Looking for stocks with the potential to generate returns higher than the market averages? Well, TipRanks provides a Top Smart Score Stocks tool that helps identify such stocks. The tool assigns each stock a unique score based on eight factors, including analyst ratings and insider activity, among others. It is worth mentioning that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX) by a wide margin.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Today, we have handpicked two stocks that were recently added to the “Perfect 10” Smart Score list: Amazon (NASDAQ:AMZN) and Ferrari (NYSE:RACE). Year-to-date, both these stocks have outperformed the 2.1% rally in the S&P 500.

Let’s take a closer look at these stocks.

Amazon.com, Inc.

Yesterday, Amazon was assigned a top-notch Smart Score of “Perfect 10” on TipRanks. Retail investors and hedge funds have maintained a positive outlook on AMZN stock. Our data shows that hedge funds bought 17.3 million shares of the company in the fourth quarter. Moreover, bloggers are bullish on the stock, while News Sentiment is also positive.

Amazon is a provider of online retail shopping and cloud computing services. Diversified revenue sources, strong brand power, and promising AWS growth prospects bode well for its long-term growth.

Following the dip in the stock’s price over the past year due to macroeconomic headwinds and mixed Q4 results, AMZN seems undervalued. Its current price-to-sales ratio of 1.93x is trading at a discount of 47.4% from its five-year average of 3.67.

Is Amazon a Buy, Sell, or Hold?

AMZN stock has a Strong Buy consensus rating on TipRanks. This is based on 36 Buy and one Hold recommendations. The average price target of $137.05 implies 48.6% upside potential from current levels. Shares of the company have gained 7.5% year-to-date.

Ferrari N.V.

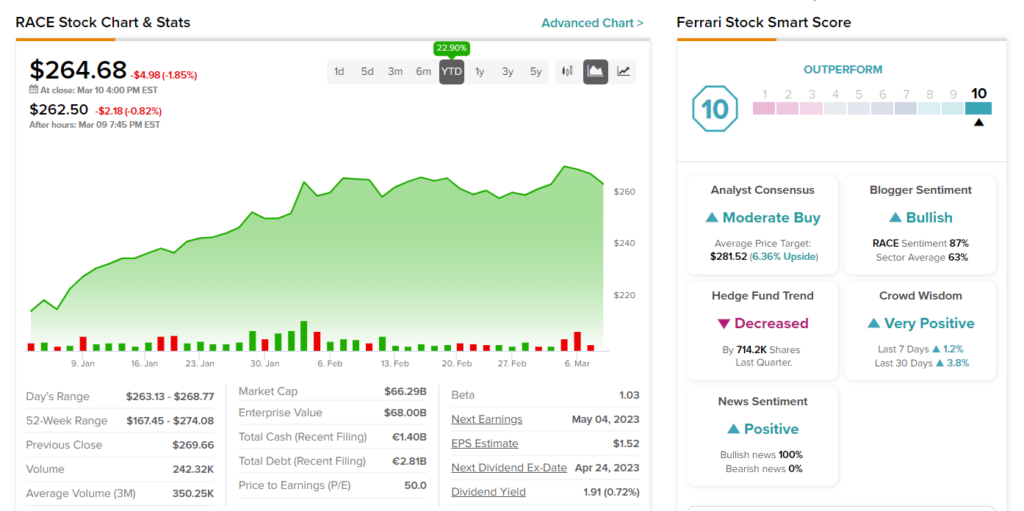

RACE stock was added to the Perfect 10 list two days ago. The stock also has a Very Positive signal from retail investors. Our data shows that about 3.8% of investor portfolios analyzed by TipRanks bought shares of the company in the past month. The stock also enjoys bullish Blogger sentiment and a Positive News Sentiment on TipRanks. Lastly, an ROE of 37.3% is another positive factor.

The luxury automaker Ferrari caters to a very small customer base of high-net-worth individuals and enjoys inelastic demand for its vehicles. Moreover, the company’s efforts to introduce new products are encouraging. Ferrari is expected to launch four new models this year, including a range of hybrid and electric vehicles. This is expected to keep the growth momentum in RACE stock alive.

Is RACE Stock a Buy?

Ferrari has a Moderate Buy consensus rating on TipRanks. This is based on five Buy and four Hold recommendations. The average price target of $281.52 implies 6.4% upside potential from current levels. RACE stock is up 22.9% so far in 2023.

Concluding Thoughts

Amazon and Ferrari are attractive picks for investors looking for stocks with more room for growth. The ability of both companies to grow revenues despite several macro woes and intense competition is encouraging. Further, they also seem to be well-positioned to survive a recession.

Stay abreast of the best that TipRanks’ Smart Score has to offer.