Semiconductor stocks, like NVDA, AMD, and AVGO, have been red-hot this year, thanks in large part to the growing number of firms seeking to equip themselves to capitalize on the artificial intelligence (AI) gold rush. After such a hot run, one has to wonder if the chip stock rip has any more room to the upside. Though it’s clear that many analysts and investors underestimated AI’s potential to propel Nvidia’s sales this year, the real danger is what could happen to the stock once estimates climb a tad too high.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Indeed, chip stocks are no stranger to booms and busts. What’s striking about Nvidia stock’s historic past-year rise is how quick the boom took hold and the unprecedented heights that shares have been driven to.

The November 2022 launch of OpenAI’s ChatGPT showed us the true power of generative AI, and nearly a year later, the AI hype hasn’t really faded. If anything, the AI opportunity feels more real than ever, with firms like Nvidia and Microsoft (NASDAQ:MSFT) looking to take monetization efforts seriously.

Looking ahead, many companies may still be feeling a sense of FOMO (fear of missing out) if they don’t have as much AI firepower as their peers. Though it’s hard to tell when the next demand slump will be, investors should be prepared to ride out a potential bust that could hit at any time.

Indeed, it tends to get harder to stay on the expectations treadmill as the speed dial is cranked up!

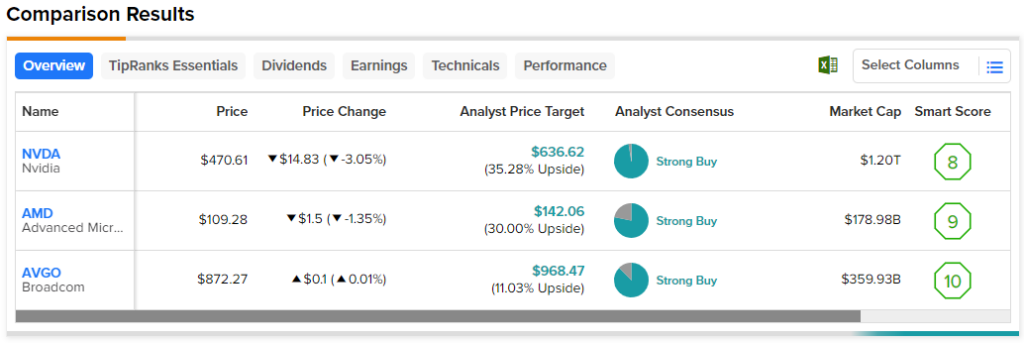

Therefore, let’s use TipRanks’ Comparison Tool to stack up three Strong-Buy-rated chip winners to see which has the most upside potential, according to analysts.

Nvidia (NASDAQ:NVDA)

It seemed like Nvidia stock’s early-August dip was the beginning of the end of the historic rally. Fast forward to today, though, and Nvidia stock is fresh off a new all-time high just shy of $500 per share. Buying the dip has continued to work for the AI chip king.

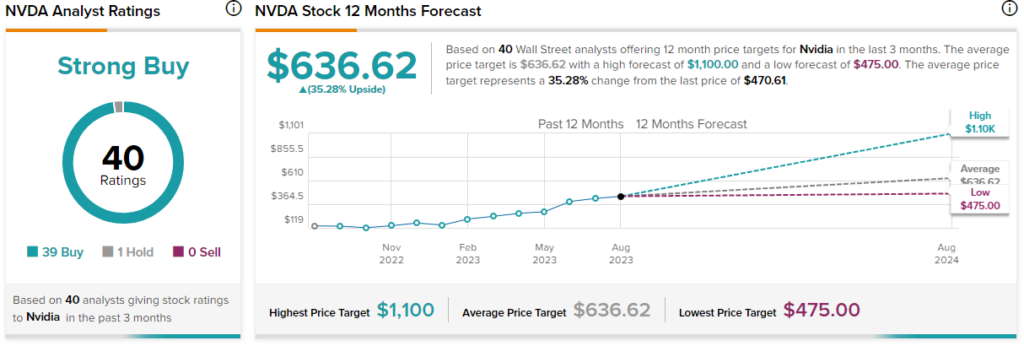

Although September is a historically awful month for stocks, analysts still think NVDA stock is a “Strong Buy” at current prices. In fact, 39 out of 40 analysts continue to recommend the stock as a “Buy.” Though there’s considerable downside risk in the event of a chip demand reversal, not having any skin in the game also carries the risk of missing out on further upside. For that reason, I have to be mildly bullish.

Despite more than tripling on a year-to-date basis, the company seems to have justified its run with profound quarterly beats. The latest (second) quarter wasn’t rewarded with a massive post-earnings rally, but it was every bit as profound as the first quarter that sent Nvidia stock skyrocketing to new heights.

Second-quarter earnings per share came in at $2.70, topping consensus estimates of $2.09. Wedbush’s Daniel Ives is just one of many analysts who seem to think investors are getting the phenomenal quarter for free after a relatively muted post-earnings reaction.

