Shares of BigBear.ai Holdings (NYSE:BBAI) have corrected quite a lot, losing nearly 78% of its value from the 52-week high. However, analysts see considerable upside potential in this penny stock (learn more about penny stocks here) due to its exposure to attractive target markets and AI -(artificial intelligence) led demand.

BigBear.ai provides AI-powered decision intelligence solutions for the supply chains & logistics, autonomous systems, and cybersecurity markets. Further, its customers include the U.S. Defense/Intelligence Departments, the U.S. Federal Government, commercial manufacturers, and logistics service providers.

The enthusiasm surrounding AI, led by the success of OpenAI’s ChatGPT, gave a massive boost to BBAI stock. Investors should note that this penny stock increased from $0.674 on December 30, 2022, to its 52-week high of $6.77 on February 6, 2023, delivering an astonishing return of over 900% in this relatively short timeframe. Nevertheless, the rally in its stock fizzled out soon due to its low growth rate.

BBAI’s revenue growth has shown a noticeable slowdown in the last two quarters. In Q4 of 2022, BBAI’s top line increased by 21%, but this growth rate decelerated to 15.8% in the first quarter of 2023. Furthermore, its sales only increased by a modest 2% in the second quarter. Looking ahead, BBAI’s revenue is expected to either remain flat or grow by 10% year-over-year in 2023, which is disappointing, especially given the rapid adoption and deployment of AI. In light of this, let’s explore what the Street recommends for BBAI stock.

What is the Prediction for BigBear.ai Stock?

TD Cowen analyst Shaul Eyal initiated coverage on BBAI stock on October 2 with a Hold recommendation. While the analyst lauds BBAI’s exposure to the Defense and intelligence market and a growing commercial portfolio, the elongated sale cycles amid the challenging macro backdrop keep the analyst sidelined. Also, the analyst believes the ongoing cash burn could lead to additional capital needs.

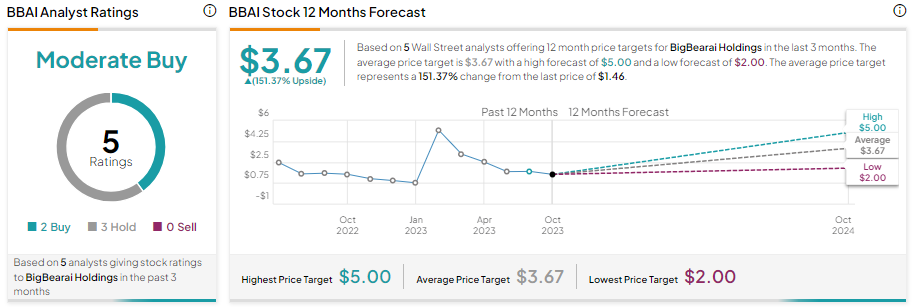

Overall, BigBear.ai stock has received two Buy and three Hold recommendations for a Moderate Buy consensus rating. The analysts’ average price target of $3.67 implies 151.37% upside potential from current levels.

Bottom Line

Though AI-led demand, recent contract wins, and a top-quality customer base support the bull case, the company’s slower growth rate and elongated sales cycle remain a drag. While analysts’ price targets indicate substantial potential for upside in BBAI stock, it is advisable to exercise caution before making any investments. Moreover, investors can utilize TipRanks’ penny stock screener to find other enticing penny stock opportunities.