-related.

Fed Chatter Rattles Broadcom Stock and the Rest of Tech

The Federal Reserve left interest rates unchanged during its latest meeting this week. But it’s standing firm, noting that more rate hikes should be expected moving forward — not what investors wanted to hear. Further, Fed Chairman Jerome Powell also emphasized that rates could stay higher for longer. Such commentary is applying more heat to the 10-year Treasury note, which surged past 4.4%.

As you may know, high rates can be kryptonite for high-multiple growth stocks, especially those in the high-flying semiconductor scene. The broader basket of tech was caught up in today’s sell-off, with the Nasdaq 100 (NDX) shedding 1.8%, while Broadcom shed 2.67%.

Still, Broadcom stands out as one of the companies that won’t be knocked on the seat of its pants as semiconductor demand looks to stay robust going into year’s end while the AI arms race advances. Undoubtedly, Broadcom’s AI exposure is growing quickly. Like Nvidia, it’s not just AI “promises” that have helped fuel the stock’s rally. The company is already cashing in on the AI boom.

Broadcom Stock Looks Interesting as AI Expectations Cool

In a prior piece, I noted that Broadcom’s AI-related sales are expected to climb by 84% to $7 billion in the next fiscal year. As firms continue plowing money into all things AI, there’s a good chance that the rise of generative AI could power sales well above that number, perhaps closer to $8 billion. It’s hard to tell, given how fast the AI boom has jolted the semiconductor scene this year. In any case, cooling AI expectations are a good thing for the risk/reward ratio over at Broadcom.

We’ve reached a stage where even massive beats (Nvidia’s latest quarter was incredible, but it wasn’t as effective in driving shares higher) can’t keep a stock flying higher. That’s what happens when a trade gets too crowded and more than just perfection is expected.

At current levels, Broadcom stock is hardly expensive at 24.9 times trailing price-to-earnings, well below the semiconductor industry average of 32.7 times. This is a modest multiple that’s not indicative of outlandish expectations, in my opinion. Further, the 2.2% dividend yield is also a nice, appreciated addition for investors willing to hang onto shares for the long haul.

Finally, it’s also a good sign that there’s a notable director, Kian Low, who’s willing to eat his own cooking. Low reportedly bought 11,000 AVGO shares bought for an average price of $872 and change. At around $808 per share, Broadcom certainly looks like a tempting AI sleeper pick.

Is AVGO Stock a Buy, According to Analysts?

On TipRanks, AVGO stock comes in as a Strong Buy. Out of 18 analyst ratings, there are 16 Buys and two Hold recommendations. The average Broadcom stock price target is $981.81, implying upside potential of 21.5%. Analyst price targets range from a low of $900.00 per share to a high of $1,050.00 per share.

The Bottom Line on AVGO Stock

It’s hard not to like Broadcom stock while it’s fresh off a correction. Analysts still like it, and expectations don’t seem all that outlandish, at least compared to other 2023 AI winners like Nvidia. At this point in the AI boom, it seems ill-advised for firms to pull back on AI spending if they wish to stay competitive, even with rates slated to stay elevated. Therefore, I’d look for AI upside to help drive shares toward $1,000