COVID-19’s impact has been crippling, but something positive may come from the pandemic. Billionaire Ray Dalio said in a live LinkedIn interview that in terms of the broader historical context, the recent economic downturn should be “relatively brief,” and could spur significant societal progress. This would include a worldwide “restructuring” lasting approximately three to five years.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

“I know that’s a long time, but it’s not forever. The human capacity to adapt and invent and come out of this is much greater,” Dalio commented. He added, “I think we should be very excited about the new future. We’re now in a wonderful revolution in terms of the capacity to think and use that in a way. I would say that is absolutely the most treasured thing in the future.”

Still making sure to account for the unknowns, Dalio has been diversifying his investments across geographic locations, asset class and currencies throughout the ongoing public health crisis.

Looking to Dalio for investing inspiration, we used TipRanks’ database to find out if three stocks the billionaire recently added to the fund represent compelling plays. According to the platform, the analyst community believes they do, with all of the picks earning “Strong Buy” consensus ratings. Let’s jump right in.

Philip Morris International (PM)

Cigarette and tobacco manufacturing company Philip Morris has become known as a “sin stock.” However, regardless of its product portfolio, Dalio sees plenty of upside in store.

Recently, the billionaire’s fund acquired a new position in PM, snapping up 67,447 shares. The value of this new addition? More than $4.9 million.

Turning now to the analysts, the stock boasts a strong fan base, which includes Piper Sandler’s Michael Lavery. He doesn’t dispute the fact that there are some headwinds facing the company. “PM expects near-term iQOS new user acquisition to be about 50% lower than it originally planned due to social distancing measures that have shut iQOS stores and made it harder to engage with consumers,” Lavery stated.

That being said, the company has already surpassed Lavery’s expectations, which were cut to near-zero. The analyst even says that if PM can maintain the pace of its customer acquisition, there could be upside to his estimates. The analyst added, “We expect HeatStick volume growth of 20% in 2020E (1Q20: +45%) and believe 90-100 billion sticks in 2021 is still achievable.”

While lower duty-free volumes and down-trading in Indonesia could take a toll on second quarter EPS, Lavery remains optimistic. “We remain bullish on PM’s strong long-term outlook, and we expect nicotine demand to remain resilient near-term (particularly in times of personal stress),” he explained.

It should also be noted that PM has had to grapple with patent infringement claims from British American Tobacco (BAT) and a transactional currency hit. Speaking to the first issue, Lavery said, “We reviewed BAT’s six patents named in its U.S. complaint, and it is difficult to handicap an outcome, but a third-party reviewer of patents generally did not give BAT’s relevant ones here very high marks.”

As for the latter, Lavery points out that about $100 million of the currency hit in the first quarter of 2020 was driven by the revaluation of euro or dollar denominated payables in markets like Russia, but he doesn’t foresee another event of this magnitude happening again.

Based on all of the above, Lavery kept an Overweight rating on the stock. He did reduce the price target from $98 to $95, but this still implies shares could climb 40% higher in the next year. (To watch Lavery’s track record, click here)

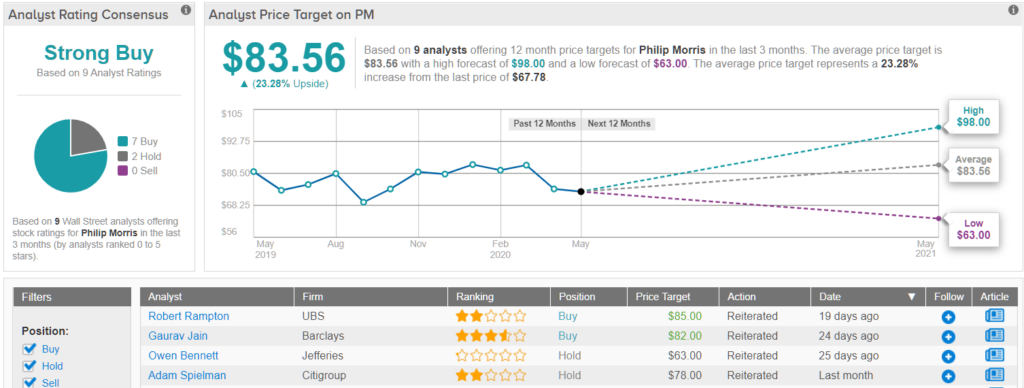

Judging by the consensus breakdown, other analysts are in agreement. 7 Buys and 2 Holds add up to a Strong Buy consensus rating. In addition, the $83.56 average price target brings the upside potential to 23%. (See Philip Morris stock analysis on TipRanks)

UnitedHealth Group (UNH)

Hoping to help people live healthier lives and make the healthcare system work more efficiently, UnitedHealth Group offers a wide range of healthcare products and insurance services. While the late-March acceleration of the COVID-19 pandemic resulted in a somewhat lackluster quarter, Dalio believes the company’s future is bright.

To this end, Bridgewater went in on UNH. In a purchase valued at $5,481,000, Dalio’s hedge fund scooped up 21,977 shares.

Five-star analyst Michael Wiederhorn agrees that UNH is moving on to bigger and better things, noting that its Q1 performance was relatively solid. “Overall, UNH produced strong results and seems well-positioned to navigate the COVID pandemic due to a relatively stable top-line, a diversified business mix and a dominant position across its businesses.”

