Any positive development in the search for a desperately needed coronavirus treatment or vaccine has prompted optimistic headlines accompanied by surging stock prices. Case in point: Vaccine maker BioNTech (BNTX) saw its shares rising nearly 20% following Monday’s news that two of the COVID-19 vaccine candidates it is co-developing with partner Pfizer were given Fast Track designation status by the FDA.

However, J.P. Morgan analyst Cory Kasimov believes the headlines illustrate how much the public has taken to biotechs during these pandemic driven times, while the news amounts to… well, not much really.

“The reality,” Kasimov said, “Is that this update is really not surprising or significant. It speaks more to the unmet need of the target indication (which is obvious in this situation) than it does to the investigative candidate(s) in question. Unlike Breakthrough Therapy Designation (BTD), fast track does not consider the clinical data to date (which we do believe are encouraging).”

Expounding on this theme, the 5-star analyst notes that while the status has a number of benefits, including “more frequent FDA interaction, eligibility for Priority Review / Accelerated Approval and a rolling BLA (Biologic License Application) submission,” they are ones which most likely will be given to all potential COVID-19 treatments and vaccines.

BNTX and Pfizer’s candidates, BNT162b1 and BNT162b2, were granted accelerated status following the release of promising preliminary data from ongoing phase 1/2 clinical trials in the U.S. An additional phase 1/2 study is currently taking place in Germany, for which results are expected to be released later this month.

The two partners hope to initiate a phase 2b/3 clinical trial – expected to enroll up to 30,000 participants – before the end of the month.

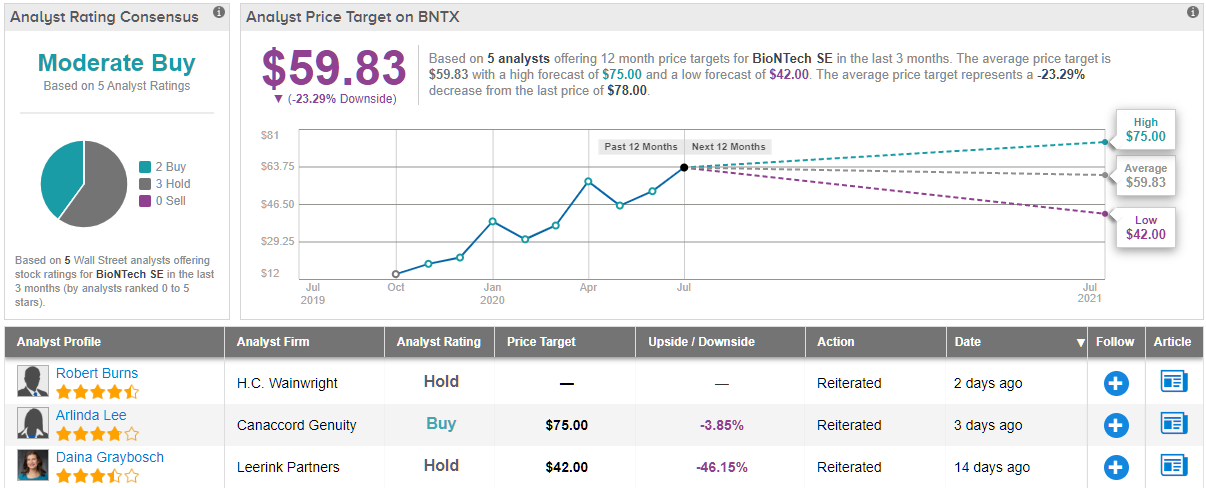

Down to the nitty gritty, what does it mean for investors? There’s no change to Kasimov’s rating, which stays a Neutral for now. Kasimov’s price target also stays put, and at $42, suggests shares will drop by a sinking 46% over the coming months. (To watch Kasimov’s track record, click here)

The rest of the Street has a more positive outlook, but only just. BNTX’s Moderate Buy consensus rating is based on 2 Buys and 3 Holds, while the average price target clocks in at $59.83. Therefore, the analysts expect downside of 23% for BNTX shares in the year ahead. (See BioNTech stock-price forecasat on TipRanks)

To find good ideas for healthcare stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.