Given the combination of ongoing 737/787 delays, and a stock market for which the word “ugly” seems more than fitting, Boeing (BA) stock has declined to levels last seen during the height of the corona crisis in 2020.

Therefore, assessing the A&D giant’s prospects, Cowen analyst Cai von Rumohr thinks the stock currently offers a “particularly attractive entry point with compelling risk-reward.”

Underpinning von Rumohr’s bullish take are three points: “1) 737/787 delays won’t last indefinitely, (2) the Airbus-Boeing duopoly is intact with solid long-term market share for BA, and (3) cash flow should improve in Q2, with continuing potential for CFPS of $20+ in 2024.”

Due to a potent mix of supply chain/logistics issues and stringent FAA oversight, Boeing has faced “multiple false starts” in ramping 737 deliveries and restarting 787 shipments. So much so, that investors are now “justifiably worried of possible additional delays.”

“It’s unclear just when Boeing will get these issues on track,” says von Rumohr, “but it’s very likely to happen this year with good potential for improvement in the coming months.”

Plus, with backlogs increasing, and Airbus’ intention to ramp production rates of A320s up to 75 a month, narrowbody demand “continues to be very healthy.”

Although supply chain/logistics issues are why Boeing’s 737 deliveries year-to-date have come in at an average of only 29 a month compared to its target of 45-50, von Rumohr thinks the “abating impact of Omicron and BA’s decision to air freight certain items that have been held up by port delays should help get shipments from the production line back on track.”

Investors have also appeared jittery around the prospect of BA conceding market share to Airbus in the “recovering” narrowbody segment, yet the analyst thinks losing share in this market will be compensated by share gains in the widebody segment. BA has a good record here; Since 2018, it has secured 88% of widebody passenger aircraft orders and a “commanding” 93% of freighter orders.

As for point 3, although von Rumohr thinks Q2 cash flow is “almost sure to be much better than Q1,” he still believes it will be “somewhat in the red.” However, as supply chain issues subside and delivery of completed planes in storage picks up, Q3 is likely to bring a “move into the black.”

To this end, von Rumohr rates BA shares an Outperform (i.e. Buy) backed by a $230 price target. If correct, investors could be lining their pockets with an 83% gain. (To watch von Rumohr’s track record, click here)

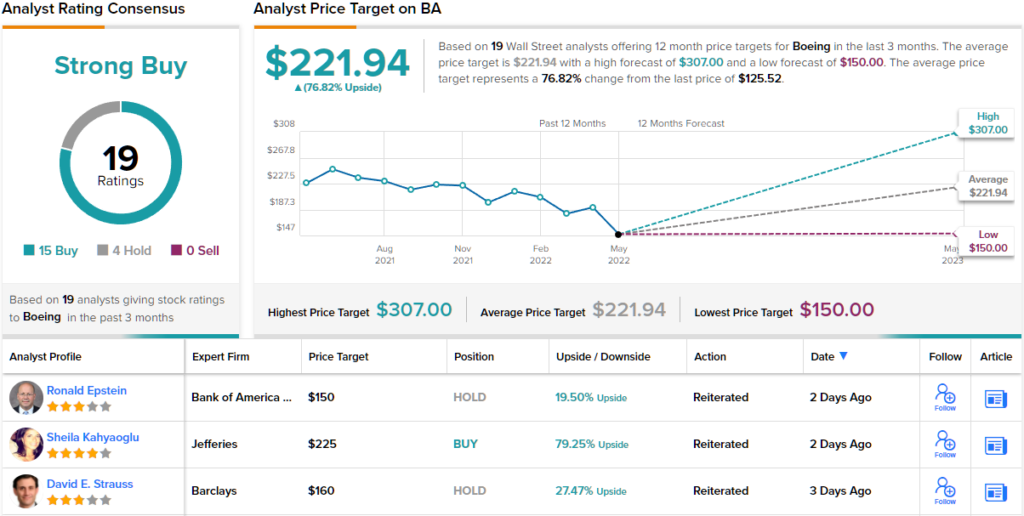

Overall, barring 4 skeptics, all 15 other recent analyst reviews on BA are positive and coalescing to a Strong Buy consensus rating. The average price target is slightly below von Rumohr’s; at $221.94, the figure suggests shares will climb ~77% higher in the year ahead. (See Boeing stock forecast on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.