Wiederhorn tells investors that management thinks the slowdown in non-COVID-irelated utilization, which was driven by highly constrained elective care and will be offset by the late-year pent-up utilization, will have a significant impact on MCR in the second quarter. As a result, despite some uncertainty surrounding COVID-19’s impact, UNH maintained its full year 2020 EPS guidance of $16.25-$16.55.

Adding to the good news, Wiederhorn argues that its Optum segment has a strong standing within the market. Expounding on this, he noted, “Trends at Optum remained solid, and management did note that even OptumHealth should be positioned to hold up relatively well due to its reliance on risk-based contracts, accounting for two thirds of revenues. Both OptumRx and OptumInsight have strong pipelines (though the timing of meetings was disrupted) with the latter of particular interest as companies look to improve the economics and delivery of healthcare.”

Even though commercial enrollment could be hampered by elevated levels of unemployment, higher Medicaid should partially offset this. Additionally, UNH is in the early stages of pricing and benefit design for 2021, with its plans possibly including pricing for COVID-19 testing and a potential vaccine.

Bearing this in mind, Wiederhorn maintained an Outperform call and $343 price target. Should this target be met, a twelve-month gain of 18% could be in the cards. (To watch Wiederhorn’s track record, click here)

Turning now to the rest of the Street, other analysts also like what they’re seeing. With 12 Buys and 2 Holds, the word on the Street is that UNH is a Strong Buy. At $326.23, the average price target indicates 12% upside potential. (See UnitedHealth stock analysis on TipRanks)

Accenture PLC (ACN)

Dalio’s third recent addition, Accenture, provides management and technology consulting services and solutions to help its clients, which inhabit almost every industry, create lasting value. With the company relying on a new strategy, Dalio thinks it has set itself up for success.

Not wanting to miss out on a compelling opportunity, Bridgewater pulled the trigger on 27,763 shares, giving it a new position in ACN. Looking at the value of the new holding, it comes in at more than $4.5 million.

When it comes to the analysts, they are also singing the company’s praises. Writing for BNP Paribas, analyst Ben Castillo-Bernaus argues that COVID-19’s disruption has presented investors with an opportunity to buy a “high-quality” IT service company, with ACN trading well below historical five-year average EBIT multiples.

“Accenture remains ‘best in class’ and the recent weakness is an opportunity to gain a position in this IT Services global leader delivering 40% returns on capital,” Castillo-Bernaus stated. He added, “Accenture has been a pioneer in developing ‘the New’ with 65% of revenues now coming from high growth Digital, Cloud and Security services.”

As for what makes the company so successful and allows it to continuously take market share, Castillo-Bernaus points to its investments in new technologies and growth areas. To back up this conclusion, the analyst cites its EUR1 billion investment in training each year and EUR800 million investment in R&D all while delivering margin improvements every year. On top of this, ACN conducts smaller-scale M&A, with it working alongside the companies before an acquisition to limit any potential deal failures.

Castillo-Bernaus also noted, “We believe Accenture has customers that spend more than $100 million annually, with 98% of Accenture’s top 100 clients having been clients for more than five years. These ‘sticky’ relationships help Accenture maintain high margins and high returns as Accenture has a high number of ‘sole source’ wins where it does not even see competition in RFPs.”

That being said, the company has started using a new approach. It will now organize itself by Strategy & Consulting, Interactive, Technology and Operations instead of by verticals, and the results will be reported geographically for these segments. “We believe it is too early to tell what kind of impact these changes will have, but Accenture has a positive track record of occasionally tweaking its growth strategy in order to best deliver on the opportunities ahead,” Castillo-Bernaus commented.

It should come as no surprise, then, that Castillo-Bernaus joined the bulls. Along with an Outperform rating, he initiated coverage by setting a $215 price target. This target conveys the analyst’s confidence in ACN’s ability to surge 17% in the next twelve months.

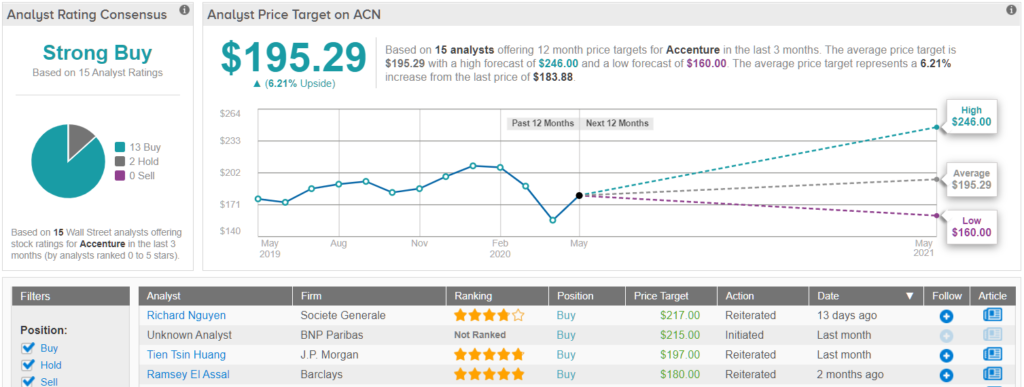

In general, other Wall Street analysts have also been impressed. ACN’s Strong Buy consensus rating breaks down into 13 Buys and 2 Holds assigned in the last three months. However, the $195.29 average price target suggests modest upside potential of 6%. (See Accenture stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.