Given its investment in Open AI, the company behind ChatGPT, and the implementation of the tech in its search engine Bing, the widely held view is that Microsoft (NASDAQ:MSFT) has gotten a head start over its rivals in the AI arms race.

Now, the company’s latest move should see that gap widen even more, so believes Oppenheimer analyst Timothy Horan. According to a report in The Information, Microsoft will soon be offering to enterprises a premium private ChatGPT service. This will not only assuage fears around data leaks or regulatory compliance for businesses operating in segments such as banking or health care but could also cost as much as ten times more than OpenAI’s public paid service.

The new service will possibly be announced later in the quarter, and Horan believes it should have a “positive upwards bias” to his already industry-leading FY24E Azure growth. Horan has that figure coming in at 24% (constant currency, +27% USD), and the product should go toward further widening its lead over AWS (~+9%).

“Recall,” the 5-star analyst went on to add, “our eye-opening recent analysis showed that, while Azure grew by $914M in calendar 1Q23, AWS actually shrank for the first time by $24M during the same period, while GCP (Google Cloud Platform) rose $149M, but likely contracted absent accounting changes. This suggests that 1Q23 marked an inflection point, with Microsoft’s emerging dominance in the hyperscaler cloud market only set to increase with Azure OpenAI, and related halo effects.”

Considering this a sector that only six months ago did not seem to even exist yet, Horan believes that in the meantime it is turning out to be the “most consequential technological breakthrough since the Internet and Mobile.” And with Azure (AI/GPU optimized infrastructure), OpenAI (LLM), and “network effects” from first-party and co-pilot on the 1.5 billion-user Windows/Office and 100 million-developer Github acting as significant tailwinds, Horan singles out Microsoft as “structurally advantaged for this next computing wave.”

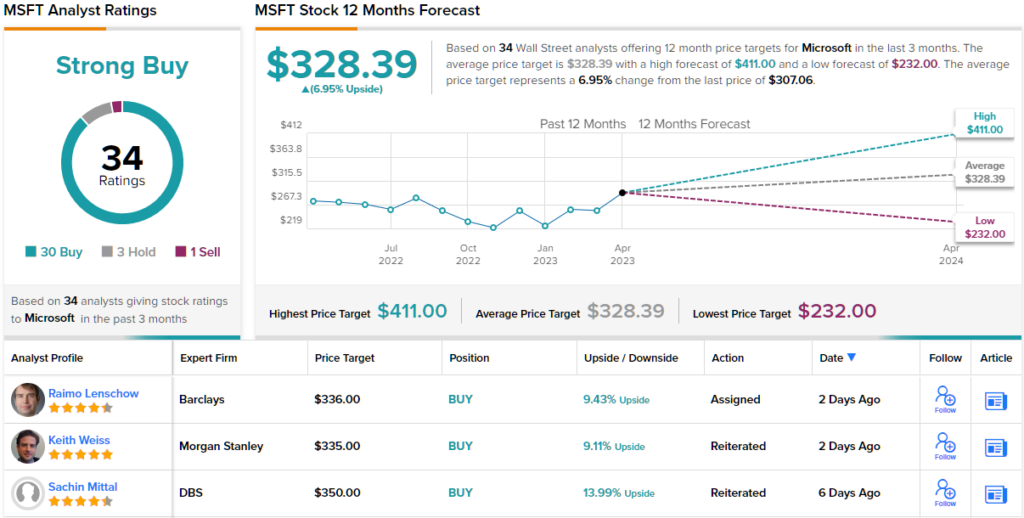

To this end, Horan reiterated an Outperform (i.e., Buy) rating alongside a $330 price target. (To watch Horan’s track record, click here)

As expected, Microsoft gets plenty of support on Wall Street. The stock’s Strong Buy consensus rating is based on 30 Buys, 3 Holds and 1 Sell. (See Microsoft stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.