The negative momentum weighing down Beyond Meat (NASDAQ:BYND) stock has cooled recently. Still, numerous hurdles have analysts sitting on the sidelines, even if Beyond Meat stock is ready to move on from its horrific 95% peak-to-trough decline.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Though investors have lost their appetite for plant-based meat substitutes (sales down over 20% in Q4), I remain bullish on Beyond Meat stock. I still like the product and think shares have sagged so much that it may not take much to move the needle higher.

That said, the company’s fundamentals are not pretty. There’s a lot of baggage that investors will be picking up with the name at these depths. For those with a deep-value mindset and faith in management, it’s tough not to like what the firm is cooking up. The latest quarter gave hope to many investors that the firm can reduce cash bleed amid sinking demand.

Indeed, the novelty of alternative meat had begun to fade. It’s not as new or exciting as it used to be! Regardless, I think recession headwinds and rising competition in the space are two bigger issues weighing most heavily on Beyond Meat stock.

Ultimately, I see pathways for Beyond Meat to get back on the road to recovery. The company can’t control recession (and inflation) headwinds, but it can continue to find the balance between innovation and cost cuts.

Beyond Meat: Looking Beyond Headwinds to a Recovery

Beyond Meat isn’t out of the woods even after a decent quarter. There’s still a lot of work to be done if the stock is to maintain its recent momentum, with shares up around 65% off their December 2022 lows. That said, if the firm can execute, there are a lot of gains to be had as it moves past (or should I say looks beyond) the “perfect storm” of headwinds.

The company is still losing considerable sums of cash. In a rising-rate environment, that’s not the formula to bring back the sizzle in the alternative-meat pioneer.

BTIG analyst Peter Saleh recently warned that Beyond Meat stock’s recent post-earnings bounce could be short-lived. Specifically, Saleh sees margin pressure, among other risks, on the horizon. Indeed, there’s also not a lot of room for error if management is to orchestrate a turnaround.

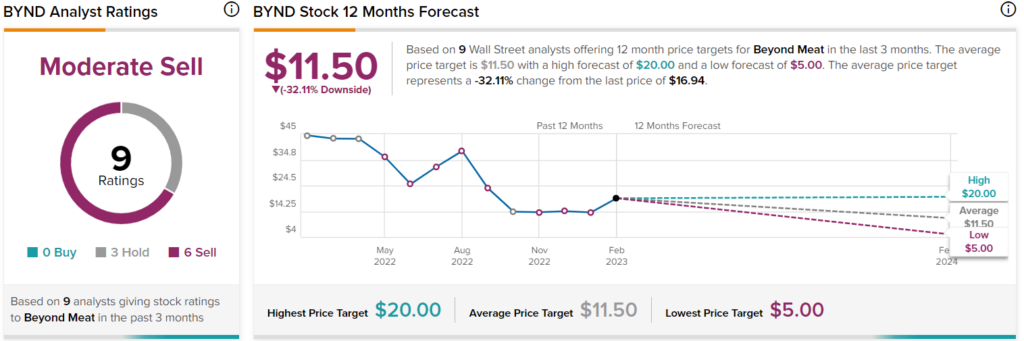

Mr. Saleh isn’t the only analyst who thinks Beyond Meat stock will surrender its latest gains. The stock sports a “Moderate Sell” rating, with no Buys by analysts covering the name.

What is the Price Target for Beyond Meat Stock?

Turning to Wall Street, BYND stock comes in as a Moderate Sell. Out of nine analyst ratings, there are zero Buys, three Holds, and six Sell recommendations.

The average Beyond Meat stock price target is $11.50, implying downside potential of 32.1%. Analyst price targets range from a low of $5.00 per share to a high of $20.00 per share.

Don’t Underestimate Beyond Meat’s Turnaround Plans

There’s not much confidence in Beyond Meat’s abilities to turn things around. Still, I think there’s upside to be had by giving management the benefit of the doubt as it moves forward with its plans.

The company brought on a Red Bull marketing executive to beef up (pardon the pun) on the retail end. The firm is also partnering with grocers and making other moves to improve operational efficiencies. With a sound marketing strategy, Beyond Meat may be able to make its product cool again. In any case, I view recent moves as encouraging as Beyond makes moves to improve its footing to grow as a “leaner” company with 19% fewer employees.

Those who side with management will be going against Wall Street, though. With no analyst Buy ratings, it’s clear that Beyond Meat is more of a show-me story, given management hasn’t had a track record of success in the firm’s relatively limited time as a publicly-traded firm.

The plant-based market may also heat up again in a post-recession environment. Alternative meats are expensive, and in tough times, they’re less competitive than the real thing. Regardless, I view plant-based meats as more than a “fad.”

Once economic conditions normalize, we’ll gain a better gauge of just what to make of the fairly nascent market that’s gone bust. While it’s unlikely that appetite for Beyond Meat will eclipse pandemic levels anytime soon, I don’t think it’s far-fetched to see the alternative meat trend heat up again once consumers have more disposable income and once Beyond Meat can serve up new formulations and products.

In essence, I view plant-based meats as more “discretionary” than the real thing.

The Bottom Line on BYND Stock

It’s still hard to value Beyond Meat stock, given potential margin headwinds. Only time will tell if the turnaround plan pays off. Regardless, I don’t think 2.7 times sales (it used to be over 20x) is too high a price for a firm that’s hungry to prove all its Wall Street doubters wrong.