It has been a very good year for bitcoin investors. Against a backdrop of multiple bank collapses, a shaky economic macro and recent geopolitical issues, the leading crypto has more than doubled in value in 2023, with investors increasingly viewing bitcoin as a safe haven asset to lean on in troubled times. Of course, the growing mainstream acceptance represents a big change in attitude toward what was not long ago considered an extremely volatile and risky asset.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

But the good news is that this year’s surge might just be the opening shot in a new bitcoin bull cycle. That is indeed the opinion of Bernstein analyst and digital asset expert Gautam Chhugani, who points out to investors the upcoming catalysts that could propel bitcoin to higher levels.

“You may not like Bitcoin as much as we do, but a dispassionate view of Bitcoin as a commodity, suggests a turn of the cycle,” Chhugani noted. “A good idea is only as good as its timing – SEC approved ETFs by world’s top asset managers (BlackRock, Fidelity et al), seems imminent. Bitcoin ‘halving’ (BTC rewards half every 4 years) is due April ’24.”

So how high can bitcoin actually go? For the upcoming cycle, by mid-2025, Chhugani anticipates it will climb to a new high of $150,000, almost a 4.5x from current levels.

Investors looking to get in on the game can buy bitcoin directly but there are other ways to participate. “A winning Bitcoin miner,” implores Chhugani, “is a high-beta way to gain exposure.”

The bitcoin miners Chhugani refers to constitute the firms with the infrastructure to validate the bitcoin transactions and receive bitcoin as a reward for doing so and Chhugani believes a pair of mining companies are extremely well-positioned to make bank.

But it’s not only the Bernstein analyst who sees good times ahead for these names. According to the TipRanks database, both are rated as Strong Buys by the analyst consensus, too. Let’s take a closer look and see what makes them so.

Don’t miss

- Top Analyst Sees Opportunity Brewing in These 2 Credit Card Stocks

- TipRanks’ ‘Perfect 10’ List: There’s an Opportunity Brewing in These 2 Top-Rated Stocks

- Morgan Stanley Says There’s a Buying Opportunity in Theme Park Stocks — Here Are 2 Names the Banking Giant Likes

Riot Platforms (RIOT)

Bitcoin might have more than doubled in value this year but that return actually pales against the gains notched by miner Riot Platforms. The stock is up by 238% year-to-date. Investors have evidently taken to a well-capitalized miner boasting a healthy cash balance of $289 million, minimal debt and a balance sheet that compares favorably to that of other mining companies.

Riot oversees two large-scale Bitcoin mining facilities in Texas and electrical switchgear engineering and fabrication operations in Denver, Colorado. And while it has taken a conservative stance regarding its balance sheet, it has still been focused on growth.

In June, the company disclosed that it is acquiring 33,280 MicroBT immersion-cooled miners at an approximate cost of $22 per Terra Hash. This addition will increase the mining fleet’s capacity by 7.6 E/Hs, ultimately reaching a total of 20.1 EH/s upon full deployment in 2024. This positioned Riot as one of the leading miners in the industry in terms of hash power. Furthermore, the company holds the option to procure an additional 66,560 miners at the same price, potentially elevating the total hash rate to 35.4 EH/s by 2025.

The company also makes use of selling electricity back to the grid, for which it sees the benefit of power credits. This has been particularly useful during the summer months, and in August alone, on the back of surging electricity prices in Texas, the company generated $24.2 million from power credits and an additional $7.4 million in demand response credits.

For Chhugani, it’s the anticipated growth along with the company remaining solely focused on its bitcoin mining endeavors – rather than chasing the shiny new thing as other miners have done – that makes Riot a top pick.

“We like RIOT over any other miner,” he says. “We reckon winning the brutal game of mining is about positioning yourself to win big and being on the right side of the cycle. It is about backing yourself, investing in capacity counter cyclically and then winning big when the BTC price cycle heats up. We think Riot does all of this.”

“What we like about Riot is that it’s also not distracted from chasing a new trend,” Chhugani goes on to add. “So it has stayed away from any pivots into AI computing or high performance computing. It is investing back in building more Bitcoin capacity, being counter cyclical and using the down market to negotiate the best equipment contracts with the mining manufacturers. Thus, it has locked prices for mining machines to expand capacity from 10.7 EH/S today to 35 EH/s by end of 2025. We think this counter cyclical focus on Bitcoin is going to win big.”

