Boosted by inflation cooling down significantly, and ongoing strength in the jobs market, economic prognosticators have recently touted the probability of a soft landing for the economy instead of the previously dreaded prospect of a full-blown recession.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Steve Eisman, famous for predicting the housing fiasco of 2008 as told in the Big Short, is amongst those taking that optimistic view. “So far, there’s no evidence of a recession,” Eisman said recently. “So as long as there’s no evidence of recession, I think the market will probably continue to melt up.”

According to Eisman, as long as interest rates don’t rise significantly and investors remain unconcerned about the market’s high valuations, stocks will keep charging ahead. “People are chasing,” he goes on to add. But the question is, what should they be running after in this bullish environment?

That’s where Wall Street analysts come into play. Against this backdrop, we delved into the TipRanks database to get the details on two names the stock experts think make worthy additions to a portfolio right now – both equities are deemed Strong Buys by the analyst consensus. Here’s why they get the Street’s backing.

Roivant Sciences (ROIV)

Let’s first head to the biotech space where we find Roivant Sciences, a commercial-stage biopharma with a primary focus on advancing and marketing medicines that enhance the quality of life. Roivant operates a novel business model, in which it acquires, or licenses promising drug candidates from other companies or academic institutions and then forms subsidiary companies (often referred to as ‘Vants’) to focus on developing each drug for a specific disease or therapeutic area.

The company’s product portfolio encompasses treatments for inflammatory and autoimmune disorders, such as the already approved topical psoriasis therapy, VTAMA, as well as other products at different stages of development.

Notable among these are the anti-TL1A drug RVT-3101, intended to treat ulcerative colitis and Crohn’s disease, and batoclimab, a monoclonal antibody IgG1 targeting the Fc neonatal receptor (FcRn) indicated as a therapy for multiple autoimmune conditions.

Roivant Sciences recently reported positive long-term data from a Phase 2b trial for RVT-3101 in the ulcerative colitis setting, adding further credence to the drug’s effectiveness and therapeutic value.

Meanwhile, batoclimab has entered a critical Phase 2 proof-of-concept trial to assess its effectiveness in treating Graves’ Disease. The initial results from this trial are expected to be unveiled in Q4.

Not stopping there, Roivant is also progressing with IMVT-1402, a next-generation FcRn inhibitor targeting autoimmune diseases. The company expects to share initial SAD (single ascending dose) Phase 1 trial data in Aug/Sep 2023, followed by MAD (multiple ascending dose) data in Oct/Nov 2023.

With all this going on, Truist analyst Robyn Karnauskas reminds investors there’s plenty to look forward to. Not only that, based on the strength of the pipeline, it looks like Big Pharma is sniffing around.

“Roivant Sciences is attracting interest from large Pharma, in particular RVT-3101, which alone could be valued at >$7B,” Karnauskas said. “We note that TL1A is an attractive target in inflammatory disease space and believe that potential acquirers are likely taking a look at the asset following positive Ph2 data… Despite any potential acquisition interest, we believe multiple readouts in the upcoming months are likely to unlock additional value for the company and expect the company to be strategic in terms of any potential M&A activity.”

These comments underpin Karnauskas’ Buy rating, which goes alongside a $23 price target, implying shares will gain ~110% over the coming year. (To watch Karnauskas’ track record, click here)

Turning to the rest of the Street, the bulls have it on this one. With 8 Buys and 1 Hold assigned in the last three months, the word on the Street is that ROIV is a Strong Buy. At $16.17, the average price target implies 48% upside potential. (See ROIV stock forecast)

Lantheus Holdings (LNTH)

We’ll stay in pharma segment for our next name. Lantheus Holdings specializes in creating and bringing to market diagnostic and radiotherapeutic products that improve patient diagnosis and treatment. While the company offers a diverse range of solutions for various indications and diseases, its primary offerings, Definity and Pylarify, specifically target unmet needs within the cardiology and oncology fields. Additionally, Lantheus leverages strategic partnerships with other key players to further enhance its portfolio in the pharma segment.

Those two aforementioned products are responsible for most of the revenue haul. Pylarify, a radioactive diagnostic agent administered through intravenous injection, employed in positron emission tomography (PET) imaging for men with prostate cancer, represented 65% of sales in Q1. The product generated $195.5 million, more than doubling 1Q22’s $92.7 million haul. Representing 23% of Q1 revenues, Definity, a diagnostic ultrasound enhancing agent, generated $68.8 million, amounting to an 18% improvement over 1Q22.

There’s also a catalyst ahead for the former, with the strong possibility of EU approval for Pylarify (Pylclari in the EU), after an advisory panel recently recommended it be given the green light. As for the latter, Definity is also in a Phase 3 study for pediatric echocardiography. Several other prospective products are also going through late-stage testing.

JMP analyst David Turkaly is impressed by the growth on tap here and thinks the stock is rather cheap at current levels.

“Over the last two years, Lantheus has morphed into a MedTech growth leader with sustainability for years to come, and while there is plenty of room to go with its leading PYLARIFY and DEFINITY platforms, the company’s new product pipeline remains very full,” Turkaly explained. “Despite this, we model zero contribution from these new opportunities through 2024, and we think the stock still looks very inexpensive versus similar-sized, high-growth peers.”

How does this translate to investors? Turkaly rates LNTH an Outperform (i.e., Buy), backed by a $130 price target. Should the figure be met, investors will be pocketing returns of 54% a year from now. (To watch Turkaly’s track record, click here)

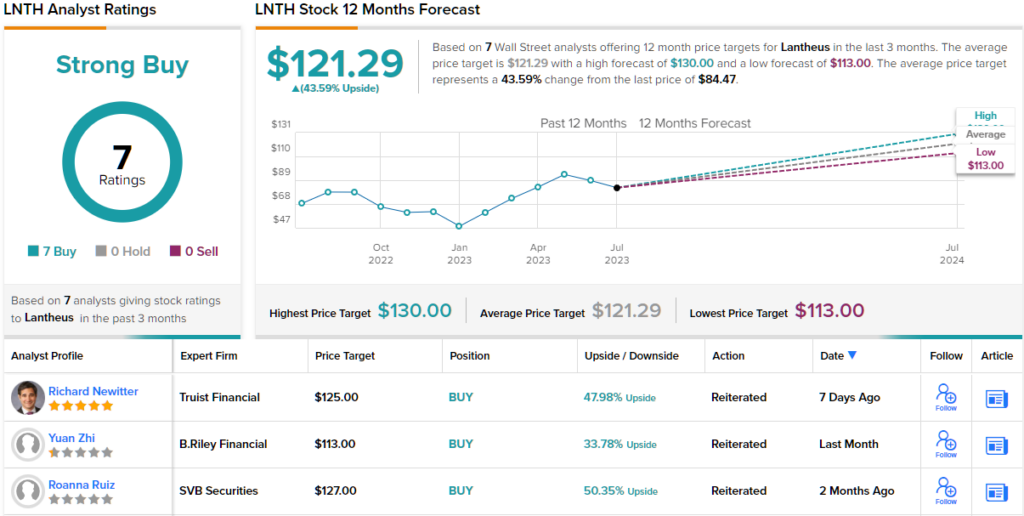

Overall, this is a name that gets the Street’s full support. Based on Buys only – 7, in total – the stock claims a Strong Buy consensus rating. The shares are selling for $84.69 and their $121.29 average price target implies ~44% upside from that level over the next 12 months. (See LNTH stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.