It may seem like a bizarre observation in the context of 14% year-over-year revenue growth and 63% booking growth in the last quarter, but Broadcom (AVGO) really isn’t that well-suited to this bullish growth cycle in chip stocks. Broadcom management certainly cares about and nurtures growth opportunities, but this name was among the first chip companies to really appreciate that margins drive long-term value, and that margin focus usually serves Broadcom better in periods of weaker sentiment.

Be that as it may, Broadcom is looking at major growth opportunities in 2021, including the next generation of Apple (AAPL) 5G iPhones, 400G networking with data center customers (including hyperscale customers), custom ASIC with AI and wireless infrastructure opportunities, and a Wi-Fi 6 upgrade cycle. With those drivers in place, Broadcom could generate a mid-teens near-term return and high single-digit long-term annualized returns.

A Strong Quarter, But Maybe Not Strong Enough

Supply pressures are a well-understood challenge across the semiconductor industry right now, but Broadcom nevertheless delivered 14% year-over-year and 3% quarter-over-quarter revenue growth in the fiscal first quarter, with a 17% year-over-year gain in the Semiconductor business and 5% increase in the Infrastructure business (largely software).

While that’s not a bad result, it was less than 1% better than expected during a quarter in which many Broadcom peers and rivals exceeded expectations by larger amounts. It should be noted that even a small miss in the semiconductor business doesn’t look good, and the guide for the fiscal second quarter was only about 2% higher than expected.

Performance relative to expectations certainly matters, but there were several points of strength in this last quarter. Within the semiconductor business, Wireless grew 52% on strong iPhone volumes and content growth, while Networking rose 15%. Broadband grew 8% as service providers continue to upgrade PON, DOCSIS, and Wi-Fi 6 routers due to ongoing work-from-home demand. Storage was weak, down 22%, but not unexpectedly so given a period of “digestion” for data center investments.

Multiple Attractive Drivers To Push The Stock

Broadcom isn’t lacking growth drivers in the remainder of 2021, and with the company 90% booked for the fiscal year, downside risk is limited. While double-ordering is an issue/risk across the sector, the combination of Broadcom’s no-cancellation policy and close working relationship with customers on custom products significantly reduces that risk.

In Wireless, Broadcom is leveraged to ongoing growth in 5G handset volumes (which are still significantly underpenetrated) and the higher filter and front-end content those phones contain. There are also widespread rumors that Broadcom has won wireless charging and new touch controller content on the next generation of iPhones, further leveraging that expected handset volume growth.

Networking orders were up 80% year-over-year in the quarter, and Broadcom will likely see strong demand for its Trident 4 (enterprise switching), Tomahawk 3 (hyperscale switching), and Jericho 2 (service provider routing) chips as 2021 rolls on and enterprise/hyperscale data center customers move forward on 200G/400G installations and service providers resume metro installations to support network traffic growth.

In addition to these products, ongoing growth in the custom ASIC business is likely as customers like Google (GOOGL) continue to scale up their AI/machine learning efforts. Longer-term, the company’s efforts in silicon photonics, particularly the effort to integrate optical transceiver functionality with/onto switching chips (the first product being the Thebit 800GB DR8 integrated transceiver), reflects an opportunity to significantly reduce power demands while driving better performance.

Wi-Fi 6 isn’t going to be as big of a deal as those other drivers, but Broadcom’s Broadband business is a highly profitable segment that often doesn’t get its due.

The Outlook

Rivals like Marvell (MRVL) are stepping up their efforts in custom silicon, but the competition here isn’t that much of a concern. Rather, datacenter interconnect competition, where Inphi (IPHI) has staked out a big lead in PAM4, could pose a threat.

The bigger risk to Broadcom, though, is sentiment, and particularly where capital allocation is concerned. Broadcom has been highly acquisitive, and management has made its desire to do more deals known, but the Street hasn’t loved the forays into software (even though bookings are growing and gross margins are around 90%) and likely doesn’t want to see more.

The modeling assumptions for Broadcom support a long-term revenue growth rate in the mid-single-digits (5% to 6%), and ongoing margin leverage is expected. In the short-term, operating margin is estimated to improve from around 54% in FY’20 (non-GAAP) to 57% in FY’21 and 57.75% in FY’23, with long-term free cash flow (FCF) growth closer to 7% as expanded operating margins and reduced capex needs to support revenue growth (an advantage of software businesses) drive wider FCF margins.

Analysts Weigh In

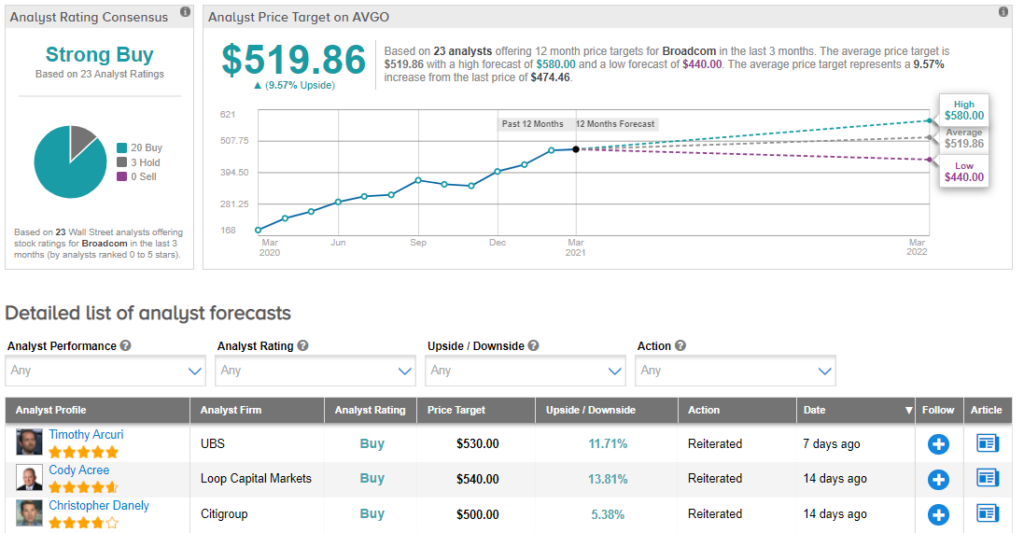

AVGO has a Strong Buy consensus rating based on 20 Buys and 3 Holds issued in the last three months. Given the $519.86 average analyst price target, 10% upside potential could be in the cards. (See Broadcom stock analysis on TipRanks)

The Bottom Line

While long-term discounted FCF supports a long-term total annual return expectation on the low end of the high single-digits, the company’s near-term gross and operating margins support a fair value around $550.

Over the long-term, margins do drive revenue and EBITDA multiples, but revenue growth can be a more powerful driver in up-cycles, which is why Broadcom isn’t necessarily ideally positioned today. Even so, this is a very high-quality chip company that gives investors good leverage to multiple growth markets, as well as a larger-than-average yield for the sector.

Disclosure: At the time of publication, Stephen Simpson owned shares of AVGO.

Disclaimer: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities.