Markets saw a general decline in 2022 – but few market segments were hit as hard as crypto, with the leading currency, bitcoin, down by 64% this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

But just because bitcoin is down it doesn’t mean that investors can’t still make money on crypto. This fact should bring our attention to crypto miners, companies that buy and maintain the extensive computer servers needed to keep up the blockchain calculations that support crypto production. They make their money by selling some of the bitcoin they mine, so finding the right balance between facility expense and the price of bitcoin is essential to their success.

H.C. Wainwright analyst Kevin Dede acknowledges these issues in a recent note on the bitcoin mining industry. He writes, “The prolonged price depression’s related financial pressure, while not new, could place greater weight on bitcoin miner operating performance—certainly observations not at all novel to those plugged into the crypto-verse.”

However, Dede suggests ‘driving while looking through the windshield ahead versus the rear-view mirror,’ essentially, to look toward the future. And here Dede expects the bitcoin price will rise to $22,300 or even higher by year-end 2023, although he prefers to take a conservative stance.

In plainer words, Dede sees better days ahead for the industry. In his view, the previous crypto price hits have weeded out the unfit, and among those that remain, several are worth a second look from investors. So let’s do that. Using the TipRanks data platform, we’ve pulled the details on several players in the bitcoin mining industry, all Buy-rated with triple-digit upside potential for the coming year. Here they are, along with comments from the analysts.

Riot Blockchain, Inc. (RIOT)

First up on our list, Riot Blockchain, is a small-cap firm, with a market cap of $550 million, but is one of the major players in the US crypto mining sector. The company’s operations are based in Texas, and the company has 72,428 deployed mining sets with a total hashrate of 7.7 EH/s (as of the end of November). Riot is in the process of expanding its ops, and aims to reach a self-mining hash rate of 12.6 EH/s during 1Q23.

That’s an ambitious goal, and Riot appears to have the ability to reach it. The company reported producing 1,042 bitcoin during 3Q22, the last quarter reported, which generated $46.3 million in total revenue. The top line was down sharply from last year, when 3Q21 saw $64.8 million, due to a lower bitcoin price and lower bitcoin production. This was partially offset by $13.1 million in earned power curtailment credits.

As of the end of Q3, Riot could boast of truly deep pockets. The company reported $369.8 million in working capital, which included $255 million in cash and liquid assets on hand, as well as 6,766 bitcoin. The bitcoin holdings were produced by the company’s self-mining operations.

Roth Capital analyst Darren Aftahi sees an interesting path forward for RIOT, and laid it out earlier this month, writing, “While the growth in the network hashrate has slowed some on a m/m basis, we believe if the challenging environment continues into 2024 which is the anticipated halving date, we could see more miners moving offline. Continued financial headwinds from other miners creates an opportunity for RIOT to take advantage of slower network hashrate growth (gaining market share) and potentially see better pricing on future machine orders, given OEM’s would need to remain competitive on pricing with second-hand machines hitting the market. These factors create a favorable growth environment during a BTC bear cycle for a well-capitalized BTC miner.”

Extrapolating forward, Aftahi puts a Buy rating on RIOT shares, along with an $11 price target that implies a robust one-year upside potential of 222%. (To watch Aftahi’s track record, click here.)

The Strong Buy consensus rating on RIOT is supported by a unanimous 8 Buys. Going by the $10.79 average target, the shares will appreciate by 215% over the next year. (See Riot Blockchain’s stock forecast at TipRanks.)

CleanSpark (CLSK)

Next up is CleanSpark, a bitcoin miner with a twist – it aims to become the first bitcoin mining firm to operate on purely renewable energy. This is an important factor, as bitcoin mining is a highly energy-intensive endeavor, using huge amounts of electricity. CleanSpark’s selling point is its goal of becoming a fully ‘clean energy’ player in the bitcoin field.

CleanSpark recently completed its fiscal year 2022, and released financial results. At the top line, the company had annual revenues of $131.5 million, up 235% y/y. That increase reflects the increasing amount of computing power which CleanSpark has brought online over the course of the year. In the fourth quarter of the year, revenue came in at $26.2 million, up 14% from the prior-year period.

These revenues were supported and produced by CleanSpark’s mining activities, which operate at a current hashrate of 5.5 EH/s as of the end of November this year. This is up 320% y/y, and represents the company’s continuing expansion of its capabilities.

Backing up its operations, CleanSpark listed its total current assets as $50.8 million. This includes $20.5 million in cash and $11.1 million in bitcoin holdings. The company has $386.6 million worth of total mining assets, a sum that includes deployed miners and prepaid deposits on machines pending delivery.

Mike Colonnese, in his coverage of this stock for H.C. Wainwright, stakes out a simply bullish position. “We believe the company is one of the best-positioned miners to navigate this prolonged crypto winter based on its scale, operating efficiency, solid balance sheet, and relatively tame electricity costs.,” Colonnese said. “CLSK remains one of our top picks in the crypto mining sector… We believe the stock is significantly undervalued at current levels, trading at just ~0.6x our F2023 revenue estimate.”

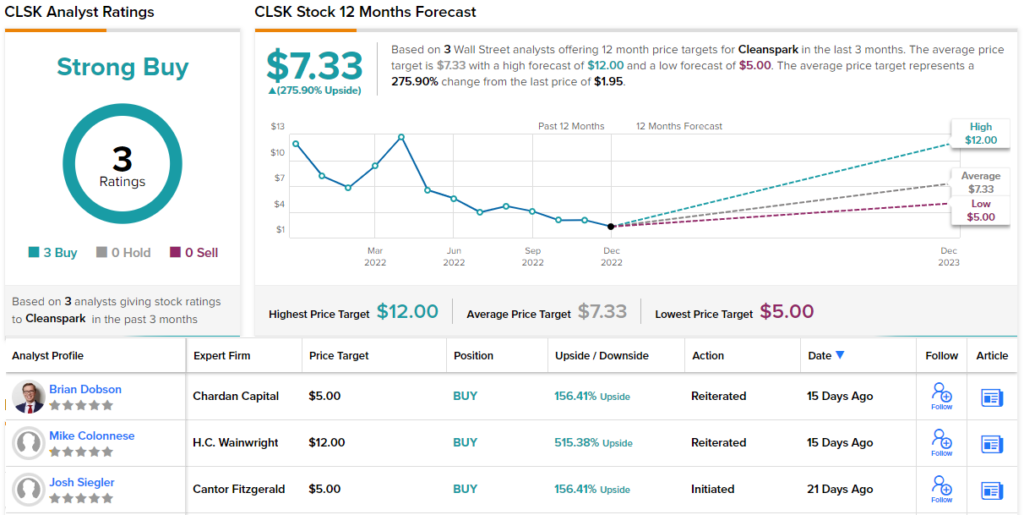

Colonnese’s Buy rating here is backed up by a Street-high $12 price target that suggests a powerful gain of 515% lies ahead for the shares. (To watch Colonnese’s track record, click here.)

All 3 of the recent analyst reviews on CLSK shares are positive, making the Strong Buy consensus rating unanimous. At $7.33, the average target price implies a 276% upside on the one-year horizon. (See CleanSpark’s stock forecast at TipRanks.)

Applied Digital Corporation (APLD)

The last company on our list, Applied Digital, has seen some changes recently. This past November, the company officially changed its name, from ‘Applied Blockchain’ to the new moniker, Applied Digital Corporation. The new name reflects the company’s more diversified approach, from simply mining blockchain to also designing, building, and deploying the sophisticated infrastructure and networked datacenter server installations that power bitcoin mining. The company’s stock ticker, APLD, remained the same.

Applied has a 100-MW hosting facility in Jamestown, North Dakota, and on December 14 announced the groundbreaking of a new 5-MW specialized processing center adjacent to that existing facility. The move marks a step into the high performance computing (HPC) industry, a move Applied is taking to tap into a potential $65 billion addressable market – and to reduce its dependence on bitcoin.

In the meantime, the company continues to mine bitcoin, and brought in revenue of $6.9 million in the first quarter of its fiscal year 2023 – the quarter ending on August 21, 2022. That quarterly revenue met the high end of the previously published guidance.

After the recent fiscal 1Q, the company broke ground on its third co-hosting facility, a 180-MW facility under construction in Ellentown, North Dakota. This facility is already contracted to its full capacity.

We’ll check in again with Wainwright’s Kevin Dede, who lays out the reasons for backing this name. He writes, “Our confidence in Applied is driven by: (1) predictable, recurring revenue model and future earnings streams supported by inexpensive, stable electricity costs; (2) demonstrated success in operating its Jamestown facility and progression in building out and fully contracting its Garden City and Ellendale site; (3) strategic partnerships with esteemed industry players that offer significant advantages in expansion; (4) a cash position and financing options capable of funding existing operations and expansion; and (5) diversifying revenue streams through HPC and launching a distressed mining asset fund.”

These comments support Dede’s Buy rating on APLD, while his $4 price target points toward 113% upside in the coming year. (To watch Dede’s track record, click here.)

Applied Digital only has 2 recent analyst reviews, but both are positive, giving it a Moderate Buy consensus rating. The additional analyst is even more bullish than Dede; combined, the $4.75 average target makes room for growth of 153% in the year ahead. (See Applied Digital’s stock forecast at TipRanks.)

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.