The oilfield services industry is in an interesting position. Energy giants must buy new rigs for these companies to grow, and secular trends look positive. In this piece, I compared two oilfield services stocks to see which is better. Baker Hughes (NASDAQ:BKR) and Halliburton (NYSE:HAL) are two of the world’s largest oilfield services companies. The oilfield services market is expected to see a compound annual growth rate of 6% through 2026, bringing its sales to $225.8 billion. While that’s good news for both companies, HAL looks better than BKR.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Baker Hughes (BKR)

Baker Hughes reported a net loss for the last 12 months and for the 2020 and 2021 fiscal years. Still, the company managed to generate $778 million in free cash flow for the last 12 months even though it’s in the red, and its balance sheet isn’t particularly terrible or great. Baker Hughes is currently in the process of restructuring and cutting costs, so a neutral view looks appropriate for now.

The company is trading at a trailing P/S multiple of about 1.4x. Although that’s a slight decline from recent trends, it’s still up significantly from where it stood about three years ago. Baker Hughes traded at a P/S ratio of about 0.7x in December 2019, before the pandemic began. The multiple continued to rise steadily even though the company has been in the red.

Baker Hughes has about $3.7 billion in cash and short-term investments, $33 billion in total assets, $9.1 billion in current liabilities, and $18.8 billion in total liabilities as of its most recent report. Also, its debt/equity ratio stands at about 46%, which is attractive considering the other issues with this company.

Although its fundamentals leave something to be desired, secular trends within the energy industry are positive. Baker Hughes reported that U.S. energy firms added oil and gas rigs for a second straight year in 2022, the first time that’s happened since 2018.

The total rig count rose 33% year-over-year to 779. The fourth quarter marked the ninth straight quarter of increases in the total rig count, the longest streak since 2011. However, although several energy giants have increased spending for the second straight year, crude oil production remains below 2019’s record levels.

Most energy companies seem to be more focused on returning capital to shareholders and paying down debt instead of boosting output. If this continues to be the dominant trend, it would be negative for Baker Hughes and Halliburton. It will take some time to see how these factors play out.

On the plus side, Baker Hughes has a dividend yield of 2.7% and has raised its dividend annually for the last five years.

What is the Price Target for BKR Stock?

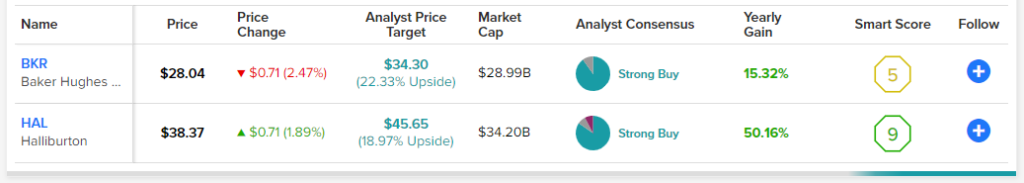

Baker Hughes has a Strong Buy consensus rating based on nine Buys, one Hold, and zero Sell ratings assigned over the last three months. At $34.60, the average price target for Baker Hughes implies upside potential of 23.4%.

Halliburton (HAL)

Halliburton is up against the same trends as Baker Hughes, but its fundamentals look more attractive. The company is profitable on a trailing-12-month basis and was also profitable in 2021, although it struggled and fell into the red during the pandemic. However, positive secular trends and Halliburton’s current profitability suggest a bullish view might be appropriate for now.

Although a recession looks likely, the world’s largest fracker is forecasting a “multi-year upcycle.” Halliburton management expects the exploration & production (E&P) sector to grow in 2023 due to years of under-investment in upstream operations. The energy crisis in Europe could also drive additional upside for the company, although Halliburton is enjoying robust trends in North America. The company said it’s “sold out” on its equipment and services in North America into 2023.

Halliburton’s balance sheet is mediocre and not quite as attractive as Baker Hughes’, but it isn’t bad enough to trigger a negative view. The company has close to $2 billion in cash and short-term investments, $22.56 billion in total assets, and $14.9 billion in total liabilities as of its most recent quarter. Halliburton’s debt/equity ratio stands at 117%, which is not bad considering the state of the industry.

What is the Price Target for HAL Stock?

Halliburton has a Strong Buy consensus rating based on 11 Buys, one Hold, and one Sell rating over the last three months. At $45.65, the average price target for Halliburton implies upside potential of 19%.

Conclusion: Neutral on BKR, Bullish on HAL

Over the long term, things could go well for both Baker Hughes and Halliburton based on expectations of continued demand growth for oil and natural gas. However, Halliburton is simply in a better position currently, as evidenced by its profitability. If Baker Hughes succeeds in cutting costs, another review would be appropriate.