In contrast to some housing market doomsayers, Steve Eisman, who foresaw the 2007–2008 US housing crisis and whose exploits in profiting from the bubble’s collapse were documented in the Big Short, believes there is no impending housing crisis on the horizon.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Instead, Eisman is basing his current investing strategy on a thesis he calls “revenge of the old school,” and is venturing into bonds for the first time in his career and acquiring stocks from traditional, established industries, all in anticipation of benefiting from the U.S. government’s increased spending initiatives.

“This is the first industrial policy in the U.S. we’ve seen in several decades,” Eisman, who is now a managing director at Neuberger Berman, recently said. “The money isn’t spent yet—it’s the government, it doesn’t take a week. There has been no revenue impact at this point, and I don’t think most of the spending has been embedded in any stocks.”

So, which stocks is Eisman eyeing? He’s pointing towards construction firms, utilities, industrials, and materials, favoring them over flashy, rule-breaking tech companies.

With this in mind, we used the TipRanks database to seek out the details on two stocks boasting such attributes, ones that the Street’s experts believe make good additions to the portfolio right now. Both of these stocks enjoy a ‘Strong Buy’ rating from analysts. Let’s dive into the details.

Vulcan Materials Company (VMC)

Vulcan Materials Company, the first ‘old school’ stock we’re looking at, is a leading US producer of construction materials. With its history dating all the way back to 1909, the company has grown to become one of the nation’s largest and most prominent suppliers of essential construction aggregates, such as crushed stone, sand, and gravel. Vulcan Materials plays a pivotal role in supporting infrastructure development, including highways, bridges, and commercial and residential construction projects across the country.

Its expansive network of quarries, distribution yards, and asphalt and ready-mix concrete production facilities allows it to serve a diverse range of markets and customers, a value proposition that enabled the company to deliver a strong financial statement in the most recent readout for Q2.

Revenue climbed by 8.2% year-over-year to $2.11 billion, beating the Street’s call by $60 million. Adjusted EBITDA saw a 32.2% increase from $450.2 million in the same period a year ago to $595.3 million, also coming in ahead of the Street’s $529 million forecast. Moreover, the EBITDA margin improved by 520 bps from 23% in the prior year quarter to 28.2%, and at the bottom line, adj. EPS of $2.29 beat the analysts’ forecast by $0.37.

Moving forward, the company anticipates achieving full-year adjusted EBITDA in the range between $1.9 to $2 billion, representing a $150 million increase from the initial projections shared in February.

Stifel analyst Stanley Elliot sees several reasons to keep a positive slant on this vintage construction name. “We remain optimistic on VMC’s leading aggregate business with healthy fiscal stimulus combining with improving res/non-res markets to provide a backdrop for multiple years of healthy volumes,” said the 5-star analyst. “Additionally, VMC has an opportunity to improve margins in its downstream businesses over time…”

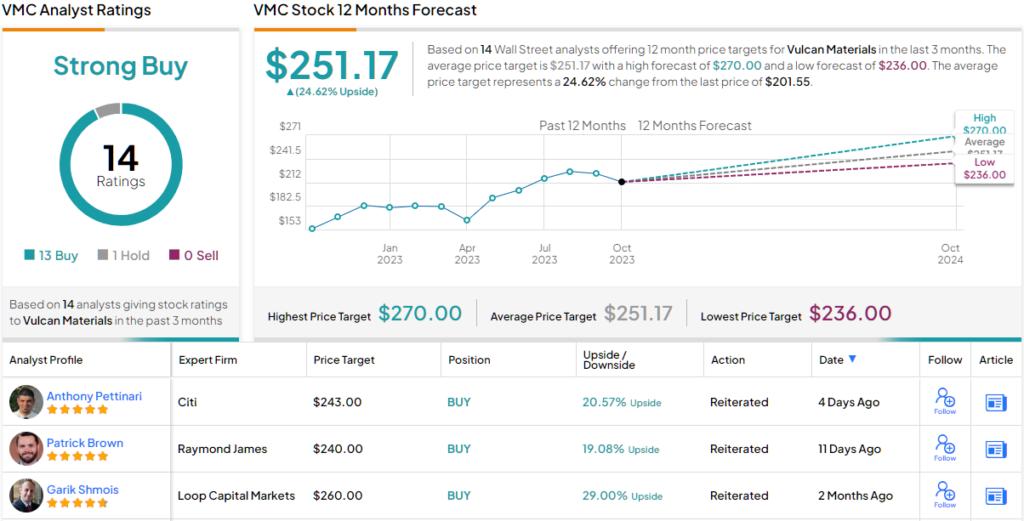

Conveying his confidence, Elliot rates VMC a Buy along with a $260 price target, suggesting shares will climb 29% over the coming year. (To watch Elliot’s track record, click here)

Overall, the 14 recent analyst reviews on VMC break down to 13 Buys vs. 1 Hold, making the analyst consensus rating a Strong Buy. The forecast calls for one-year returns of ~25%, considering the average target stands at $251.17. (See VMC stock forecast)

Construction Partners (ROAD)

For our next pick, we’ll stay in the building industry with the aptly named Construction Partners, a prominent player in the construction and infrastructure sector.

