Semiconductor and infrastructure software company Broadcom’s (NASDAQ:AVGO) stock skyrocketed 79% YTD on the back of the AI wave. Investor sentiment remains buoyant, fueled by the long-term potential AI offers chip stocks. While chip demand for personal computing and smartphones has been lukewarm this year, most analysts believe Q4 will be favorable. Broadcom’s strategic investments and commitment to AI make me bullish on AVGO’s stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Outstanding Growth Trajectory

Broadcom has emerged as a key player in the field of AI innovation. Its strengths are its semiconductor design, networking technologies, and software solutions. Using this expertise, the company is now integrating AI capabilities into its diverse array of products and services.

Broadcom’s revenue has increased from $13.2 billion in Fiscal 2016 to $35.4 billion over the trailing 12 months, reflecting the magnitude of its growth. Over the same period, earnings per share (EPS) have increased from $11.45 to $32.50.

This significant growth trajectory most likely justifies Broadcom’s stock price surge of 389% over the last five years, compared to the tech-heavy Nasdaq Index’s (NDX) 139% gain over the same period.

Over the last few years, the acquisition of enterprise software companies like Symantec’s Enterprise Security Business and CA Technologies has allowed Broadcom to augment its AI capabilities significantly while diversifying beyond chip-making. Infrastructure Software revenue accounted for 22% of total revenue in Fiscal 2022. With these acquisitions, the company expects to drive revenue by powering its software operations.

More recently, macro headwinds affected personal computing and smartphone market demand this year. Nonetheless, Broadcom reported a robust third quarter Fiscal 2023. Total revenue grew 5% year-over-year to $8.9 billion, while adjusted EPS jumped to $10.54 from $9.73 in Q3 Fiscal 2022.

Notably, in Q3, the Semiconductor Solutions segment accounted for 78% of total revenue, with Infrastructure Software making up for the rest. In Q3, revenue in both segments increased their revenues by 5%.

Moreover, Broadcom is also a dividend stock, offering a yield of 1.9%, higher than the tech sector average of 1.02%. At the end of the quarter, it had $12 billion in cash and cash equivalents and $4.6 billion in free cash flow, which should aid dividend payments and future strategic investments.

Bright Future Ahead with AI

This year, Broadcom partnered with Alphabet’s (NASDAQ:GOOGL) Google Cloud to use generative AI tools to strengthen cybersecurity measures and improve operational efficiency for businesses.

Additionally, on November 22, after a lot of regulatory hurdles, Broadcom finally closed the acquisition of cloud software company VMware. With this $61 billion cash-and-stock transaction, Broadcom intends to diversify its business from semiconductors to the cloud.

As a result of the acquisition, the company expects to generate around 49% of its revenue from Infrastructure Software. It also counts on adding $8.5 billion of pro-forma EBITDA (earnings before interest, tax, depreciation, and amortization) in the next three years after the deal’s completion. While a merger of this scale will take time to show its full potential, this deal could certainly add to Broadcom’s revenue, going forward.

Furthermore, Broadcom’s focus on developing AI-centric chips and hardware accelerators has the potential to empower a wide range of industries, from healthcare to automotive to telecommunications and beyond.

Looking ahead, management expects revenue to be around $9.27 billion, a 4.1% increase year-over-year, with adjusted EBITDA of roughly 65% of projected revenue.

Meanwhile, analysts predict that Q4 revenue will be around $9.28 billion, with EPS of $10.96. For Fiscal 2023, revenue is expected to grow by 8% to $36 billion, with earnings growth of 12% to $42.03 per share. Broadcom will release its Fiscal 2023 fourth-quarter results on December 7.

Is AVGO Stock a Buy, According to Analysts?

In October, Evercore ISI analyst Matthew Prisco expressed his cautiously optimistic outlook for Broadcom. According to the analyst, China-related concerns and macroeconomic headwinds may have limited the company’s performance in the short term.

However, he does anticipate that semiconductors will perform better in the fourth quarter. With that in mind, the analyst raised the target price for AVGO from $1,000 to $1050, giving it a Buy rating. More recently, analysts at Robert W. Baird and Bernstein reiterated their Buy ratings on AVGO, each with a price target of $1000.

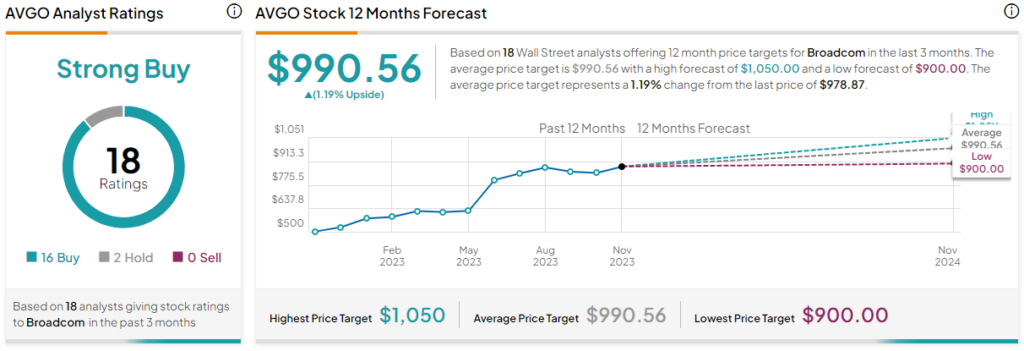

Overall, Wall Street is optimistic about Broadcom’s AI long-term prospects, giving it a Strong Buy consensus rating. Out of the 18 analysts covering the stock, 16 rate it a Buy, while two rate it a Hold. None of the analysts rate the stock a Sell. The average analyst AVGO target price is $990.56, which is just 1.2% above current levels.

Priced at 22.5 times expected 2024 earnings and 10 times forward sales, Broadcom seems reasonable for a high-growth chip stock with AI and cloud prospects. Analysts forecast revenue growth of 7.8% to $35.8 billion and EPS growth of 11.7% to $42.03 in Fiscal 2023.

The Bottom Line on Broadcom

I believe Broadcom’s strategic investments, commitment to integrating AI into its offerings, and diversification of its business are preparing it for future growth and innovation. With a robust portfolio of products and a history of successful acquisitions, the company is poised to capitalize on the AI niche to drive more revenue and profits in the near term.

Though the stock has nearly reached its mean target price, with another strong quarter, Broadcom stock is likely to see more upside in the near term. TipRanks has assigned a Perfect 10 Smart Score to AVGO, which implies higher chances of the stock outperforming the broader market.