Sentiment can change very quickly on Wall Street. Rewind to October and Boeing (NYSE:BA) stock was still languishing in the doldrums with its year negatively impacted by several issues.

But since then, the A&D giant has gathered momentum and some. The shares are up by ~50% from the October lows. As this rally gained traction, fueled by data indicating improved delivery performance and the growing belief in its sustainability, Deutsche Bank analyst Scott Deuschle upgraded Boeing’s rating from Hold (i.e. Neutral) to Buy, and bumped his price target up from $204 to $270.

Now the shares are within touching distance of that target, Deuschle notes that on a technical level, the stock’s RSI (relative strength index) is at 93, making it “one of the most powerful momentum stocks across the broader market.”

Does that mean it’s already time to move on to other opportunities? Not necessarily. “While its possible that BA could take a breather in the near-term given the overbought RSI levels, we think its equally possible that it continues to grind higher as industrial investors position for good 2024 stories, and also chase the largest constituent of their benchmark into year-end,” the analyst explained.

There is also a varied set of “potential near-term catalysts” to consider. That includes the possible delivery of a 787 to China-based Juneyao Airlines, or the long-awaited certification of the MAX-7 certification. At the same time there appears to be an ongoing catalyst in the shape of “delivery momentum.” The strength seen recently from 737 MAX and 787 deliveries is particularly encouraging given the 5 MAX deliveries and 2 787 deliveries on December 15/16.

Despite all that has gone badly in 2023 – from 737 quality issues to the strike at Spirit AeroSystems to problems with suppliers – Deuschle thinks it is quite “remarkable” to now be calling for a 2023 FCF result above the midpoint of the guide (Deuschle is forecasting $4.1 billion).

“As investors increasingly appreciate BA’s financial resilience, we think the high-end of the 2024 guide will gradually come to be viewed as achievable each month that goes by that delivery momentum sustains and nothing negative comes to light (or there are only a few negatives, rather than a host of them),” the analyst summed up.

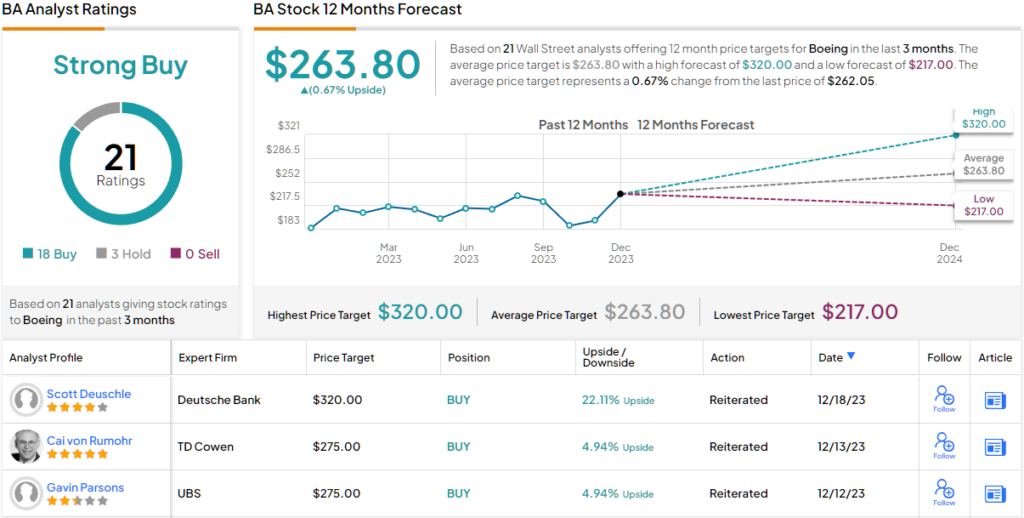

The upshot of all the above is another bump to the price target, which now moves from $270 to $320, implying shares will gain another 22% in the months ahead. No need to add, Deuschle’s rating stays a Buy. (To watch Deuschle’s track record, click here)

17 of Deuschle’s colleagues join him in the bull camp, with 3 fencesitters unable to detract from a Strong Buy consensus rating. That said, it looks like other analysts think the stock is due a bit of a cooling down period; going by the $263.80 average target, the shares will stay rangebound for the time being. (See Boeing stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.