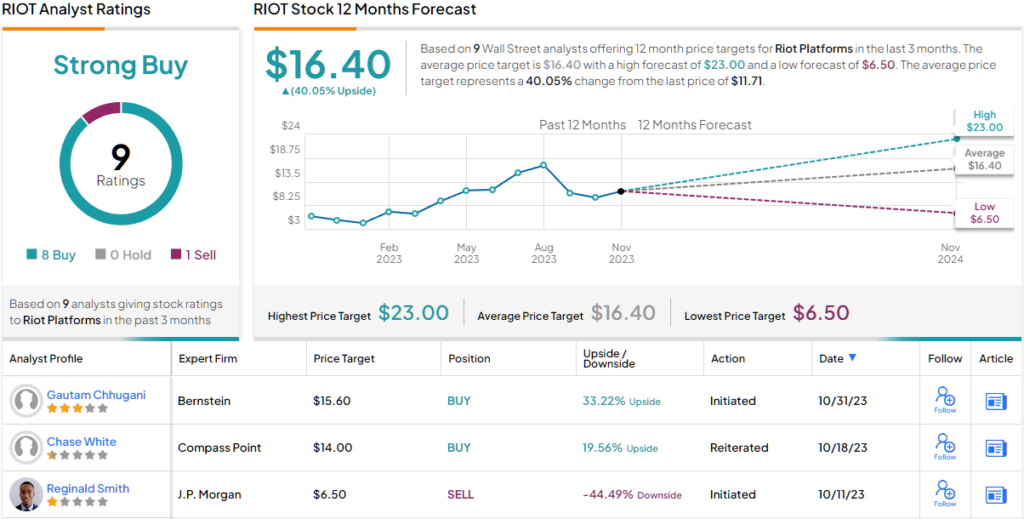

These comments underpin Chhugani’s Outperform (i.e., Buy) rating while his $15.6 price target suggests shares will climb 33% higher in the year ahead. (To watch Chhugani’s track record, click here)

That stance gets the backing of almost all of Chhugani’s colleagues. Barring one bear, all 7 other recent reviews are positive, providing the stock with a Strong Buy consensus rating. The average target stands at $16.40, suggesting shares will post growth of 40% in the year ahead.

CleanSpark (CLSK)

The next Bernstein-endorsed miner we’ll look at is Cleanspark, a former microgrid solutions specialist that shifted its focus to bitcoin mining some time ago. The company began exploring mining operations in late 2020 and has since made mining its primary focus.

That is not the only change that has taken place at CleanSpark. Where once the company’s strategy involved selling much of the bitcoin it mined in order to fund expansion – a game plan that worked, as unlike other firms, it did not have to eventually sell its BTC at a reduced price – the company now prefers HODLing, positioning it well for the upcoming halving event. This event that takes place every 4 years or so, and in the past has been a catalyst for a bitcoin bull market. For instance, in September, CleanSpark mined 643 BTC, selling only 80 of those coins (12%), leaving it with a total of 2,240 bitcoin holdings.

The company is also boosting capacity at a fast pace and in a recent update said it has exceeded a total hashrate of 10 EH/s. During the last five months alone, the hashrate has risen by nearly 50%, bringing it more than halfway to the intended capacity of 16 EH/s by the end of the year. With the addition of recently purchased 4.4 EH/s of Antminer S21 bitcoin miners that are expected to be delivered early next year, once fully utilized, the company anticipates reaching a total hashrate of over 20 EH/s.

For Chhugani, all of this makes CleanSpark another excellent choice for investors.

“We like CleanSpark, because it reminds us of Riot, except it’s focused in Georgia state, and has an even lower power cost vs. Riot without the dynamic power credits enjoyed by Riot,” he explained. “It also stays focused on self-mining (Bitcoin over AI), has built strong visibility to double capacity by end of 2023. Again, no use of leverage, healthy liquidity and gains from any shakeout in hashpower.”

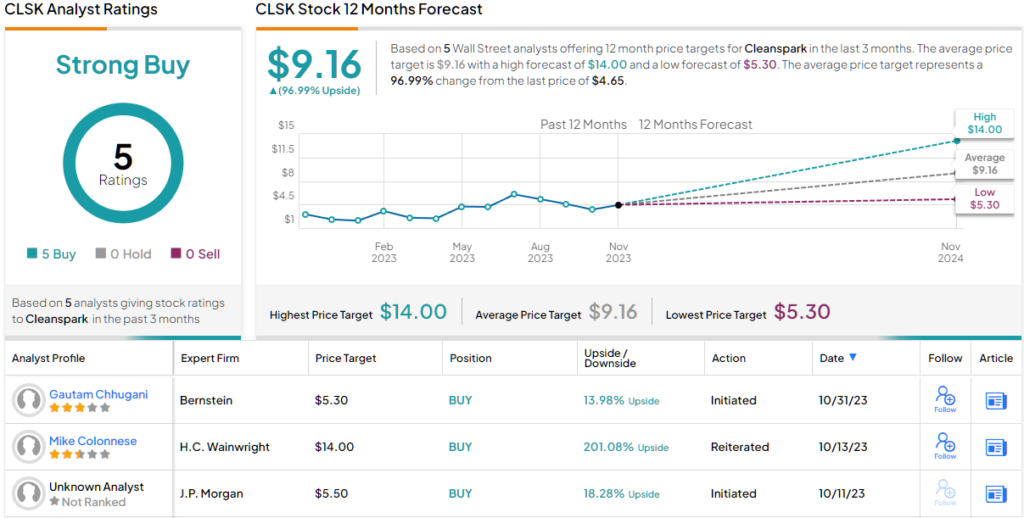

Quantifying his stance, Chhugani rates the shares as Outperform (Buy), backed by a $5.3 price target. Should the figure be met, a year from now, the shares will be changing hands for a 14% premium.

Compared to his colleagues, however, Chhugani’s forecast is rather conservative. The average target currently stands at $9.16, making room for 12-month returns of an excellent 97%. All analysts are on board here as CLSK’s Strong Buy consensus rating is based on a unanimous 5 Buys.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.