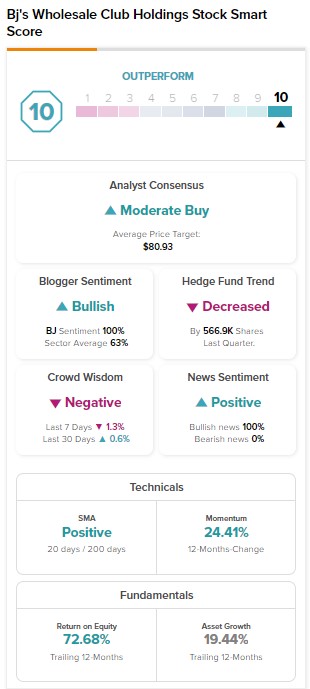

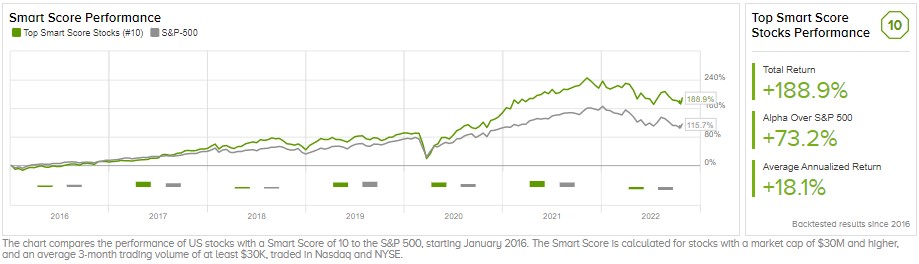

BJ’s Wholesale (NYSE:BJ) is now a part of TipRanks’ “Perfect 10” Smart Score list. The coveted list has stocks more likely to outperform the benchmark index. For instance, shares carrying a “Perfect 10” Smart Score have consistently outperformed the S&P 500 Index (SPX) by a significant margin (see the graph below).

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Here’s Why BJ Landed a “Perfect 10” Smart Score

BJ’s Wholesale’s entry in the “Perfect 10” Smart Score list shouldn’t surprise much. The leading warehouse club operator continues to deliver solid financials on the back of a growing membership base and value offerings.

Its sales have consistently increased over the past several quarters (learn more about BJ’s financials here). Further, its lean cost structure, strong balance sheet (with a low net debt to adjusted EBITDA ratio), and acceleration in new club openings augur well for growth.

What stands out is the increase in the higher-tier membership penetration rate. In Q2, its higher tier membership penetration increased to 37%, up 400 basis points year-over-year. These higher-tier members spend more and have higher retention, which is good for the company.

Highlighting the increase in higher tier membership base, Jefferies analyst Corey Tarlowe said, “these higher-tiered members are more valuable due to their higher spend and greater loyalty, thereby helping to drive more predictable sales ahead, in our view.”

Tarlowe has a Buy recommendation on BJ stock and expects the company to gain from private-label product expansion. Moreover, the analyst believes that “BJ’s TAM (total addressable market) is expansive, given the ability to more predictably and profitably grow units. Over time, we think BJ’s can reach 350+ stores, implying +MSD% annual sq ft growth.”

What is the Price Target for BJ Stock?

BJ stock has outperformed the broader markets and is up about 13.7% year-to-date. Meanwhile, analysts’ average price target of $80.93 implies 6.3% upside potential in BJ’s Wholesale stock.

Further, BJ stock has a Moderate Buy consensus rating on TipRanks based on 11 Buys, four Holds, and one Sell recommendation.

Bottom Line

BJ’s value pricing, growing membership base, strong balance sheet, and new club openings position it well to deliver strong growth ahead. While it has a negative signal from hedge fund managers, Bridgewater Associates’ Ray Dalio opened a new position in BJ stock in Q3 (Learn more about Dalio’s Q3 transactions here.)

Overall, BJ stock has an Outperform Smart Score of “Perfect 10” on TipRanks.