DraftKings (DKNG) shares have fallen more than 65% over the past year on headwinds from the spread of Delta and then Omicron, both variants of the COVID-19 virus.

Shares are becoming more likely to switch to uptrend mode as the COVID-19 infection continues its transition from a pandemic to a situation of living with the coronavirus. In addition, the company’s fundamentals appear to be improving. As such, I’m bullish on DraftKings stock.

Headquartered in Boston, Massachusetts, DraftKings is a digital sports entertainment and gaming company that develops and operates sports betting and fantasy sports competition applications for users in the United States.

Q4 2021 Results

The company performed very well in the fourth quarter of 2021, driven by excellent player retention and customer acquisition as well as effective cross-selling.

Combined with an increase in key business metrics like Monthly Unique Payers (MUPs) and Average Revenue per MUP, total revenue rose nearly 47% to $473 million, beating analysts’ median forecast by $27.32 million.

The bottom line resulted in a net loss of $0.80 but beat the average consensus estimate by $0.01.

Looking Ahead

For full-year 2022, the company is forecasting revenue of $1.85 billion to $2 billion, up 43% to 54% compared to full-year 2021. The analysts are forecasting revenue of $1.97 billion.

Adjusted EBITDA is instead expected to be negative and in the $825 million to $925 million range.

Financial Condition

The balance sheet needs improvement. The Altman Z-Score of 0.57 indicates distress, suggesting the possibility of a bankruptcy event.

However, sales are rising, which means the company may be on the right track to aim for a stronger financial position.

Outlook

The entire global online sports betting market had suffered during the COVID-19 pandemic as measures to contain the spread of infection resulted in the cancellation of several sporting events.

As the public health emergency improves, the aforementioned headwinds should subside, which will allow DraftKings and other operators to deliver more stable growth by capitalizing on the rebound in online sports betting popularity.

Driven by increasing digitization, the global online sports betting market is expected to grow significantly over the next few years and reach $60 billion by 2026. This is the expectation despite ongoing bans on online gambling in some countries.

DraftKings Inc’s growth strategy will focus on optimizing the user experience while the portfolio develops offerings that enhance the company’s competitive profile.

Wall Street’s Take

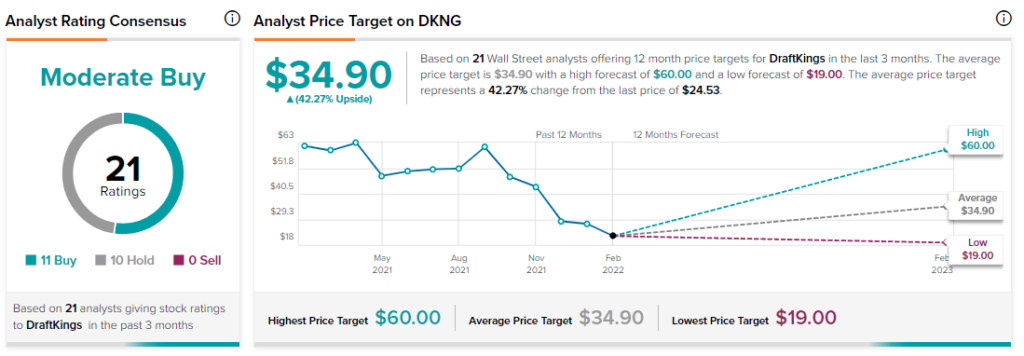

Over past three months, 21 Wall Street analysts have issued a 12-month price target for DKNG. The company has a Moderate Buy consensus rating based on 11 Buys, 10 Holds, and zero Sells.

The average DraftKings price target is $34.90, implying 42.3% upside potential.

Conclusion

As the successful vaccination campaign progresses, the global health emergency is improving, meaning event cancellations affecting online sports betting should no longer occur.

This makes things easier for DraftKings, which needs to improve its financial position through organic growth.

Sales are increasing, which is a positive sign. DraftKings shares should recover.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure