BioNTech (BNTX), the drug company most never heard of before 2020, made a lot of headway regarding its partnership with Pfizer (PFE). That partnership ended up producing something that many were waiting for with more breathless anticipation than the latest iPhone: a COVID-19 vaccine.

BioNTech surged after that development accordingly. It was up 2.1% in premarket trading on Monday and kept those gains going into Monday’s trading session. The stock is now up about 7%.

I’m bullish on BioNTech. There are clear signs that COVID-19 is relenting and becoming the kind of background disease we live with every day, like a cold or the flu. However, BioNTech is already gearing up for a post-COVID market.

BioNTech has not had a great year. It looked great back in mid-August 2021—where it was rapidly moving toward a peak where it almost hit $460 per share—but that peak simply didn’t last. After a few attempted recoveries, BioNTech ultimately settled around $143 today.

Yet, perhaps we shouldn’t count BioNTech out just yet. Word emerged that its latest COVID-19 booster shot, built around the omicron variant, is generating an improved immune response against that particular variant.

The 30 and 60 microgram doses, reports noted, offered between a 13.5 and 19.6-fold increase in addressing the BA.1 Omicron subvariant. Earlier testing, featuring both the redesigned vaccine and the original in the same shot, produced a 9.1 and 10.9-fold increase.

Wall Street’s Take

Turning to Wall Street, BioNTech has a Moderate Buy consensus rating. That’s based on three Buys and seven Holds assigned in the past three months. The average BioNTech price target of $236.40 implies 64.9% upside potential.

Analyst price targets range from a low of $168 per share to a high of $350 per share.

Investor Sentiment is Not Looking Bright

Though analysts are looking reasonably upbeat, and BioNTech does have some interesting possibilities in the wings, investor sentiment is skewing fairly hard to the negative. BioNTech currently holds a Smart Score of 3 out of 10 on TipRanks, the highest level of “underperform.” That makes it somewhat more likely than not that BioNTech will lag the broader market.

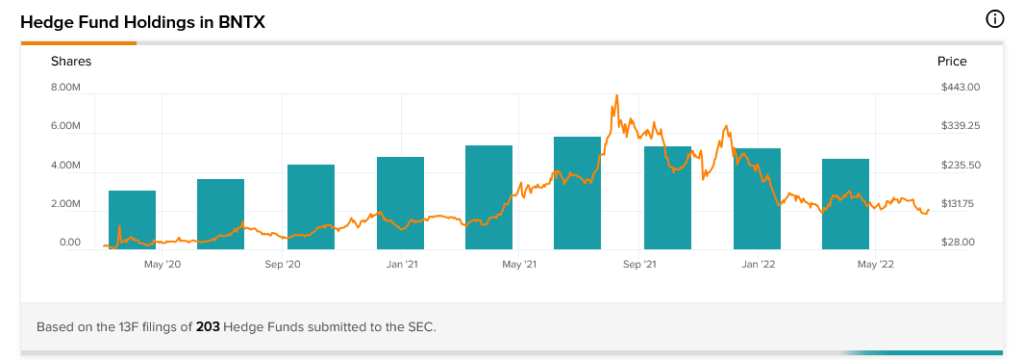

One serious problem comes from hedge fund involvement. Based on the TipRanks 13-F Tracker, hedge funds’ connection to BioNTech has once again declined. Hedge funds have pared back their involvement in every quarter since June 2021.

Meanwhile, tracking BioNTech insider trading is something of a challenge. There is no data available as yet for insider trading at BioNTech. So, figuring out just which direction the insiders are taking is that much harder to puzzle out.

The same can’t be said, however, for retail investors – at least, those retail investors who hold portfolios on TipRanks. They’re getting out of BioNTech rapidly. In the last seven days, portfolios that held BioNTech were down 0.5%. In the last 30 days, that figure was down 1.6%.

As for BioNTech’s dividend history, it was largely nonexistent. At least, it was until June 1, 2022, when the company issued a $1.53 dividend. That’s good news for investors, and it’s easy to wonder if BioNTech can keep that streak alive on a quarterly, semi-annual, or even annual basis.

There’s More Here than Just COVID-19 Vaccines

The latest news for BioNTech isn’t exactly encouraging. It’s offering yet another booster shot for a disease that is rapidly declining into the newest version of the cold or the flu: a disease people simply live with and, sadly, occasionally die from.

The New York Times‘ latest charts and graphs show figures declining on their way back down to the early days of the pandemic, back before it even really got started.

COVID-19 vaccines are readily available. They’re readily available to the point where vaccine doses are being destroyed for lack of demand. It’s easy to wonder how much longer BioNTech—and by extension, Pfizer—can maintain its high profitability levels in the face of such conditions.

The good news here, for investors, is that BioNTech is about more than just COVID-19 vaccines. While certainly, that’s a big part of its operation right now—and a major part of the run-up it saw last June—there’s more here than just that.

In fact, there are signs that BioNTech may be going back to its roots. The company got its start back in 2008, pursuing cancer treatments. The original founders believed that there was a clear discrepancy between what cancer treatments were available and what treatments could be available if they could just be developed.

Pursuing an mRNA-based treatment for COVID-19 was really just a side project. Now, BioNTech has billions on hand to put into its research, thanks to the massive win that was the COVID-19 vaccine and its accompanying booster shots. It has also laid the groundwork for a series of developments in cancer treatment.

Sure, those developments are often still early-stage. However, if investors consider this just a head-start in the making, the sky may be the limit.

Better yet, BioNTech’s huge new war chest gives it a lot of room to do quite a bit in the field. It can pursue cancer treatments, certainly. Indeed, Seagen (SGEN) made a lot of headway recently, even making an attractive buyout target, on its advancements in cancer fighting.

Cancer is one of the great major unbeaten diseases. If BioNTech can manage to bottle the same kind of lightning it did with COVID-19, then it may be on track to being one of the biggest names in biotech around.

Concluding Views

Granted, things don’t look so great for BioNTech right now. It’s lost close to three-quarters of its value in the last year. Investor sentiment metrics look abysmal, those of which can even be found.

Consider, however, the potential. It’s currently trading well under its lowest price targets. The upside potential is substantial. Better yet, the company has a massive war chest. That could let it buy any of dozens of smaller pharmaceutical companies. It could also clear the way to build one monster drug play.

Drug makers tend to be recession-resistant, too. Medication purchases are generally in the same strata as food; usually, customers won’t cut those expenses until there’s no other choice.

BioNTech has a great, untapped potential right now. With the share price falling back to early 2021 levels, there’s a possibility to realize those gains once more.

That’s why I’m bullish on BioNTech; it’s got the cash it needs to fund research and pay dividends for the foreseeable future. If it can make another hit as it did with the COVID-19 vaccine, that only makes a good thing even better.