I’m a value investor who hates chasing, but still, I’m inclined to agree with Ives. Nvidia has found a way to sprint, even with the expectations treadmill running in overdrive. For the second half of 2023, Ives sees another “rip higher” for Nvidia and the rest of tech.

What is the Price Target for NVDA Stock?

Nvidia stock is a Strong Buy, with 39 Buys and one Hold. The average NVDA stock price target of $636.62 implies 35.3% upside potential.

Advanced Micro Devices (NASDAQ:AMD)

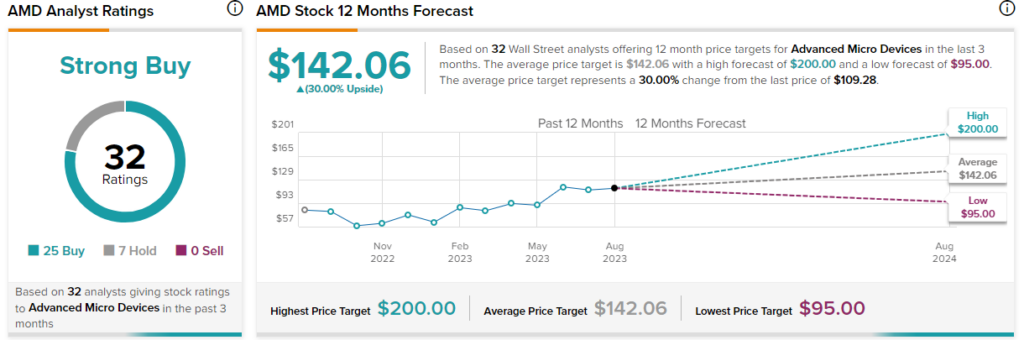

AMD is the natural second choice for an investor seeking to profit from the AI chip rip at a sensible discount. Though AMD’s best AI chip isn’t quite at the level of Nvidia’s best, the valuation likely already reflects such. Shares of AMD go for 26.5 times forward price-to-earnings versus Nvidia’s 46.7 times.

The real upside to be had from AMD is if it can close the gap with Nvidia in the later stages of the AI race. It’s no easy feat, especially since Nvidia seems to be running at full speed. In any case, I still view AMD as offering tremendous value for its offerings. As such, I’m staying bullish.

If a recession strikes, perhaps more customers will be inclined to go for AMD chips as they tend to be competitive in price. For instance, AMD’s MI250 chip may be only 80% as fast as Nvidia’s A100 chip, according to MosaicML, but if 80% is enough to get the job done at a much lower price of admission, AMD may have one thing over Nvidia should the economic soft landing end up harder than expected.

For now, it seems like everybody wants the absolute best at any cost. In due time, though, enterprises could shift toward AMD chips to power AI applications as they seek a better bang for their buck.

At writing, AMD stock is off around 30% from its all-time high. The company is standing in Nvidia’s shadow, but probably not for long as the firm continues to innovate on the AI front. Further, CEO Lisa Su is a visionary leader who’s already defied expectations over the past five years, with an incredible 300% gain over the timespan as it overtook Intel (NASDAQ:INTC) on the front of CPUs.

What is the Price Target for AMD Stock?

AMD stock is a Strong Buy, with 25 Buys and seven Holds. The average AMD stock price target of $142.06 entails 30% upside potential.

Broadcom (NASDAQ:AVGO)

Broadcom stock isn’t as hot as the likes of Nvidia or AMD, but it still has growing skin in the AI race. The company’s AI-related revenue could grow by 84% to $7 billion in the next fiscal year, according to management. Despite the hot AI growth on the horizon, AVGO stock sunk 5.5% last Friday after the release of some underwhelming quarterly numbers that still managed to top estimates.

Indeed, many investors seem hungry for an Nvidia-like quarterly beat. That’s an unrealistically high bar and one that few firms may be able to pass, even as the AI boom continues. Personally, I view the post-earnings flop as a buying opportunity produced by disappointed traders who went into the quarterly reveal with unrealistic expectations. Therefore, I’m staying bullish on the stock.

At writing, shares trade at just 19.2 times forward price-to-earnings, lower than the 21.5 times of the semiconductor industry average. With a 2.05% dividend yield and some great AI prospects of its own, the stock stands out as one of the GARP (growth at a reasonable price) names in a market that may very well see another valuation cooldown in September.

What is the Price Target for AVGO Stock?

Broadcom’s a Strong Buy on Wall Street, with 15 Buys and two Holds assigned in the past three months. The average AVGO stock price target of $965.38 implies 10.6% upside potential.

Conclusion

Thanks to AI, the chip rip could extend even further from here, and only time will be able to tell when the next semiconductor bust hits. Of the three stocks in this piece, investors expect the most upside from Nvidia. Indeed, the semiconductor winners could keep on winning the most for investors.