The Dothan, Alabama-based firm has established a strong presence in the industry, particularly in the Southeastern region of the country. With a focus on civil infrastructure, its core competencies lie in the construction and maintenance of roads, highways, bridges, and related projects. While CPI serves both public and private sector clients, its extensive involvement in public infrastructure projects like state highways and municipal roadways has been a significant contributor to its growth.

And growth has certainly been on the menu. Boosted by a series of acquisitions but also contract work and revenues generated by sales of products such as hot mix asphalt and aggregates, revenues climbed from $785.7 million in fiscal 2020 (which ends in September) to $1.30 billion in 2022. At the same time, the backlog increased to $1.41 billion from $608.1 million.

Going by the latest financial update, there will be more growth on tap this year. The company recently released preliminary results for FY 2023 that show revenue is expected to hit the range between $1.547 billion to $1.557 billion, vs. last year’s $1.30 billion. FY 2023 net income is anticipated to come in between $44.8 million to $47 million, compared to 2022’s $21.4 million. Looking to FY 2024, revenue is expected to further rise to the range between $1.750 billion to $1.825 billion with net income hitting the $63 million to $70 million range.

With all this to come, it’s no wonder Raymond James’s Patrick Tyler Brown, a 5-star analyst ranked right at the top end of Wall Street experts, is buoyant regarding CPI’s future.

“We contend that CPI remains a key beneficiary of a generational investment in infrastructure through recently enacted federal programs (IIJA) and significantly improved funding at state DoTs (department of transportation),” Brown said. “As such, we get the sense that not only does the near-term demand outlook for CPI look constructive, but so does the next few years as these funding mechanisms should continue to yield momentum.”

“We remain convinced that CPI can likely growth organically in the high-single-digit range over the next few years given flush state DoTs, IIJA ramp, and as near/re-shoring trends become more meaningful,” the analyst went on to say.

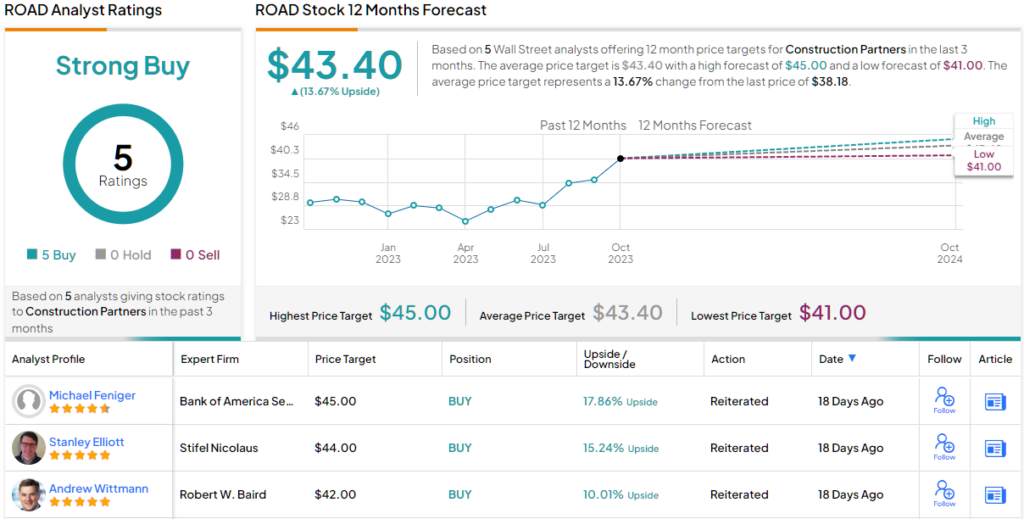

These comments form the basis for Brown’s Strong Buy rating on ROAD, while his $45 price target makes room for additional gains of 18% in the year ahead. (To watch Brown’s track record, click here)

4 other analysts have recently waded in with ROAD reviews and like Brown, all are positive, providing the stock with a Strong Buy consensus rating. Going by the $43.40 average target, a year from now, shares will be changing hands for ~14% premium. (See ROAD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.